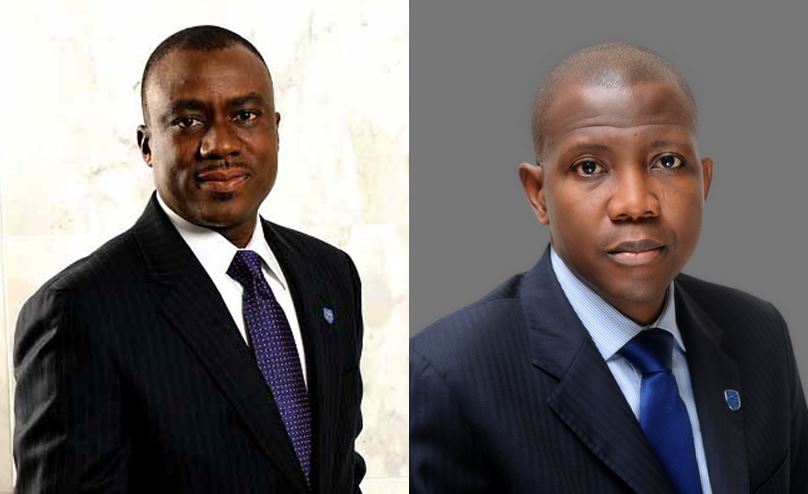

Following the appointment of Mr Yinka Sanni as Regional Chief Executive (West Africa) for Standard Bank Group, the Stanbic Bank group has announced the appointment of Mr Demola Sogunle as the new Chief Executive officer of the Stanbic IBTC Holdings PLC and Wole Adeniyi as the Chief Executive officer of Stanbic IBTC Bank PLC.

Both appointments are in line with the company’s internal succession policy, and subject to the approvals of the required regulatory bodies. This announcement was contained in a press release from the group signed by the company secretary, Chidi Okezie and made available to Nairametrics.

As regional CEO, Mr Sanni will have oversight responsibilities for Nigeria, Ghana and Cote d’Ivoire as well as the delivery of Standard Bank Group’s strategy across West Africa.

READ ALSO: Stanbic IBTC gives update on its business continuity approach amid COVID-19 lockdowns

Before this appointment, Sogunle was the Chief Executive of the Bank, and previously served as Deputy Chief Executive of the Bank. He had also served as Chief Executive of Stanbic IBTC Pension Managers, Head of Risk Management, Chief Compliance Officer, as well as Head of Treasury and Financial Services.

Demola holds a First-Class degree in Agricultural Science and a Ph.D. in Land Resource Evaluation and Management, both from the University of Ibadan, Nigeria. He obtained an MBA in Banking and Finance from ESUT Business School, Nigeria and has completed the Advanced Management Program (AMP) of the Harvard Business School, Boston, USA.

Demola also holds a Treasury Dealership Certificate from the Chartered Institute of Bankers of Nigeria (CIBN) and is a member of the Global Association of Risk Professionals. He still remains a Non-Executive Director on the Board of the Bank.

READ MORE: Corporate Actions: 41 for 100, An IPO and offices unsealed

Similarly, Wole Adeniyi was the Deputy Chief Executive of the Bank, until the appointment. He has served as Executive Director, Personal and Business Banking. He is a First-Class graduate of Business Administration from the University of Benin, Nigeria, and holds an MBA from the Manchester Business School of The University of Manchester, UK.

He is also a Fellow of the Institute of Chartered Accountants of Nigeria (FCA), and a Certified Information Systems Auditor (CISA). Other promotions Mr. Remy Osuagwu has been appointed Executive Director, Personal and Business Banking, to succeed Adeniyi in the execution of the retail strategy of the Bank .

He was previously Head, Business Banking. He holds a bachelor’s degree in Banking & Finance, as well as an MBA. He has had extensive experience in banking and financial services, spanning a period of over 20 years.

About Stanbic IBTC

Stanbic IBTC Holdings PLC, a member of Standard Bank Group, is a full-service financial services group with a clear focus on three main business pillars – Corporate and Investment Banking, Personal and Business Banking and Wealth Management.