The Central Bank of Nigeria (CBN) has reacted to the circulated videos and pictures that claimed it had introduced N2,000 and N5,000 banknotes to members of the public.

The apex bank in a statement described the videos and pictures of the purported circulation of the N2,000 and N5,000 banknotes as false and a piece of fake news that is being pushed out to the members of the public and asked them to disregard the falsehood.

Going further, they asked the members of the public to report to law enforcement agencies if they found anyone in possession of such banknotes.

READ ALSO: Companies are pulling their ads from YouTube in a boycott

This was disclosed by the Central Bank of Nigeria in a tweet post on its official twitter handle on Sunday, May 31, 2020.

The CBN stated, ‘’Videos and pictures of purported circulation of N2,000 and N5,000 banknotes are false and fake. Members of the public are advised to disregard such falsehood and to report anyone found in possession of such banknotes to the law enforcement agencies’’.

Videos and pictures of purported circulation of N2,000:00 and N5,000:00 banknotes are false and fake. Members of the public are advised to disregard such falsehood and to report anyone found in possession of such banknotes to the law enforcement agencies

— Central Bank of Nigeria (@cenbank) May 31, 2020

Download the Nairametrics News App

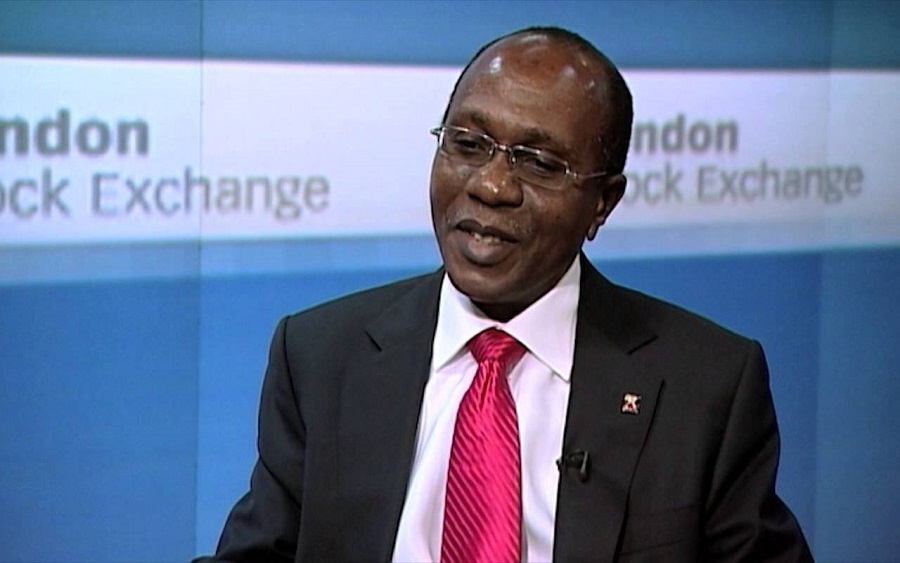

It would be recalled that the planned introduction of the new N2,000 and N5,000 banknotes by the CBN under the leadership of the then Governor, Lamido Sanusi, in 2012, had elicited some mixed reactions from some experts.

The Federal Government at that time said that the proposed N5,000 banknotes will not be for mass circulation, but would only be reserved for banks and heavy cash users.

We are not ready to see the value of money fall. Therefore, we need the government should cancel or remove 1,000 and 500 notes.

We are not ready to see the value of money fall. Therefore, the government should cancel or remove 1,000 and 500 Naira notes.