The bears clawed down prices in the local bourse today as the All Share Index and market capitalization shed 0.22% each, to 25,166.01 index points and N13.115 trillion respectively.

Market turnover finished lower compared to the previous trading session, as total volume and values dipped by 40.13% and 38.60% respectively, to 348.21 million units and N3.43 billion.

FBNH was the most traded stock by volume at 47.3 million units while GUARANTY topped by value at N576.2 million.

Market sentiment, as measured by market breadth, finished flat as 19 tickers gained, while 18 lost. MAYBAKER (+9.71%) recorded the highest price gain to close at N3.39 per share, as ETI topped the losers chart shedding -9.92% to close at N5.45k per share.

The ASI slipped as significant losses in the Banking (-2.79%), Oil & Gas (-0.36%) and Consumer Goods Indexes (-0.07%) overshadowed moderate appreciations in the Insurance (+1.16) and Industrial Index (+0.23%).

Price depreciations in bellwethers overweighed the Banking Index as ETI (-9.92%), UBA (-6.25%) and ZENITHBANK (-2.51%) all declined. OANDO (-5.71%) and FLOURMILL (-4.76%) drove the Oil & Gas / Industrial Index southwards.

Conversely, the Insurance Index rose by +1.16% as MANSARD and CUSTODIAN gained +8.19% and +7.69% respectively, while GLAXOSMITH (+7.64%) and GUINNESS (+4.17%) buoyed the Consumer Goods Index.

Top gainers

CUSTODIAN up 7.69% to close at N6.3; GLAXOSMITH up 7.64% to close at N8.45; GUINNESS up 4.17% to close at N20; DANGCEM up 0.87% to close at N138.5; and MTNN up 0.87% to close at N116.

Top losers

ETI down 9.92% to close at N5.45; UBA down 6.25% to close at N6.75; FLOURMILL down 4.76% to close at N20; ZENITHBANK down 2.51% to close at N17.45; GUARANTY down 1.81% to close at N24.4.

Outlook

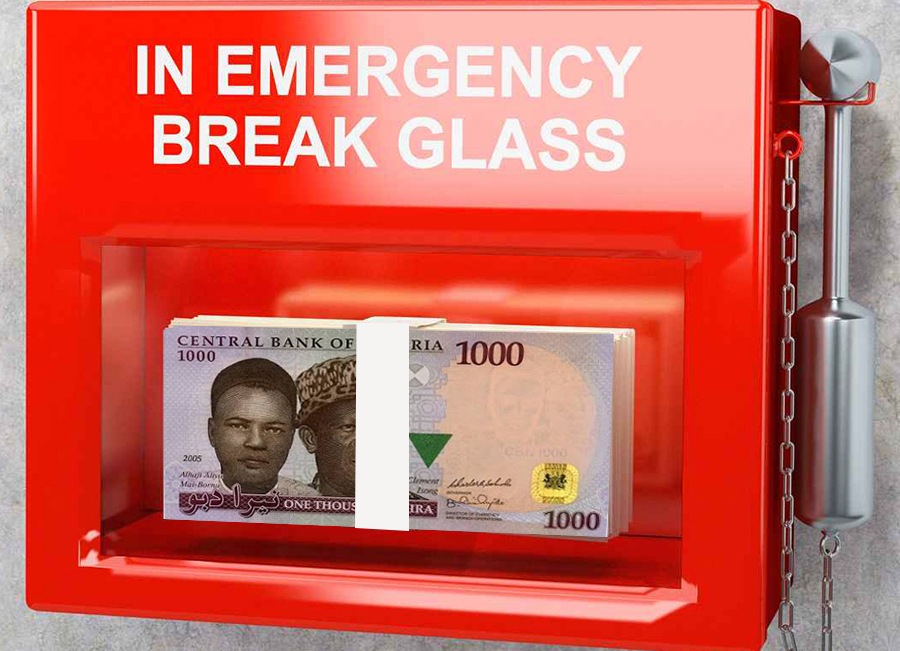

Most Nigerian bank stocks finished negative, partly due to the reduction of interest rate by the Monetary policy committee of Nigeria’s Central Bank from 13.5% to 12.5%. This probably will affect Nigerian banks profit margin negatively, as banks generally borrow short term to lend long term.

Nairametrics envisages cautious buying in the short term, as the present macro fundamentals doesn’t favor financial stocks.