The National Centre for Disease Control (NCDC) is pulling out all the stops and leaving no stones unturned in her campaign to galvanize Nigerians in the battle to stop the spread, and ultimately win the war against the Covid-19 pandemic.

The coronavirus disease 2019 (Covid-19) outbreak, which was first identified in Wuhan, China, in December 2019, has since become a global pandemic, spreading to almost every country in the world, including Nigeria.

With the campaign funded by the NNPC-IPPG team, an association of Indigenous Oil and Gas Producing Companies, and buoyed by its mandate to tackle the challenge of public health epidemics through prevention, detection and control, NCDC has taken the #TakeResponsibility awareness campaign against the Covid-19 virus a notch higher with the newly launched multi-language mass media campaign.

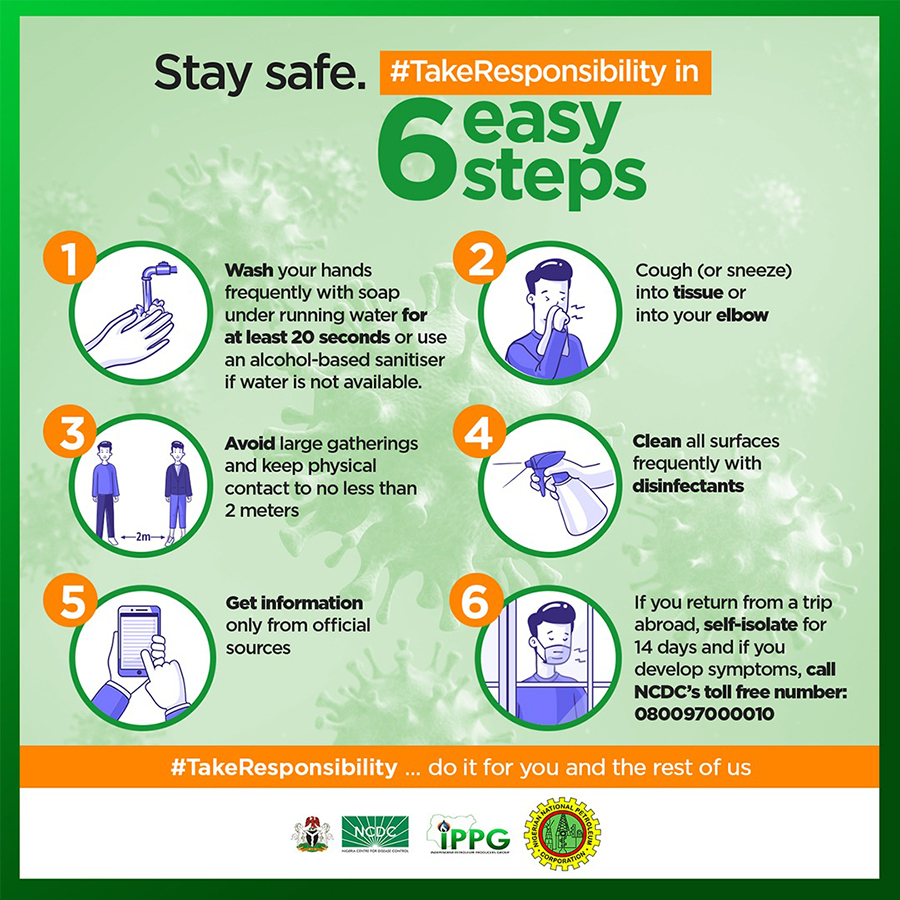

The new #TakeResponsibility campaign, disseminated pan-Nigeria in Hausa, Igbo, Yoruba, Pidgin and English languages across Print, Radio and Social Media platforms, is premised on the key NCDC guidelines and safety precautions to stop the spread of the novel coronavirus.

The safety precautions include washing of hands frequently with soap under running water for 20 seconds; or using alcohol-based sanitizer where water is not readily available; coughing or sneezing into tissue and disposing same into a dustbin immediately or coughing or sneezing into the elbow.

Other guidelines involve the practice of social distancing, such as avoiding large crowds; keeping physical contact to no less than 2 meters and wearing a face mask whenever one is in a public space; cleaning all surfaces frequently with disinfectants and avoiding fake news about the virus by getting information only from official sources (like the NCDC and WHO).

Also critical is the advice for people to stay in their states and if a traveler returns from a trip abroad, such an individual should self-isolate for 14 days and if he/she develops symptoms like frequent cough, sneezing, fever or shortage of breath, the individual should call his or her State Emergency Number or NCDC’s toll-free number: 080097000010, for immediate assistance.

Coronavirus, which affects all age groups, but mostly the elderly and those with underlying medical conditions such as high blood pressure, diabetes, asthma, etc., is primarily spread between and among people during close contact, often via small droplets produced by coughing, sneezing or talking.

According to NCDC-NNPC-IPPG partnership, the summary of all the Covid-19 guidelines and safety precautions is for Nigerians of every tribe and tongue, and non-Nigerians in the country to #TakeResponsibility by playing their part in the all-important race to halt and end the pandemic for the good of all.

EDITOR’S NOTE: This is a sponsored content.