Africa has been the delight of most foreign investors and they have been taken advantage of several opportunities especially foreign portfolio investments. But when it comes to debt one country ranks top in Africa.

China is at the fore of Africa’s debt drive, making the Asian nation Africa’s largest bilateral creditor, as it has given the continent loan worth $152 billion in 18 years (between 2000 and 2018.)

With such huge loan, a lot of critics are concerned over how feasible it would be for African nations to refund the credit with the advent of Coronavirus, which has eaten deep into the fabrics of the nations.

READ MORE: COVID-19: Could Africa’s Awakening be the Silver Lining?

Head, China Africa Research Initiative, Johns Hopkins University, Deborah Brautigam, explained that in a Bloomberg article that it is likely for China to agree to delay but not forgive its $152 billion of loans, an approach at odds with prior forbearance plans from groups including the Paris Club. Her reason:

“The Chinese have always done their lending on the idea that individual projects contribute to structural transformation and economic development. Those projects might be good projects and viable projects to get countries to a new stage where they might be in a position to repay the loans.”

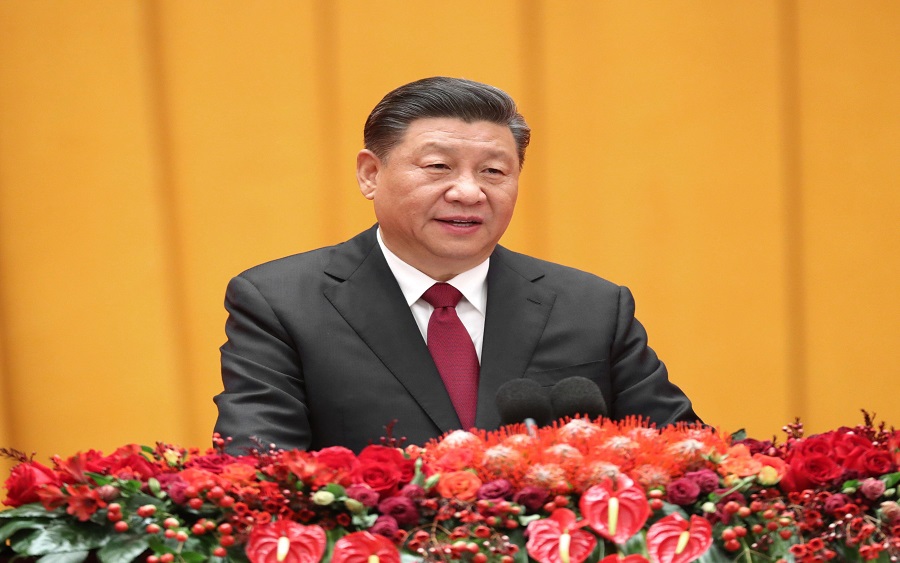

The $152 billion loans: The loans include facilities made between 2000 and 2018. While many have been repaid on schedule, she explained that it shows how much China’s lending has grown in Africa amid a push for political and economic clout through an overseas infrastructure investment plan, which was started by President Xi Jinping in 2013.

READ ALSO: Nigeria needs a bailout

China will also provide $2 billion over two years to support the fight against the pandemic, especially in developing countries, Xi said in a speech to the World Health Assembly.

“The good news is that China is typically willing to negotiate payment extensions. Usually, it’s not that difficult to lengthen the payment period or lengthen the maturity of loans. China has backed the G-20 plan, although it hasn’t participated in previous global debt relief initiatives. All told, according to IIF data, China’s outstanding debt claims reached $5.5 trillion last year,” she added.

Nigeria owes China about $3.1 billion more than 10% of the $27.6 billion external debt stock. Minister of Finance, Zainab Ahmed, disclosed in February that the Federal Government decided to go for a $17 billion loans from China as the World Bank and the African Development Bank’s (AfDB) failed to show much interest in Nigeria during the recession.

READ ALSO: Opera refutes Hindenburg Research’s allegation that it violated Google’s policy

The minister explained that the global lender, AfDB, and other lending institutions failed to show much interest in the nation during the recession period, which lasted for a year, as this made it requested the loan from the China-Exim Bank.

She disclosed to the Senate Committee on Local and Foreign Loans that 70% of the loan, which is about $17 billion, would come from the China-Exim Bank as Nigeria is in need of $22.8 billion to balance the $29.96 billion loan request. Meanwhile, the remaining loan would be sourced from other lending institutions such as the Islamic Development Bank.

excellent article. what is the breakdown in credit extended by the year in the $152 billion ?