Shortly after it resumed from recess, top on the to-do list of the Senate was the approval of the $2.36 billion (N850 billion) loan request made by President Muhammadu Buhari. The legislators wasted no time to give a nod to the request.

The loan, according to President Muhammadu Buhari, is needed to replace previously approved external loans, as the conditions from international capital markets are not conducive for borrowing.

The President’s loan request, which was read earlier on Tuesday on the floor of the red chamber, is to be sourced from the domestic capital markets and will be used to fund projects in the 2020 budget.

The President, in his correspondence to the upper chamber, also added that the Minister for Finance, Budget and National Planning, Zainab Ahmed, has been directed to provide further details that may be requested by the Senate over the new borrowing plan.

(READ MORE: Again, Finance Minister argues that Nigeria is not in debt distress)

The Federal Government (FG) had earlier submitted to the National Assembly a revised 2020 budget, with reduced revenue and expenditure expectations, to reflect the current reality of the impact of the coronavirus outbreak.

Senate gives reasons for speedy action

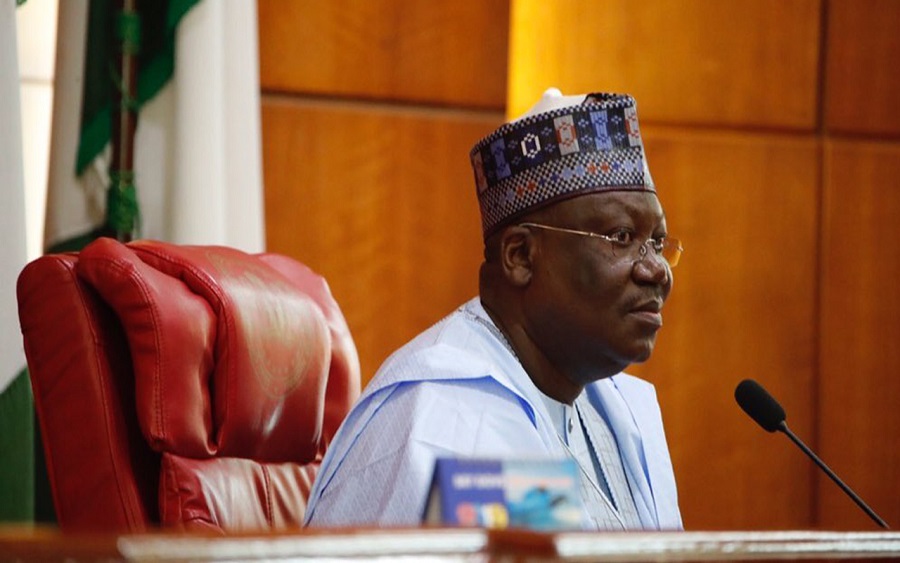

Senate President, Ahmad Lawan, explained that the lawmakers have been working with the executive on areas of adjustments for a more realistic implementation, and Senate’s resumption today led to a quicker resolution of some of their decisions.

According to him, the task before the lawmakers are imperative and the responsibility of the legislator is even more important because of their closeness to the people adding that issues should be handled faster.

He said, “The pandemic has affected our budget for this year, not just because of falling oil prices, but also because it has forced a reduction in economic activities, leading to an enormous loss of revenue.

READ MORE: Instruct EFCC, ICPC to monitor spending on Coronavirus, group tells Buhari

“The Senate has convened today to enable us to sustain work on solutions and to ensure that the health crisis does not create further problems that might be much more difficult to deal with.

“The pandemic has unsettled economies, affected the way we relate to each other and disrupted calendars of activities across different sectors. Government has responded well with the measures and we are ready to support it further.”

The pandemic has affected our budget for this year, not just because of falling oil prices, but also because it has forced a reduction in economic activities, leading to an enormous loss of revenue.

— President of the Senate (@SPNigeria) April 28, 2020

Meanwhile, the pandemic saw the FG, revise down its budgeted crude oil price from $57 per barrel down to $30 per barrel of crude.

READ ALSO: Trump speaks with President Buhari on telephone over COVID-19

It could be recalled that before the global lockdown due to the coronavirus, the Senate had approved $22.7 billion external borrowing for several priority projects around the country.

It must be noted that Nigeria, which is seeking about $6.9 billion from multilateral institutions like the IMF, World Bank Group and the African Development Bank, is going through an unprecedented fiscal crisis.