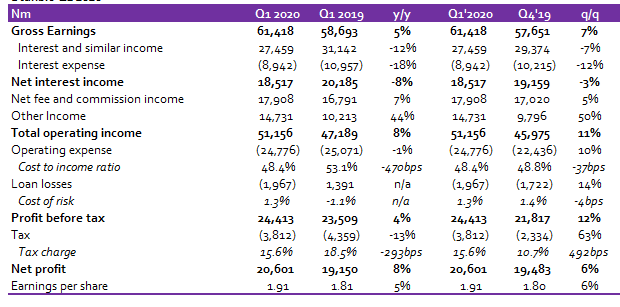

Interest Expense on the other hand, declined 18% y/y to N8.9bn, despite the 13% YTD growth in Customers Deposits, reflecting improved funding costs. We highlight the continued improvement in CASA ratio (80.6% in Q1 2020 vs 71.1% in FY 2019 and 56.8% in FY 2018). We expect its improved deposit mix to remain supportive of funding costs going forward. Overall, Net Interest Income fell 8% y/y to N18.5bn in Q1 2020.

The major catalyst for earnings came from the sturdy growth in Non-Interest Income (up 21% y/y to N32.6bn), driven by the increase in Trading Income (up 47% y/y to N14.4bn) and Net Fee and Commission Income (up 7% y/y to N17.9bn).

The growth in Trading Income was buoyed by Income from Fixed Income Instruments (N14.5bn in Q1 2020 vs N9.8bn in Q1 2019). Management noted that this was due to gains from arbitrage income on T-bill positions sold in the NTB market to take profit, as yield in this market segment continue to trend lower. Having booked significant gains on its long-positions in Q1, we expect slower momentum in Trading Income in subsequent quarters.

READ MORE: Another crushing recession ‘is coming’

On the other hand, the growth in Net Fee and Commission Income was due to higher asset management fees (up 18% y/y) and growth in brokerage and financial advisory fees (up 41% y/y).

Unlike in Q1 2019 when the bank recorded write backs of N1.4bn, the bank had Impairment Charge of N1.9bn in Q1 2020. Thus, cost of risk stood at 1.3% in Q1 2020, significantly higher than 0.3% in FY 2019. We highlight that the quantum of Non-Performing Loans increased by 23% YTD to N26.7bn (FY 2019: N21.6 bn) while NPL ratio rose to 4.2% (FY 2019: 3.9%). We attribute this to the impact of weak macro conditions brought about by COVID-19. Looking ahead, we expect subdued macro conditions to exert pressure on asset quality.

(READ MORE: NIGERIA OIL: Darker days ahead as Brent falls below production cost)

Stanbic recently published its UNAUDITED report for Q1 2020 wherein Interest Income declined 12% y/y to N27.5bn. The reduction in Interest Income was due to a steep decline in Interest on Investments (down 31% y/y) which offset the growth in Interest on loans and advances (up 8% y/y). The growth in Interest on Loans and advances was on the back of a 49% y/y (up 15% YTD) growth in Net loans to Customers. We believe the decline in Interest on Investments despite the substantial increase in Trading assets (up 96% YTD to N488.1bn in Q1 2020) was due to the low yield environment.

Cost efficiencies for Stanbic, however, remained firm as Operating Expenses declined by 1% y/y. The decline in OPEX, coupled with the growth in Operating Income (+8% y/y), led to a 470bps improvement in Cost to Income Ratio (CIR ex provisions) to 50.4%.

READ ALSO: UBA: Modest growth in FY 2019 profit despite a disappointing Q4 performance

As stated earlier, the strong growth in Non-Interest Income (up 21%) was the key driver behind the growth in Pre-tax Profit (up 4% y/y to N24.4bn in Q1 2020). Supported by a lower effective tax rate of 15.6% in Q1 2020 compared to 18.5% in Q1 2019, Net Profit grew higher by 8% y/y to N20.6bn, bringing Annualised ROAE to 26.2% in Q1 2020 vs 27.9% in Q1 2019.

We have a target price of N39.52/s for Stanbic with a BUY recommendation.

______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.