The wise saying, “never let a good crisis to waste” appears to be bearing fruit for some savvy investors in the Nigerian Stock Exchange. The stock market is up 2.7% since April and the momentum seems to be picking up right after the Easter Holidays. Stocks have gained 5.8% on either side of the Easter Holiday (before and after) hitting a daily average of 2.3%.

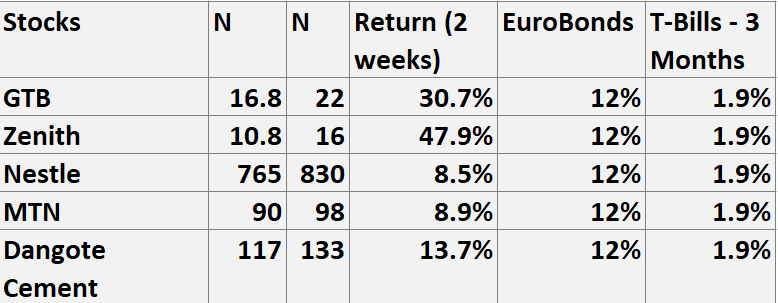

Despite these gains, the market is still down by a whopping 23% year to date. But in every crisis lies a unique opportunity to make money. Just two weeks ago, blue-chip stocks like GTB, Zenith Bank, Nestle, MTN, Dangote Cement all traded at historical lows of 16.75 (now N21.9), N10.7 (N15.9), N765 (N830.2) and MTN N90 (N98), N117 (N133). In just a week the stocks have posted impressive returns (see table below).

See other list of gainers

ZENITHBANK (+9.66%) and GUARANTY (+7.09%) climbed further to drive the lenders, as DANGCEMENT (+10.00%) lifted the Industrial Index. Similarly, NB (+9.84%) and DANGSUGAR (+8.55%) rose as the Consumer Goods sector continued its upward movement, while OANDO (+9.85%) buoyed the Energy Sector.

On paper, investors who bought these stocks at their lows have posted superior returns in less than a month. This return does not factor in dividends that they may have earned. When compared to alternative investments such as treasury bills, Eurobonds, stocks appear to be also doing better.

Why the rally? A number of interesting factors can be attributed to the rally we are seeing. In discussing with several traders, Nairametrics understands that most of the buying is from local investors. Typically, rallies like what we are currently seeing are driven by foreign investors but some traders opine that this is majorly driven by the locals.

Another source informed Nairametrics that the rally was also helped by recently maturing investments that have now found their way back into the stock market. Some fixed-income investments matured during the week and investors seeing an opportunity in the stock market are channeling these funds in that direction.

We also hear that while some foreign investors may also be buying, most of them are not selling as they have sold down most of their investments in blue chips and observing Nigeria’s currency situation before they probably begin another round of trading. We do also note that despite the rally, there is a huge word of caution.

A pump and dump rally? In trading, whenever stock prices are on the rise and volumes are up, investors see this as a sign of a sustained rally in share prices. In contrast, if share prices are falling and volume is also up then it means we might be in for a sustained bearish ride. However, if stock prices are rising and volume is low then it might just be a sign of a bull trap. Some investors opine the recent rally does not have significant volumes to amount to a sustained rally.

Share volumes have averaged about 320 million in the most recent trading days far from the 600 million-plus we see in sustained rallies. Higher volumes are signs that investors are trading heavily in stocks. For now, stocks are on steroids while smart money investors reap the rewards of taking calculated risk.

Nairametrics will be launching its Premium Stock Select Newsletter in a few weeks.

I believe a caveat should have been added at the end of this (and should be added to any other such related article), saying that this is not intended to serve as trading advice; as protection from any fallback from people who’ll see this as trading advice and rely on same for making a trade and who may end up possibly losing