The Central Bank of Nigeria (CBN) has issued a fraud alert to the general public about the activities of cyber-criminals, who are taking advantage of the current COVID-19 pandemic to defraud citizens.

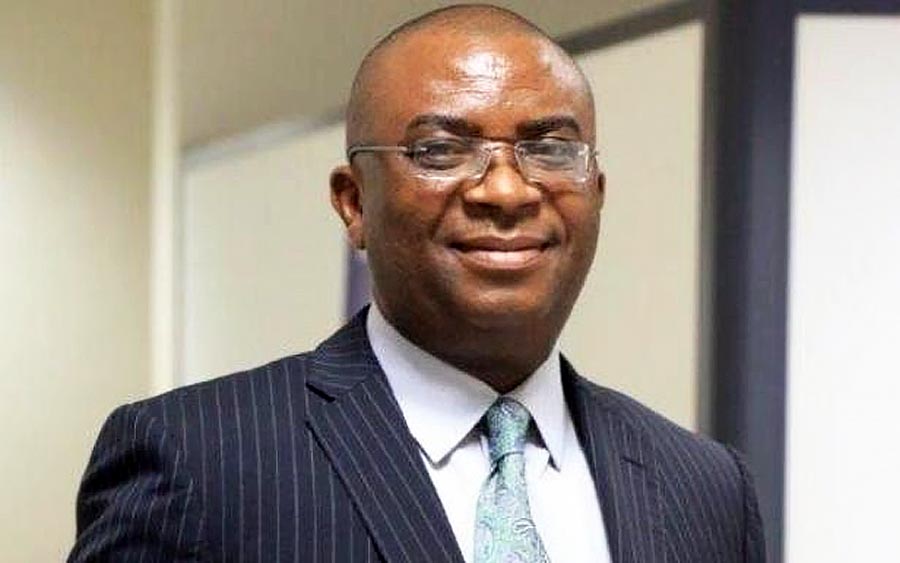

This was disclosed in a press release that was signed by the CBN Director of Corporate Communications, Isaac Okoroafor, and disseminated to the general public on April 6th, 2020.

In the statement, CBN said that cyber-criminals are taking advantage of COVID-19 pandemic to defraud citizens, steal sensitive information, or gain unauthorized access to computers or mobile devices using different techniques.

The apex bank admitted that the trend is not peculiar to Nigeria, as there has been a rise in COVID-19 related cyber-criminal activities all over the world. However, it is the priority of the apex bank to ensure that Nigerian bank customers are made aware of the current trend in order to prevent them from falling victims.

(READ MORE: CBN reverses suspension order on dispute management operations, interswitch reacts)

Some of the cyber-criminal activities that have risen during the COVID-19 include:

- Phishing campaigns: The cyber-criminals send out emails claiming to be from health organizations such as the Nigerian Centre for Disease Control (NCDC) or the World Health Organizations (WHO). The email may contain a link which, if clicked, seals login credentials or other confidential information from the victim’s computer or mobile device.

- Relief Packages: The cybercriminals also send messages via social media or emails asking people to click on links to register in order to get their COVID-19 relief packages from the government or other organizations. They simply just use this to get confidential information from unwary victims. Relief package scams also come in the form of phone calls asking people to provide their banking details to receive relief packages.

The criminals also ask unsuspecting customers to get the bank mobile apps, which they use to steal information from their victims’ mobile phones, among other things. They have also produced COVID-19 maps which steal information in the background.

The apex bank advised bank customers and the general public to take the following steps as precautions:

- Avoid downloading mobile apps from untrusted sources.

- Obtain relief package or other information from trusted news media.

- Beware of and verify emails or phone calls claiming to be from NCDC, WHO or government, especially when such emails request your banking details or to click on a link. Visit official websites of relevant organizations for desired information; and

- Avoid clicking on links or attachments in emails that claim to have more information regarding the COVID-19 pandemic.

The CBN gave assurances that it would continue to monitor and investigate these activities and provide updates as they occur.

My mums fcmb acct was hacked.

We blocked it and unblock it after severe process in the bank.

But still they manage to collect her money.

Happened on 8th of december 2021.

Whats the solution since blocking and unblocking isnt working?