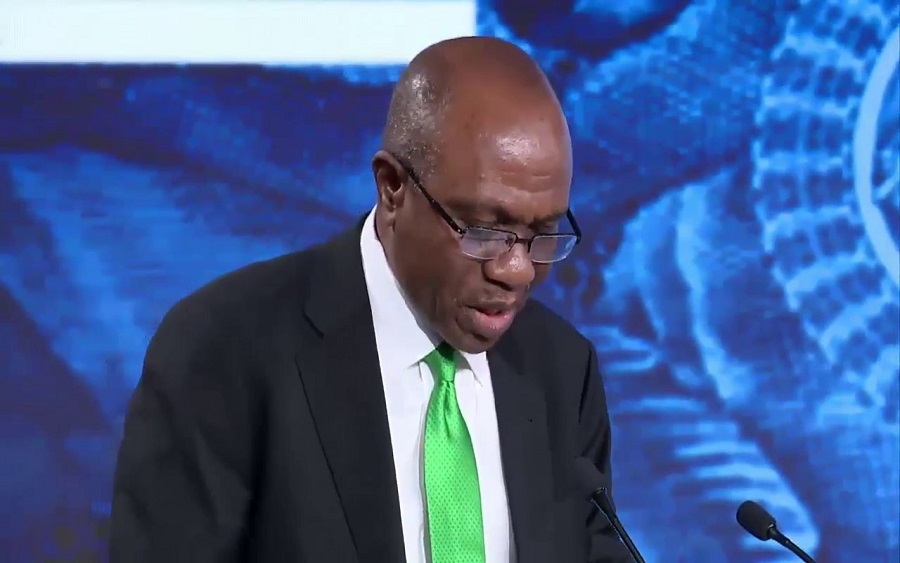

With an unassuming personality, Mr Godwin Emefiele controls the monetary policies of Nigeria and the economic destiny for Nigeria depends on his judgment. So when COVID-19 came to the shores of Nigeria, the calm watchman designed mechanisms in safeguarding Africa’s largest economy.

At the just-concluded Monetary Policy Committee (MPC) meeting, Godwin Emefiele said the recent decisions of the Central Bank of Nigeria (CBN), were targeted at strengthening the financial system in order to alleviate the initial impact of the global crisis caused by the COVID-19 pandemic.

On tightening, Godwin Emefiele, the CBN governor stated that the MPC was of the view that it would help rein in the rising inflation in the economy as well as support reserve accretion.

In addition, he explained that the committee observed that tightening would result in a reduction in money supply and limit the capacity of lenders to create credit, thus resulting in increased cost of credit, with adverse impact on output growth.

“Tightening would also result in a reduction in aggregate demand as a fall in disposable income results in output compression; whereas policy emphasis at this time should be on stimulating aggregate supply and demand, both already weakened by COVID-19,” he added.

[READ MORE: CBN pays $4.45 billion external debt to World Bank, others in 2-month)

On whether to loosen, Emefiele buttressed further that the CBN felt the decision would stimulate the economy in the short term, and boost aggregate supply and demand.

Consequently, in the wake of the global crisis as a result of disruptions associated with the outbreak of the Coronavirus and the oil price battle between Saudi Arabia and Russia, the CBN announced a stimulus to protect the Nigerian financial system and the economy.

The stimulus package, which would involve an injection of about N3.5 trillion to support the Nigerian economy, include the extension moratorium on loans by an additional year beginning from March 2020, to ease the pressure on loan repayments by companies.

The apex bank also reduced interest rates from 9% to 5% on its existing intervention programs over the next one year; created a N50 billion targeted fund to support households and Small and Medium Enterprises (SMEs) affected by COVID-19, and introduced credit support for the healthcare sector.

READ ALSO: CBN, Bankers committee back N3.5 trillion stimulus package for Nigeria

However, Silas Ozoya, President/CEO at SUBA Capital in a phone chat with Nairametics said:

“Considering the current COVID-19 situation and present lockdown, how would this fund get to the targeted end consumers and how would they execute with it in a lockdown? Those are the first set of question in my head begging to be answered. Injecting such fund into the economy is a good move by the CBN and yes, it would to some extent ease the effect of the looming recession.

“Since this is still developing, let’s see how the Central Bank intends to put this fund out and how the funds would be managed to effectively cushion the effect of this pandemic triggered recession we are gradually sliding into.

“Finally, announcing and injecting more funds into the economy isn’t enough on its own, the proper disbursement, management and recovery (where necessary) of such funds are more paramount to the continuous growth of the economy.”

[READ ALSO: CBN issues guidelines to access N50 billion COVID-19 credit facility)

Also, the CBN introduced regulatory tolerant measures to consider temporary and time-limited restructuring of loan terms and tenors to households and businesses affected by COVID-19 and strengthened the loan-to-deposit ratio policy.

To cushion the adverse effects of the pandemic on the economy, the CBN also announced the provision of N1 trillion from its intervention fund to support local manufacturing to boost import substitution, and another N100 billion to support the health services sector.

The fund was to provide loans to the pharmaceutical companies, hospitals and other health practitioners to build new hospitals and health facilities or expand existing ones to first-class health centres.

This is in addition to the N1.5 trillion private sectors-driven Infraco Project Fund, designed to target the construction of critical infrastructure across the country.

Again, pharmaceutical companies would be assisted through loan interventions to reestablish drug manufacturing firms in Nigeria and curtail the spread of the coronavirus.