The Senate will revisit more investment laws to support the development and growth of the Nigerian capital market. The laws to be revisited include the Investment and Securities Act, the main law governing the capital market, the Petroleum Industry Bill (PIB) and pension fund management among others.

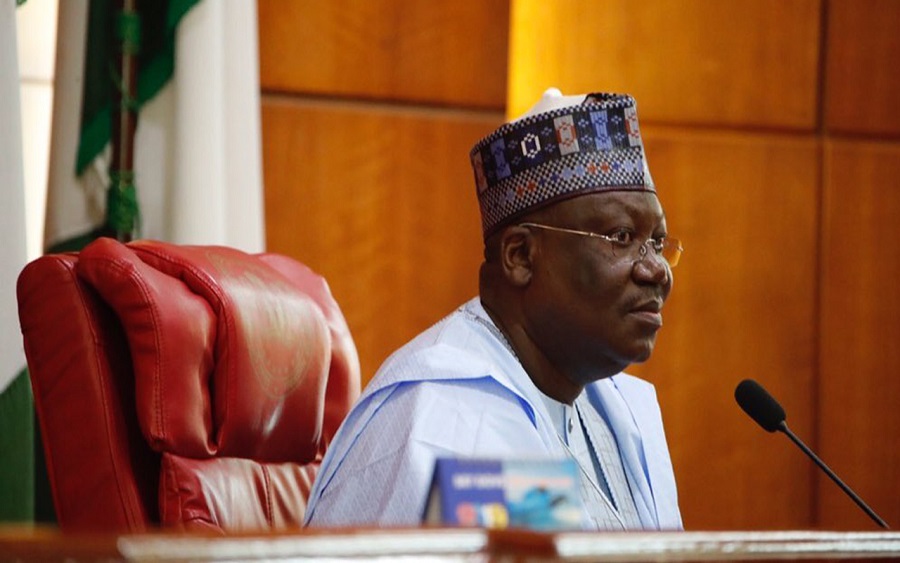

Chairman, Senate Committee on Capital Market, Senator Ibikunle Amosun, assured stakeholders that the Senate would provide necessary tools for the growth of the market.

Amosun disclosed in Lagos during the visit of the Senate Committee on Capital Market to the Nigerian Stock Exchange (NSE) and FMDQ Holdings Plc.

The former Ogun State governor added that the national assembly will do everything possible to strengthen investors’ protection and the growth of the market.

(READ MORE: Senate considers petrol subsidy removal, naira devaluation)

According to him, the Senate Capital Market Committee will look at the possibility of increasing investments from Pension Fund Administrators to the stock market, which will enhance market liquidity in the Nigerian bourse

Amosun buttressed that the capital market has a role to play in rescuing the economy at this critical stage in the light of the coronavirus pandemic which has hit global financial markets. He said,

“The capital market is a potent avenue for deepening our economy. We have always talked about diversification which is essential to growing the economy and that is why the capital market has to play a very significant role in that aspect.

“Let me reassure that we will create that enabling environment for investors as well as to take out necessary policies to support the market and so we are urging investors not to press the panic button yet.”

Nigerian Stock Exchange (NSE), CEO, Mr. Oscar Onyema, explained that the that Nigeria remains an attractive investment destination as Africa’s most populous country, positioned to be a top 20 economy by 2030 and top 10 by 2050.

Please, how many of these legislators have invested some of their capital in the Nigerian bourse; we need to know because we expect them to lead the way in bringing back local & foreign investors to the bourse.