In view of the prevailing fears of Coronavirus outbreak, the Central Bank of Nigeria (CBN) has advised Nigerians to forego cash transactions and adopt alternative payment methods like electronic transfers to avoid the spread of the virus.

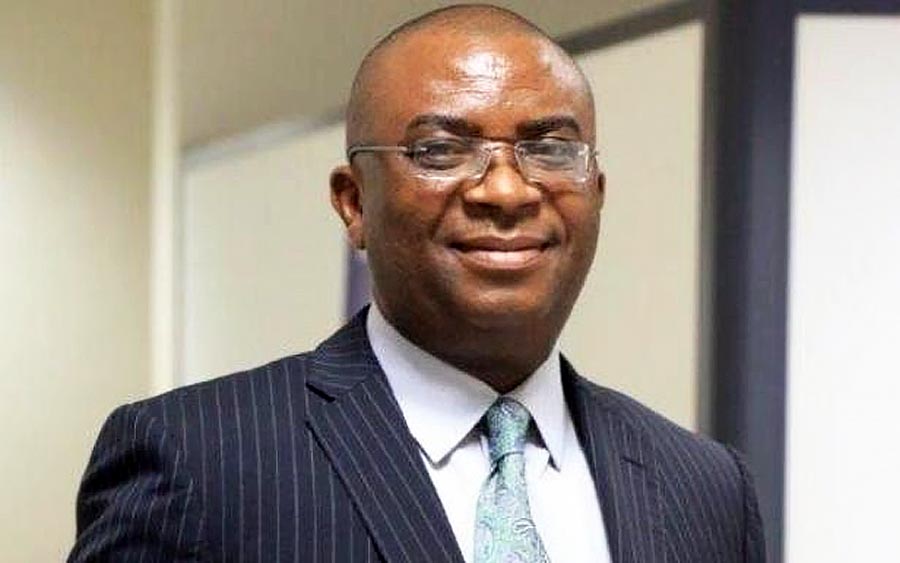

CBN Director of Corporate Communications, Mr Isaac Okoroafor, gave the advice in an interview with the News Agency of Nigeria (NAN) in Lagos on Tuesday.

He pointed out that one of the ways people could contract the disease was by touching an infected surface or object and then touching one’s mouth, nose or sensitive body parts. In view of this, he said, it was safer for Nigerians to adopt alternative payment methods such as electronic transfers, internet banking, USSD transfers, use of mobile banking apps, etc, to avoid contracting or spreading the disease.

[READ MORE: REMINDER: Nationwide implementation of cashless policy starts April 1st)

Okoroafor noted that these alternative payment methods came with benefits, were well developed and worked well.

He said: ”Its efficiency has minimised liquidity, settlement, systemic credit and operational risks which were inherent in financial transactions. It is secured, reliable, accessible, prompt and cost effective to meet all users’ needs. Nigerians should use it.’’

He added that the Naira note is one surface that different people come in contact with on daily basis, and advised that it would also be wise for users to wash hands after handling money, before touching food. This is particularly important for people, who constantly handle food to be eaten by others.

The CBN’s spokesperson reiterated the need for Nigerians to handle the Naira with care and pride, describing it as a symbol of our identity and value. He warned Nigerians against stepping on, squeezing, defacing or staining the naira notes. Okoroafor also warned that it should not be sold or counterfeited.

READ MORE: CBN says banks create N2 trillion new loans in 6 months

The CBN’s cashless policy was announced in September 2019 through a circular that was issued by the apex bank and is set to commence full implementation on the 1st of April, 2020.

The cashless policy comes with extra charges for customers whose deposit or withdrawals exceed the limits set by that Apex bank.

Are we truly ready for this cashless stuff. Were I have been fighting with my bank to reverse a pos “declined transaction” which was debited from my account since December 2019, with all clear evidence and facts and claim by staff that their hands are tied by decision from head office.

My point is not to criticize, but why wait the last minute, and are we ready, not even truly ready?