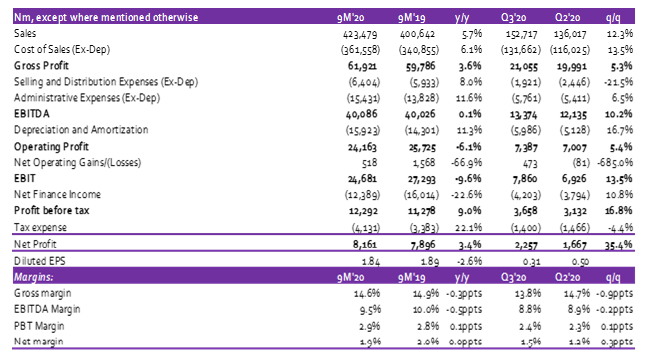

Flourmills Nigeria Plc released its 9M 2020 financial results and recorded an improved Q3 2020 performance. In Q3, revenue was up 12.3% q/q to N152.7 billion from N136.0 billion in Q2 2020.

The much-improved Q3 2020 revenue growth pulled 9M 2020 Revenue performance higher with Revenue growing 5.7% y/y (H1 2020 – 0.4% y/y) to N423.5 billion ahead of our 9M estimate of N404.7 billion.

The growth in revenue was driven by growth across major Revenue lines with Agro-Allied (+19.6% y/y to N81.3 billion) leading while Sugar (+13.5% y/y to N67.6 billion) trailed. Food segment turned positive in Q3, up 3.0% y/y to N262.1 billion as at 9M 2020. On the negative, Support Services remained dour with revenue down 32.8% y/y to N12.5 billion as at 9M 2020. We note that volumes grew 8% in Q3, higher than the 6% volume growth recorded in H1.

Management highlighted the positive impact of the border closure on Revenue from Pasta and Bread Flour while Fertilizers and Animal Feeds sales continue to strengthen the Agro-Allied business.

Cost of Sales (adjusted for depreciation) grew 6.1% y/y to N361.6bn in 9M 2020 from N340.9bn in 9M 2019. We note the growth in Cost of Sales was largely in line with the growth in Revenue and volumes which in our opinion reflects a fairly efficient performance in the face of pressured grains prices.

[READ MORE: Stanbic FY 2019: Modest earnings despite frail Q4 performance)

The growth in Cost of Sales was reflected in higher Material costs (+5.6% y/y to N323.4 billion) and Factory Staff payments (+12.5% y/y to N13.0 billion). Consequently, Gross Profits was up 3.6% y/y to N61.9 billion for 9M 2020 from N59.8 billion in 9M 2019. However, we note a marginal 0.3ppts decline in Gross Margin to 14.6% in 9M 2020 as Cost of Sales growth was still higher than revenue growth by 0.4ppts. The mild uptick in Cost of Sales was driven by increases in direct staff costs (up 13.4% y/y) and factory rent payments (up 268.0% y/y).

The company recorded a 10.5% y/y increase in Operating Expenses (adjusted for depreciation) driven by increases in Selling & Distribution Expenses (up 8.0% y/y) and Administrative Expenses adjusted for depreciation (up 11.6% y/y). We believe the rise in Opex must have been driven by increased spending on Advertisement as the company tries to expand its B2C channels.

While EBIDTA remained flat y/y, Q3 EBITDA grew double digits (up 10.2% q/q due to decline in Opex and faster Gross Profit growth within the quarter). Depreciation and Amortisation was up 11.3% y/y to N15.9 billion in 9M 2020. Consequently, EBIT slipped lower by 6.1% y/y to N24.2 billion in 9M 2020 from N25.7 billion in 9M 2019.

The company’s sustained efforts at deleveraging its balance sheet continued to bear fruit as finance cost dipped lower by 20.7% y/y to N13.1 billion in 9M 2020 from N16.6 billion in 9M 2019. Finance Income increased by 35.8% y/y to N728.3 million in 9M 2020. Consequently, Net Finance Costs slid lower by 22.6% to N12.4 billion in 9M 2020 from N16.0 billion in 9M 2019. Against this backdrop, Profit before Tax grew 9.0% y/y to N12.3 billion for 9M 2020 from N11.3 billion for 9M 2019.

Tax Expense grew 22.1% y/y to N4.1 billion with management declaring it took a prudent approach in estimating the impact of the finance bill on its tax bill. Nevertheless, Net Income was up 3.4% y/y to N8.2 billion in 9M 2020. However, Earnings per share for 9M 2020 declined to N1.84/s from N1.89/s in 9M 2019 on the back lower Net Income attributable to shareholders with Profit growth driven by subsidiaries.

We have a BUY recommendation on the stock with a target price of N29.00. Current price N22.35/s.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.