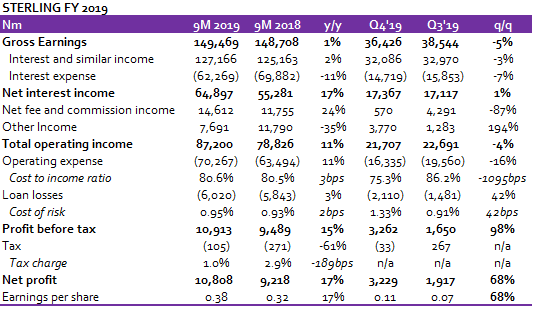

Sterling Bank (Sterling) released its FY 2019 UNAUDITED report, with Gross Earnings coming in flat at N149.5bn, in line with our estimate of N149.5bn. Supported largely by moderation in Interest Expense (down 11% y/y) and growth in Net Fee and Commission Income (up 24% y/y), Pre-tax Profit grew 15% y/y to N10.9bn, significantly ahead of our estimate of N8.3bn.

The better than expected growth in Pre-tax Profit was due to the low-Interest Expense and higher than expected Net Trading Income (N5.1bn vs CSL Forecast of N2.6bn). EPS rose to N0.38 in FY 2019 (vs CSL Forecast of N0.27 and FY 2018 EPS of N0.32).

Net Interest Income grew strongly, up 17% y/y on the back of the moderation in Interest Expense (down 11% y/y) amidst the marginal increase in Interest Income (up 2% y/y). The decline in Interest Expense which comes despite the double-digit increase in Customer Deposits (up 17% y/y), reflects continued decline in funding costs. Additionally, we believe the reduction in Borrowed funds (down 14% y/y) and Debt securities issued (down 51% y/y), supported the moderation in Expense Expense.

Unlike the trend we observed across most banks, the bank did not expand its loan book (Net loans to Customers declined marginally 1% y/y in FY 2019). We believe the muted growth in loan book was largely responsible for the marginal increase in Interest Income (up 2% y/y).

[READ MORE: Stanbic FY 2019: Modest earnings despite frail Q4 performance)

Net Fee and Commission Income grew strongly (up 24% y/y to N14.6bn in FY 2019), driven mainly by growth in e-business fees and commissions (up 40% y/y) and other fees and commissions (up 45% y/y).

Impairment Charge rose marginally, up 3% y/y to N6.0bn in 9M 2019, bringing Cost of Risk (COR) to 0.95% compared with 0.93% in FY 2018.

Operating Expenses grew 11% y/y but declined 16% q/q. The y/y rise in OPEX was driven by growth in personnel costs (up 14%/y), general and administrative expenses (up 11%/y) and Depreciation and Amortization (up 23%/y). The increase in OPEX which was at par with the growth in Operating Income (up 11% y/y) kept Cost to Income Ratio (CIR ex-provisions) stable at 80.6% in FY 2019 (FY 2018; 80.5%).

Pre-tax profit was up 15% y/y to N10.9bn. Net profits also grew 17% y/y to N10.8bn, bringing RoAE to 10% in FY 2019 compared with 9.2% in FY 2018.

We have a BUY rating on Sterling bank with a target price of N2.71/s. Current price: N1.84/s.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.