Going by the Transmission Company of Nigeria’s (TCN) 2020 objective, some of the 11 electricity distribution companies (DisCos) operating in Nigeria may be forced out of the industry. TCN has pushed for the recapitalisation of DisCos to separate the wheat from the chaff in the new year.

The transmission firm plans to restructure the capital base of the distribution companies operating in the country.

The power sector in Nigeria was privatised in 2013 and the supply of the electricity was divided into several categories: six generation companies; 12 distribution companies covering all 36 Nigerian states, and a national power transmission company.

Why it matters: Since the power sector was privatised by the Goodluck Jonathan administration in 2013, the electricity supply hasn’t improved much, and every business continues to provide electricity for themselves mostly with petrol and diesel generators.

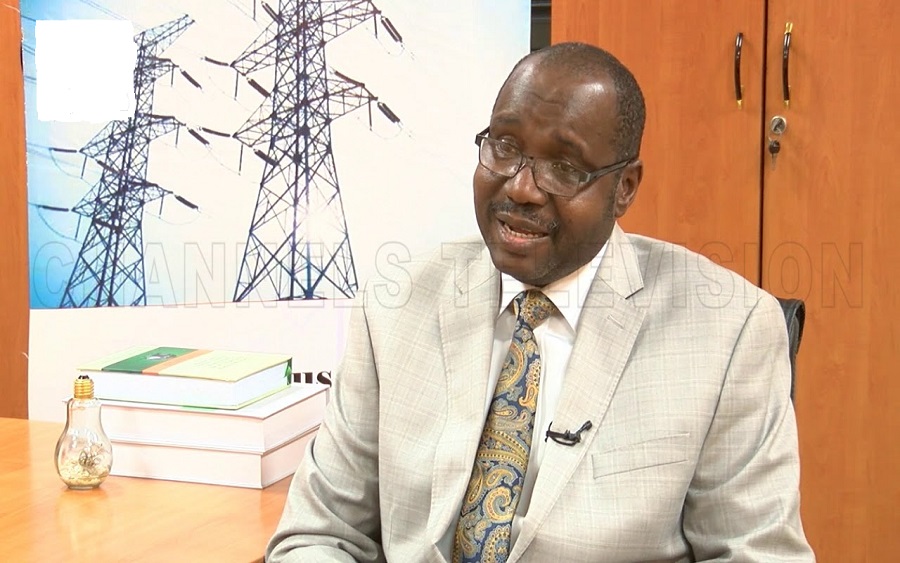

The Managing Director of TCN, Usman Mohammed, was of the opinion that the distribution companies within the country were not effectively disbursing their responsibility, so recapitalisation would improve their operation.

He said the capacity to duly supply electricity efficiently was lacking among the power distribution companies. Mohammed also opined that the recapitalisation of the power sector would attract investors to boost development.

[READ ALSO: Power: FG signifies financial commitment to Siemens agreement(Opens in a new browser tab)]

“We are working to see that all the projects that we have under the Transmission Rehabilitation and Expansion Programme will pick up and they will continue to be implemented in a sustainable manner.

“We are going to actually push for the recapitalisation of Discos in 2020. We believe that by doing that we are pushing the power sector to sustainable growth and development. The power sector has to attract investments.”

“The only way we can attract investments is to ensure that the power sector is sustainable. This means that every party is working and the regulator provides what is called a cost-reflective tariff consistent with the position of ECOWAS.”

Mohammed also stated that “So we need to recapitalise the Discos for them to have commensurate investments to fix their networks and provide meters so that they can reduce the Average Technical and Commercial losses in their system for electricity to work.”

[READ ALSO: Enyimba Economic City: A tale of N500 billion and 625,000 jobs(Opens in a new browser tab)]

TCN not waiting for DisCos: In his statement reported by Punch, Mohammad said TCN would continue to expand the grip without waiting for improvement and development in DisCos’ operation.

“If you look at the current situation that we are now, of course, the transmission will continue to expand. We will not wait for the Discos. It takes a long time to build a transmission infrastructure than Discos’, which is easier. Therefore, we are looking at transmission as the enabler.

“Out of the 738 interfaces that we have with the Discos, only 421 have protection on their side, the remaining 317 do not have protection on the side of the Discos. This means faults in the houses of people can easily hit the TCN transformers and damage them.”

FG needs to stop funding power: According to Mohammed, the government can’t afford to keep funding certain operations of the power sector.

“The industry can only work when all the players are working. If transmission doesn’t work, it will bankrupt generation and distribution.

“If distribution doesn’t collect the money, nobody gets money and this means the government has to continue to finance generators through payment assurance. But for how long are we going to continue to do that? So we have to fix distribution.”

Gains and pains of recapitalisation: The recapitalisation plan shows that TCN doesn’t believe the current distribution companies can deliver on the needed improvement of the electricity supply. However, despite the good intention of the exercise, it might force some companies which are unable to meet the requirement out of the market.