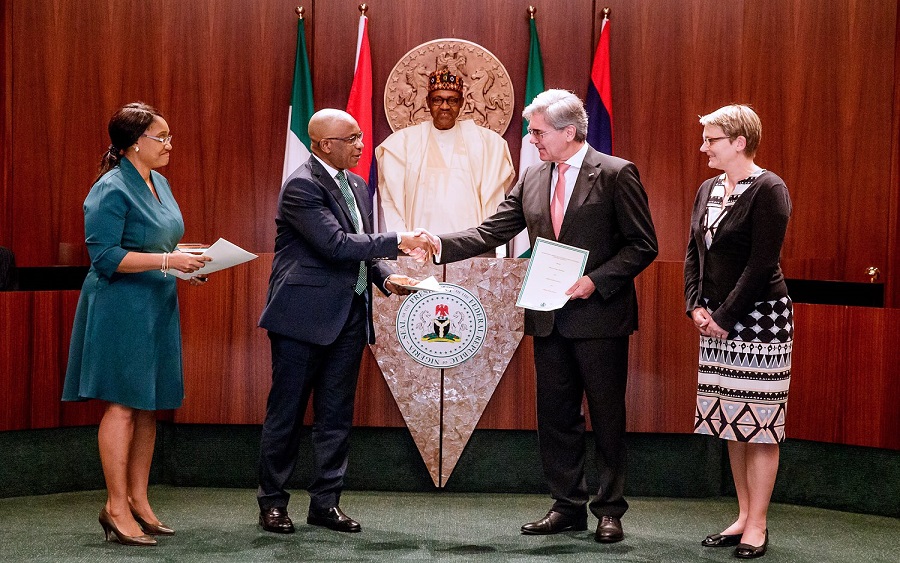

We recall that on 22 July, Nigeria and power giant, Siemens signed a power sector deal which would lead to the production of 25,000MW of electricity in the country by 2025. At the meeting between the presidency and the management of Siemens, the president set a goal of achieving 7,000MW and 11,000MW of reliable power supply by 2021 and 2023 respectively.

The agreement was a fallout of Angela Merkel’s visit to Nigeria in 2018 which led to the submission of the Nigerian Electrification Roadmap. Notably, the agreement incorporates fixing Nigeria’s archaic transmission grid and distribution infrastructure.

Despite the privatisation exercise that was carried out in 2013, inadequate electricity supply remains a key challenge that has continued to plague economic activities in the country. The perennial problems plaguing the power sector ranging from infrastructure (generation & transmission facilities), absence of cost-reflective tariffs and poor metering systems have remained largely unresolved.

This year, economic activities have been grounded following the collapse of the national transmission grid, an event that has featured in every quarter. Following the collapse of the national grid, distributing companies (Discos) have seen power allocation cut drastically while some got no power allocation.

Though we laud the agreement with Siemens as a major step towards reviving the nation’s troubled electricity considering the focus of the project across the power value chain, we have concerns around Siemens’ position in the power value chain given the huge investment the power giant will make. In view of the fact that the Transmission Company of Nigeria (TCN) is currently 100% owned by the government while the GenCos and Discos are privately controlled, we see a possibility of Siemens getting a stake in TCN.

[READ MORE: Insurance: NAICOM extends recapitalization deadline)

However, we are uncertain as to how that will work for the discos and GenCos given that Siemen’s huge investments may mean they have to relinquish control to them. Additionally, we note that the desire of government to maintain a stranglehold on the power sector in bid to regulate electricity tariffs remains a key risk.

There is no gainsaying that the epileptic power supply across the country has been a major barrier to economic activities, resulting in high cost of manufacturing goods locally and by extension the competitiveness of local producers when compared to their conterparts in other developing countries. Against this backdrop, we reiterate the need for improved power supply if the country is to transit to an industrial-based economy.

________________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.