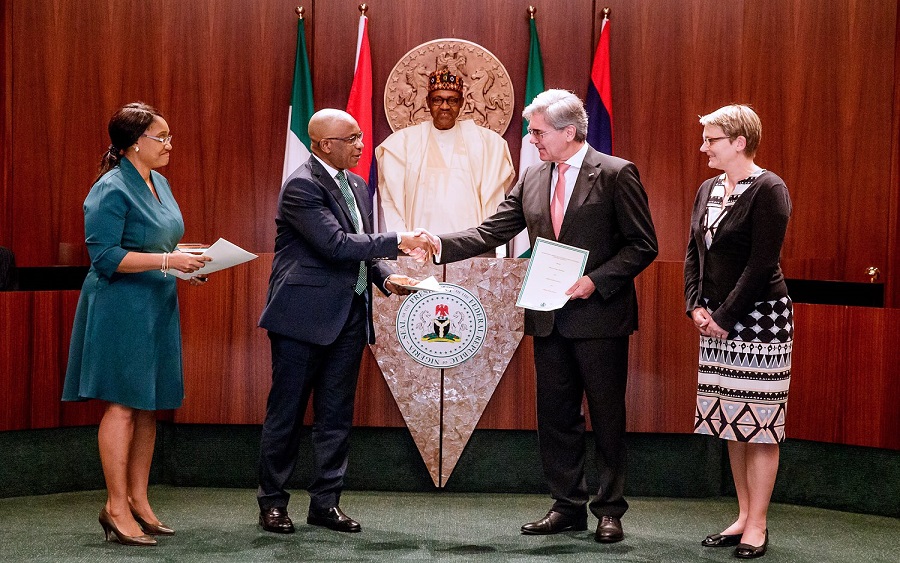

President Muhammadu Buhari has signed the Nigerian Electrification Roadmap which was presented to him by Siemens in November 2018. The deal was facilitated by the German Chancellor, Angela Merkel last year, in August.

The deal was signed in Abuja with the Global Chief Executive Officer of Siemens, Joe Kaeser. The agreement came months after the leading supplier of systems for power generation held several meetings and consultation across Nigeria.

[READ ALSO: Akin Alabi questions Jumia’s operating model, Jumia responded]

Siemens had also conducted electricity field observation dating back to October last year, a month after the meeting between President Buhari and the German Chancellor. According to reports, several meetings had also been held between power distribution companies, other stakeholders in the power sector and the Chief of Staff to the President, Abba Kyari, leading to today.

Speaking about the roadmap deal, President Buhari said, “Today, in partnership with the German Government and Siemens AG, we are making an important move forward in addressing Nigeria’s electricity challenge. Our goal is a simple one: to deliver more electricity to Nigerian businesses and homes.”

Today, in partnership with the German Government and Siemens AG, we are making an important move forward in addressing Nigeria’s electricity challenge. Our goal is a simple one: to deliver more electricity to Nigerian businesses and homes. pic.twitter.com/953qM2Sw5z

— Muhammadu Buhari (@MBuhari) July 22, 2019

Buhari’s challenge to Siemens: “My challenge to Siemens, our partner investors in the Distribution Companies, the TCN, and NERC, is to work hard to achieve the target of 7,000 megawatts of reliable power supply by 2021 and 11,000 megawatts by 2023 – in phases 1 and 2 of this initiative, respectively.

“Our intention is to ensure that our cooperation is structured under a Government-to-Government framework. No middlemen will be involved so that we can achieve value for money for Nigerians.

“We also insist that all products be manufactured to high quality German and European standards and competitively priced.

“This project will not be the solution to ALL our problems in the power sector. However, I am confident that it has the potential to address a significant amount of the challenges we have faced for decades.

“It is our hope that as the power situation improves, we will improve investor confidence, create jobs, reduce the cost of doing business and encourage more economic growth in Nigeria.”

[READ ALSO: Pepsi acquires Pioneer Foods Group Ltd, makers of Butterfield Bread]

I am no longer positive the place you’re getting your information, but

good topic. I needs to spend some time studying more or understanding more.

Thank you for fantastic information I used to be looking for this info for

my mission.

This is awesome news!!!, @olalekan thanks for the write up, however can we get more details into the deal.

i wished most Nigerian youth were more interested in issues that actually have an effect on their lives.