The Nigerian Senate has ordered an investigation into the failure of the Central Bank of Nigeria (CBN) to remit over N20 trillion into the Federation Account. The N20 trillion was generated from stamp duty charges collected from banks and other financial institutions from 2016 till date.

The lawmakers directed its Committee on Finance to probe the decision of the CBN not to remit the funds into the Federation Account. According to Senator Ayo Akinyelure who initiated the motion, the CBN and the Nigeria Inter-Bank Settlement System (NIBSS) technically defied the directive of the President.

Banks are not transparent? Akinyelure said the CBN has not been transparent in its dealings since the implementation of the collection of stamp duty policy. A circular released by the apex bank in January 2016 directed all banks and financial institutions to charge stamp duty of N50 on lodgements into current accounts against revenue projections by the Federal Government of N2.5 trillion annually, Punch reported.

Akinyelure further disclosed that the directive was duly followed by the Nigerian banks and financial institutions as they charged N50 on every eligible transaction in accordance with the provisions of the Stamp Duty Act 2004 and the Federal Government Financial Regulations 2009.

What prompted the investigation? The need to probe the CBN for its handling of the stamp duty charges was initiated while the chamber was discussing the need to improve Internally Generated Revenue of the Federal Government of Nigeria through non-oil revenue. Akinyelure observed that the non-compliance of the apex bank to the Presidential directive on stamp duty charges is troubling.

“The Central Bank of Nigeria and NIBBS have technically refused to comply with the Presidential directives for the recovery of over N20tn revenue into the coffers of government.

[READ MORE: Audited Reports: CBN, FIRS, others flout Senate’s 7-day ultimatum]

“The CBN and NIBSS deliberately failed to cooperate and comply with the directives of Mr President for the realisation of over N20 trillion revenue due from stamp duty collected for 2013 to 2016.

“Subsequently, over N5 trillion minimum revenue is due to be collected annually to the federation account, to be shared among states of the federation for infrastructural and economic development.”

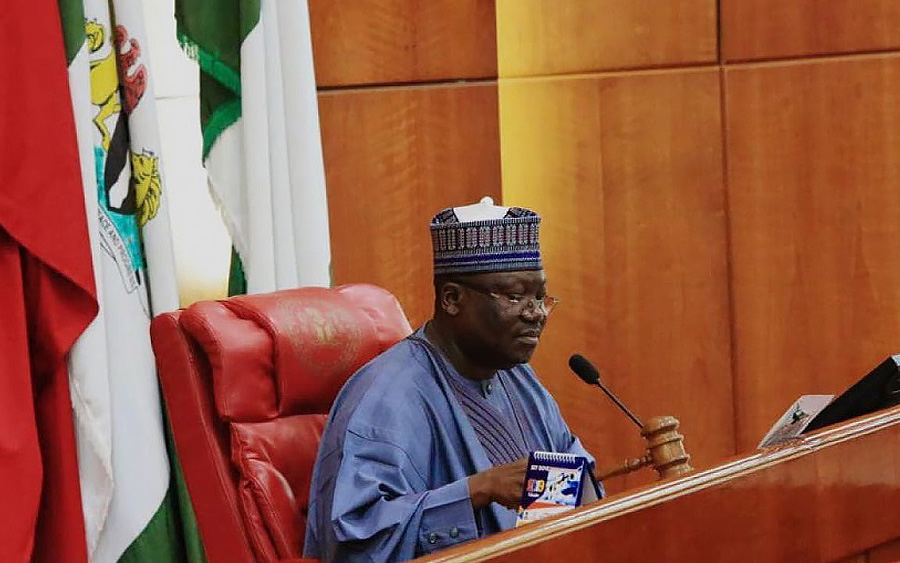

In the meantime, the Senate President, Ahmad Lawan, said he discovered the fees collected from the stamp duty was barely N1 trillion.

“I engaged the Ministry of Finance and CBN for interaction, and I discovered that what we have been expecting to be available as stamp duty is not so.

“I was under the impression that we had over N20 trillion somewhere. It will interest you to know that we don’t even have N1 trillion.”