The Federal Government of Nigeria missed its revenue targets for the month of October and this may result in more borrowing.

According to the Central Bank of Nigeria (CBN) in its October 2019 Economic Report, the estimated federally collected revenue of N894.09 billion fell short of the monthly budget estimate of N1.2 trillion. The shortage of N351.98 billion represents a 28.2% shortfall.

The N894.09 billion recorded in October is the third consecutive drop in federally collected revenue, with September and August figures standing at N902.1 billion and N925.7 billion respectively.

The Central Bank attributed the failure to meet the federally collected revenue target to shortfall in both oil and non-oil revenue, which shows that the country’s revenue challenges are still staring it in the face.

Oil revenue breakdown

The apex bank disclosed that oil receipts, at N577.30 billion or 64.6% of total revenue, were below the monthly budget estimate of N798.83 billion by 27.7%.

- However, it exceeded the receipt of N467.58 billion in the preceding month by 23.5%.

- Crude oil and gas exports, domestic crude oil/gas sales and other revenue streams experienced significant increase in October.

- The N577.30 billion recorded in October is the highest the country has recorded in 2019.

The decrease in oil revenue has been associated with shut-ins and shut-downs at some terminals of the Nigerian National Petroleum Corporation (NNPC) due to pipeline leakages and maintenance activities.

Non Oil revenue breakdown

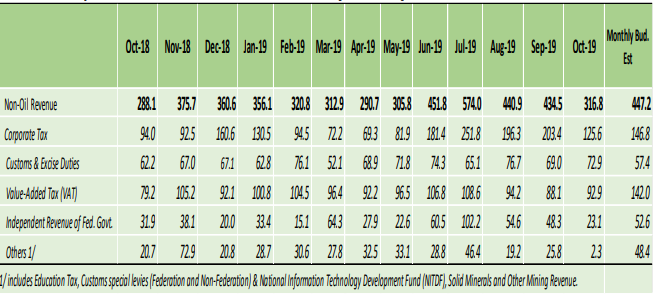

Non-oil receipt for October stood at N316.79 billion or 35.4% of total revenue.

- Non-oil receipt was below the monthly budget estimate of N447.24 billion and the preceding month’s earning of N434.52 billion by 29.2% and 27.1%, respectively.

- Corporate tax, independent revenue of Federal Government and other revenue sources experienced significant drops in October.

- The non-oil receipt of N316.79 billion recorded in October is the lowest the country has recorded in 2019.

[READ MORE: How Nigeria can finance its budget deficit without loans – BPE boss]

The drop in collection, relative to the monthly budget estimate, was, due to the decline in revenue from Corporate Tax, VAT, Education Tax and Federal Government Independent Revenue.

How the generated revenue was disbursed

Out of the N697.50 billion that was retained in the Federation Account, the sums of N89.16 billion, N23.11 billion, and N2.33 billion were transferred to the VAT Pool Account, Federal Government Independent Revenue, and “Others”, leaving a net balance of N582.90 billion.

- The Federal Government received N279.98 billion out of the net balance while the state and local governments received N142.01 billion and N109.49 billion, respectively.

- The balance of N51.42 billion was shared among the oil-producing states as 13% Derivation Fund.

- Also, from the N89.16 billion transferred to the VAT Pool Account, the Federal Government received N13.37 billion while the state and local governments received N44.58 billion and N31.21 billion respectively.

Additionally, N950 million was distributed in the month as Exchange Gain, with the Federal, State and Local governments receiving N440 million, N220 million and N170 million. Overall, the total allocation to the three tiers of government in October 2019 amounted to N673.01 billion, which was below the preceding month’s budget estimate of N1.091 trillion and monthly allocation of N676.9 billion.

The Federal Government spent N695.89 billion in October, with the fiscal transactions showing that recurrent and capital expenditure constituted 57% and 37.3% of the total expenditure, respectively; transfers gulped 5.7% of the recurrent expenditure; non-debt obligation was 76.8% while debt service payments accounted for 23.2% of the total.

Implication: The failure of the Federal Government to meet its budgeted revenue targets implies that government borrowing might continue to surge in 2020, as government will seek to fund its activities despite a shortfall in revenue.