In order to sanitise the lubricant subsector, the Department of Petroleum Resources (DPR) has announced a partnership with security operatives, according to Punch.

In addition to this, the agency promised to arrest and prosecute any dealer that is in the business of storing or selling harmful lubricants capable of destroying the machinery of factory owners and motorists nationwide.

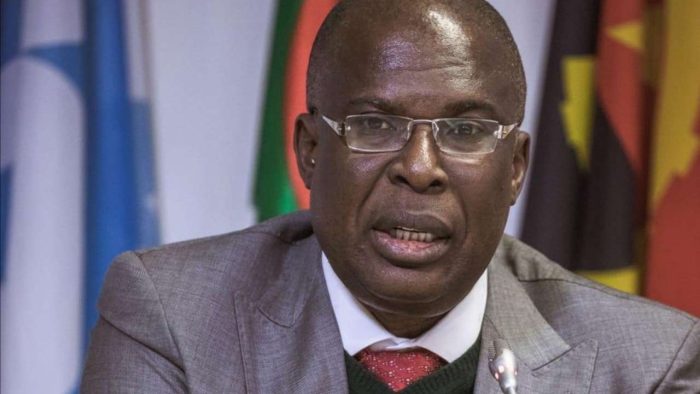

The Details: This proclamation was made by acting Director, DPR, Ahmad Shakur at a stakeholders’ workshop on the regulatory requirement for lubricants oil subsector.

“I wish to reiterate here that at the end of this workshop, we will come out with far-reaching resolutions and recommendations to sanitise the lubricant subsector, synergise with the security agencies and major stakeholders to apprehend and prosecute anybody found storing and selling lubricants without the DPR license and adulterating them.

“Lubricant adulteration, counterfeiting and sub-standardisation have a wide range of consequences on consumers of lubricant products. For example, car owners suffer losses as a result of damage to engine and other mechanical parts; factory owners suffer losses through damage to critical plants and machine parts.

“Therefore, sanitising the lubricant subsector is what we intend to pursue vigorously. I, therefore, implore you all to adhere strictly to our regulations,” the acting director said.

[READ MORE: DPR cautions IPMAN against PMS diversion]

Why this matters: Lubricants reduce wear and tear, act as coolants, and prevent corrosion. They also help to reduce friction between the two rubbing surfaces.

However, the sharp practices of lubricant dealers who are looking to make quick gains have led them to of selling contaminated lubricants and base oil to Nigerians.

The ripple effect is loss of engines and machinery which cost Nigerians several billions of naira to replace.

Similarly, the Ilorin division of the DPR office has admonished petroleum marketers not to entertain any thought of hoarding fuel during the Yuletide. Sule Yusuf, who is the Controller of Operations in the state, advised marketers to always check the measurement of their pumps daily to avoid cheating unsuspecting customers.