The Treasury Bills Auction of the Central Bank of Nigeria (CBN) held on Wednesday was fully subscribed even though the interest rate on the treasury bills is reducing.

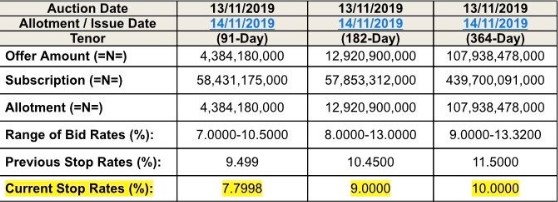

The Central Bank offered 91-day tenor had a total subscription of N58.43 billion while N57.85 billion and N439.7 billion were recorded as total subscription on the 182-day and 364-day tenors.

The following are reportedly the successful bid range rates:

- 91-day tenor was between 7% and 10.5%;

- 182-day tenor was between 8% and 13%; and

- 364-day tenor was between 9% to 13.32%.

However, the success rate for the 91-day tenor dropped from its previous 9.49% to 7.79%; that of the 182-day tenor dropped from 10.45% to 9% while the 364-day tenor dropped from 11.5% to 10%.

Meanwhile, analysts according to Punch were reportedly not surprised by the downward trend of the interest rates, stating that the continuous drop in T-bills rates would force investors to find other high yielding alternatives. Also, they expressed that capital flight might intensify as the quest to preserve the value of the naira would mount pressure on naira to chase after the dollar.

“The crash of interest rates of treasury bills, investors’ search for alternative investments would intensify. The money market returns would also reflect the current rates in the medium term and new inflows and matured investments will be invested at current rates in the money market fund, which will drag the performance of the fund,” Managing Director, Afrinvest Securities Limited, Mr Ayodeji Ebo.

[READ MORE: Update: CBN to bar individuals, start-ups from trading treasury bills]

“The downward direction of the FGN T-biils stop rates was not unexpected, though the level of capital flight is not much at the moment, I see investors holding their maturing bills in euro currencies such as dollar outside the banking system. However, no monetary policy directive lasts forever. This policy regime will soon pass away,” Financial and Risk Management Consultant, Mr Dayo Akinola.

next month is the end of 2019,so much upheveal in 2019,why now and wait for next year and how the current budget affects the economy.i think the cbn did this treasury bill for some purposes.now I get confused now ? to be or not to be ?previously the cbn barrs Banks from biding for treasury bill now ,nairametric did said the cbn barrs individual from bidding in treasury bill,which okechukwu commented,now which way ?.I think all these news came from Mr Trump’s twitter