The Central Bank of Nigeria’s (CBN) Financial Stability Report has disclosed that the apex regulator and 15 Deposit Money Banks injected N228.28 billion in the Asset Management Corporation of Nigeria (AMCON) in 12 months.

The DMBs contributed 0.5% of their total assets as at the date of their audited financial statements to the Banking Sector Resolution Cost Trust Fund (BSRCTF), also known as the AMCON Sinking Fund.

What it means: The AMCON’s sinking fund was established following the realization that recoveries from AMCON-acquired bad loans might be insufficient to meet the cost of restoring financial stability. The fund was to further ensure that the burden on the national treasury is reduced as any banking crisis will be resolved by banks, the CBN and AMCON.

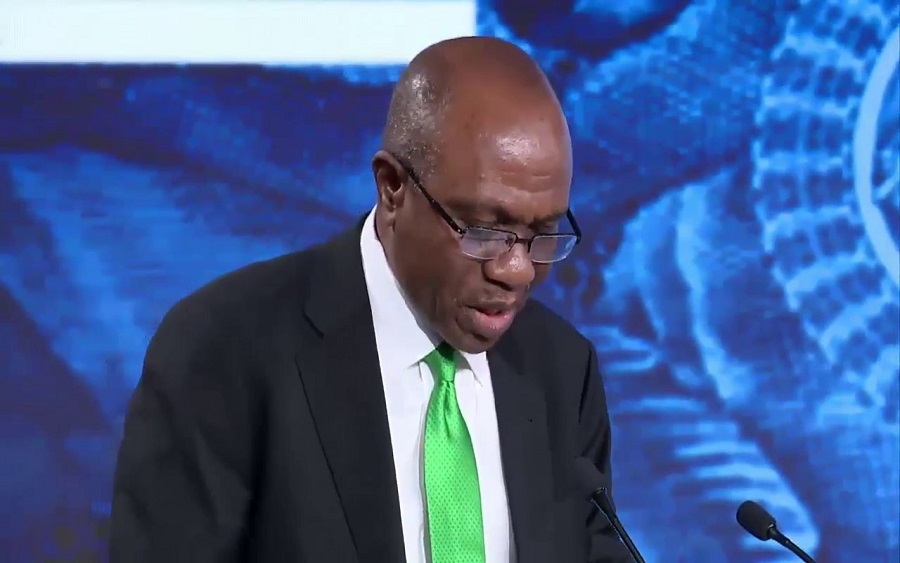

According to the report, which was endorsed by CBN Governor, Godwin Emefiele, the investment of N898.45 billion in Polaris Bank Limited (defunct Skye Bank Plc) raised the corporation’s liabilities to N5.43 trillion as at June last year.

AMCON is an instrument created by the Federal Government to bolster ailing banks through the injection of capital in consideration for equity.

[READ ALSO: AMCON to recover over N5 trillion debt with judicial intervention]

Considering the Act that established it, the undertaker has a mandate to recover bad debts owed by institutions – private or public – on behalf of the Federal Government.

The rising bad loans and the need to save the banking industry from imminent collapse prompted the Federal Government to set up AMCON in 2010 with a 10-year mandate. The AMCON Act 2019 (Amended) gives the corporation more powers to recover bad debts from obligors.

It said the annual on-site routine examination of the AMCON was also conducted by the CBN during the review period.

The CBN report stated, “The carrying value of AMCON’s liabilities increased from N4.53 trillion at end-June 2018 to N5.43 trillion at end-December 2018, arising from the Corporation’s investment of N898.45 billion in Polaris Bank Ltd.

“AMCON’s liabilities N5.43 trillion was projected to be covered by the Banking Sector Resolution Cost Trust Fund (BSRCTF) and the corporation’s internal credit recoveries and asset sales. Contributions to the BSRCTF by the CBN and 15 participating banks for year 2018 was valued N228.28 billion.”

[READ ALSO: CBN intervenes with $8.28 billion to defend Naira]

The recoveries generated by AMCON as well as the contributions to the BSRCTF were used to repay the corporation’s debt obligations, which fell due in December 2018.

“The corporation made cash recoveries of N89.97 billion for the 2018 financial year from asset sales and credit repayments, bringing its total recoveries from inception to end-December 2018 to N759.05 billion, consisting of cash, N366.85 billion; shares forfeiture, N128.47 billion; and property forfeiture, N263.73 billion,” it added.