Tolaram Group, the Indomie maker that has dominated the Nigerian instant noodles market for years, is now delving into the ports and cargo business. In specific terms, the company is set to invest the sum of $1.1 billion to build what analysts are projecting to be the biggest and busiest port in Nigeria and the entire West Africa region.

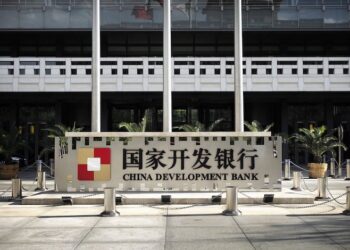

What we know: According to a report by Financial Times, the project is being sponsored with Chinese money. About $630 million was sourced from the China Development Bank, while the remaining $470 million was gotten in the form of equity from China Harbour Engineering Company. The state-owned engineering firm would be responsible for constructing the port.

[READ MORE: 5 Nigerian companies with a combined market value of 5% of Nigeria’s GDP]

In the meantime, ownership structure for the project has been broken down thus:

- Tolaram Group: 22.5%

- China Harbour Engineering Company: 52.2%

- Lagos State Government: 20%

- Nigerian Ports Authority: 5%

In his reaction to this development, Tolaram Group’s Managing Director for West Africa, Haresh Vaswani, was quoted as saying that it was not an easy thing to raise the money needed for a project of this magnitude.

“This is a real game changer for us, doing project financing of this scale . . . It’s easy to raise money for a factory — you need $30 million, $50 million. But you want to raise $800m? That’s a whole different ballgame.”

However, the money has been raised and will now be used to finance Tolaram’s biggest project yet. The port in question here is the Lekki Port which has been described as “the anchor of an 800-hectare free economic zone” located in the Lagos, Nigeria’s commercial capital.

Tolaram’s expansion drive: The company has been expanding aggressively in Nigeria and elsewhere ever since 1988 when it first imported the Indomie noodle brand into the country. In 1995, it began manufacturing Indomie locally and has since then dominated the market. Its subsidiaries also operate in other sectors apart from the fast-moving consumer goods space. But does it have what it takes to excel in the ports and cargo business?

Tolaram Group believes it does have what it takes, besides the money, of course. According to the company, the aim here is to build a modern, state of the art port facility that can compete with other ports in neighbouring West African countries whilst ultimately positioning Nigeria to become a major player in the business. To do this, plans are also underway not only to build a fantastic port but also to ensure that the facilities around the port (such as roads) are equally good. As such, part of the $1.1 billion will be dedicated to this.

[READ MORE: Can a company operate without a website in 2019?]

Note that Nigeria imports a whole lot of goods and as such, needs functional state of the art ports. So far, it has been managing with the services rendered by the Apapa Port which, unfortunately, is not up to the task. It is, therefore, expected that Tolaram’s emergence as a major player in this field will be very useful to the Nigerian economy. In doing that, the company will be positioned for more profitability in a country that has already given it so much in terms of profitability.