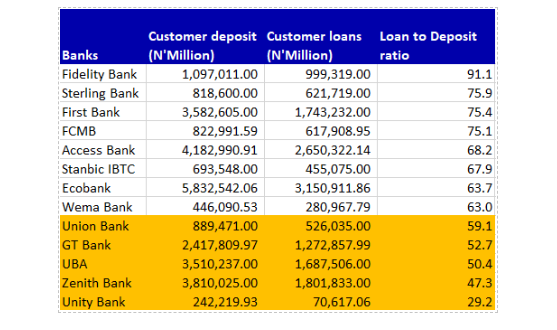

As the September 30th deadline set by the Central Bank of Nigeria (CBN) for banks to maintain a 60% minimum loan-to-deposit ratio approaches, reports show that the total bank loans to customers of the thirteen (13) Nigerian banks listed on the Nigerian Stock Exchange (NSE) stood at 15.9 trillion as of June 2019.

Meanwhile, the reports further show that the total loans and advances rose to N17.7 trillion as of June 2019, from N16.15 trillion in December 2018. This suggests the 13 listed banks increased total loans and advances by N1.5 trillion between January and June 2019.

A closer look into the banks’ financials shows that while total loans and advances hit N17.7 trillion, banks’ deposits as of June 2019 stood at N28.3 trillion. This implies the 13 listed banks all together have a 62% loan-to-deposit ratio.

FUGAZ top loan chart: Data collected from the financials of the 13 banks show that although Ecobank Transnational Inc (ETI) has the largest amount of loans, the total loans by its Nigerian subsidiary “Eco Bank Nigeria” was not provided in the bank’s financial. Meanwhile, the FUGAZ (First Bank, UBA, GTB, Access and Zenith Banks) top the chart of the total loans to customers.

[READ MORE: MFBs, DMBs, others get new lending limit directive from CBN]

According to the reports, Access Bank has a loan portfolio of N2.65 trillion, followed by Zenith with N2.80 trillion, First Bank (N1.74 trillion), UBA (N1.68 trillion) and Guarantee Trust Bank disbursed N1.27 trillion respectively.

The CBN LDR Policy: While bank loans to customers have improved significantly, not all banks have met the Central Bank’s loan-to-deposit ratio. Basically, deposit money banks, whose loan-to-deposit ratios are below the new target 60%, are intensifying efforts to get more borrowers before the September 30 deadline.

[READ ALSO: CBN reveals plans to deduct bad loans from bank balances of defaulters in any]

The CBN, in an earlier circular, stated that failure to meet the minimum LDR would result in a levy of additional cash reserve requirement equal to 50% of the lending shortfall of the target LDR. The move, according to CBN, is to improve lending to the real sector of the country’s economy.

- A quick look shows only 7 banks have currently met the CBN new LDR policy.

- Fidelity Bank currently has 91.1% LDR with N999.3 billion of N1.97 trillion customers’ deposit.

- Sterling Bank, First Bank, FCMB, Access Bank, Stanbic IBTC, Ecobank and Wema have all met the CBN LDR.

- Meanwhile, Union, GTB, UBA, Zenith and Unity Banks currently fall short.

Bracing up: While investors await the implementation of the CBN new LDR policy, banks are reportedly bracing up. Recently reacting to the policy, the Chief Executive Officer of Guaranty Trust Bank Plc, Segun Agbaje, while granting an interview to Arise TV, disclosed that,

“The CBN has actually been good with how they’ve done it. At the time this was announced, the loan to deposit ratio was 57%. All people have to do is grow by 3%. So, I think there’s a bit more alarm than reality. You’re growing 3% by the end of September and I think for most banks, they should either get very close or there some banks that are over it. I think it’s been measured. If we had gone from 57% to 80%, then we would have had a lot of chaos.”

However, concerns are still being raised over the policy. The Director of EFG Hermes Research in charge of Sub-Saharan African banks, Ronak Ghadi, recently opined that the apex bank’s regulation could be damaging for the Nigerian Banking Industry.

“The introduction of the new net LDR encourages commercial banks to undertake more risk at a time when the macro-economic environment remains fragile at best. Specifically, it could lead to the underwriting of high risks loans which could further lead to the weakening of assets and by extension, the destabilisation of the industry.”

[READ FURTHER: CBN Monetary Policy Committee and Minister of Finance clash over Nigeria’s debt]