***Nigeria’s GDP slows to 1.94% in Q2 2019, as non-oil sector contracts***

Bonds

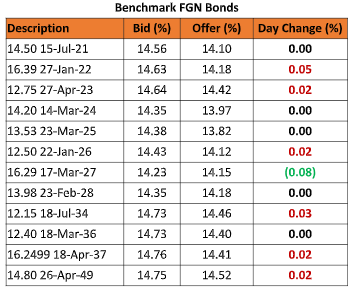

The FGN Bond market traded on a relatively quiet note, with few demand interests witnessed around the mid end of the curve. Yields however ticked marginally higher by c.1bp, as traders maintained bearish bets following the weaker than expected Q2 GDP figures.

We expect interests in FGN bonds to remain relatively muted, due to expectations for higher yields in the T-bills market.

[READ MORE: Coupon Payments to Sustain Demand Interests on FGN Bonds]

Treasury Bills

Yields in the T-bills market compressed marginally by c.5bps, as a decline in funding pressures spurred some buy interests on the short end of the curve. Yields on the longer dated maturities however remained slightly pressured, with most bids now at c.14.00%.

We expect the market to maintain its current flattish trend, as market players anticipate a renewed OMO auction by the CBN on Thursday, when c.N204bn worth of OMO T-bills mature.

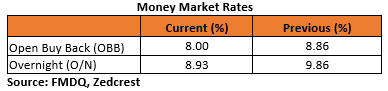

Money Market

Rates in the money market remained relatively stable as system liquidity remained in positive territory at c.N145bn. The OBB and OVN rates consequently ended the session at 8.00% and 8.93% respectively.

We expect rates to remain stable tomorrow, as there are no significant funding pressures anticipated.

[READ MORE: Treasury Market Opens Bearish as Market Players React to Higher CBN OMO Rate]

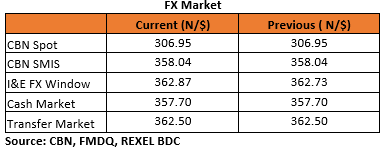

FX Market

At the interbank, the Naira/USD spot and SMIS rates remained stable at N306.95/$ and N358.04/$. The Naira depreciated at the I&E window by 14k to close at N362.87/$. At the parallel market, the cash and transfer rates remained stable at N357.70/$ and N362.50/$ respectively.

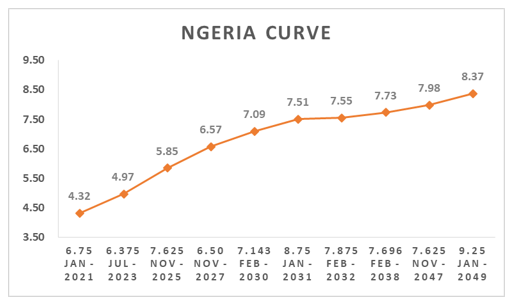

Eurobonds

The NGERIA Sovereigns weakened further, as a decline in oil prices from the trade war escalation and possible increase in output by the OPEC+ weighed on sentiments during the session.

The NGERIA corps were the most hit, with yields trending higher by c.11bps on average across the traded tickers. We witnessed the most selling interest on the UBANL 22s, ZENITH 22s and SEPLLN 23s

[READ MORE: Daily update on Treasury Bills, Bonds, Forex, oil price and more]

Contact us:

Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision