Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

I&E Market Turnover Hits All time High of $1.2bn as FPIs fuel Rally on T-bill*** FGN Bonds Trade to Sub-14% in Post-Election rally***

KEY INDICATORS

Bonds

The FGN Bond market opened the day on a firmly bullish note, with significant buying witnessed especially on the mid to long end of the curve, following the final announcement of the presidential election results. Yields on the 2027s and 2034s consequently broke the 14% support level, to trade at a low of 13.91% and 13.81% respectively. Yields however retreated slightly towards the end of the session, to close at c.10bps lower on the day.

We expect demand interests to persist, but on a less aggressive note as market players seem to view support for bonds at c.14%.

Benchmark FGN Bonds

Treasury Bills

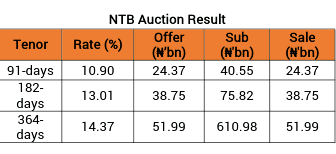

The T-bills market rallied further by c.50bps in today’s session, with continued buying interest witnessed especially on the long end of the curve which traded as low as 14% during the sesssion. In line with our expectations, the NTB auction by the CBN was signifcantly oversubcribed by c.632%, with the most demand on the 364-day which was 11.75X oversubscribed. Stop rates consequently cleared by c.35bps lower from their previous auction levels at 10.90% (-7bps), 13.01% (-39bps) and 14.37% (-58bps) on the 91, 182 and 364-day bills respectively.

Given the signifanct level of demand at today’s NTB auction, we expect market sentiments to remain firmly bullish, as market players anticipate a renewed OMO offering by the CBN tomorrow.

NTB Auction Result

Money Market

Rates in the money market declined further by c.4pct as system liquidity improved slightly to c.N140bn. The OBB and OVN rates consequently ended the session at 9.50% and 10.58% respectively.

We expect rates to trend lower tomorrow due to expected inflows from OMO maturities, c.N350bn.

Money Market Rates

FX Market

At the Interbank, rates remained unchanged at N306.85/$ (Spot) and N356.97/$ (SMIS). The NAFEX rate in the I&E window appreciated by 0.09% to N361.18/$ as market turnover hit an all-time high of c.$1.2bn following increased FPI inflows into the market. At the parallel market, the cash and transfer rates depreciated by 0.06% and 0.14% at N358.00/$ and N366.00/$ respectively.

FX Market

Eurobonds

The NGERIA Sovereigns maintained a bullish run fuelled by a successful declaration of the Nigerian election results. Yields which trended significantly higher at the open of the session however retreated slightly, with yields closing lower by c.10bps on the day.

In the NGERIA Corps, we witnessed slight interests on the ZENITH 22s, FIDBAN 22s and SEPLLN 23s.

Contact us:

Dealing Desk: 01-6311667 | Dayo: 07032208237 | Seyi: 08023231396 | Nnamdi: +2348133385000 | Tosin: +2347039394376

Email: research@zedcrestcapital.com

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.