The leading tech company, Apple Inc. has partnered with Goldman Sachs to unveil Apple Card, a credit card that can be used to cater for all transactions. The apple card is designed to be used primarily on Apple devices such as iPhone, iPad, Apple Watch, or Mac.

Although it is optimized to be used on Apple Pay – a payment platform that allows one to make transactions with one’s iPhone or Apple watch, it can also be used for the traditional payments.

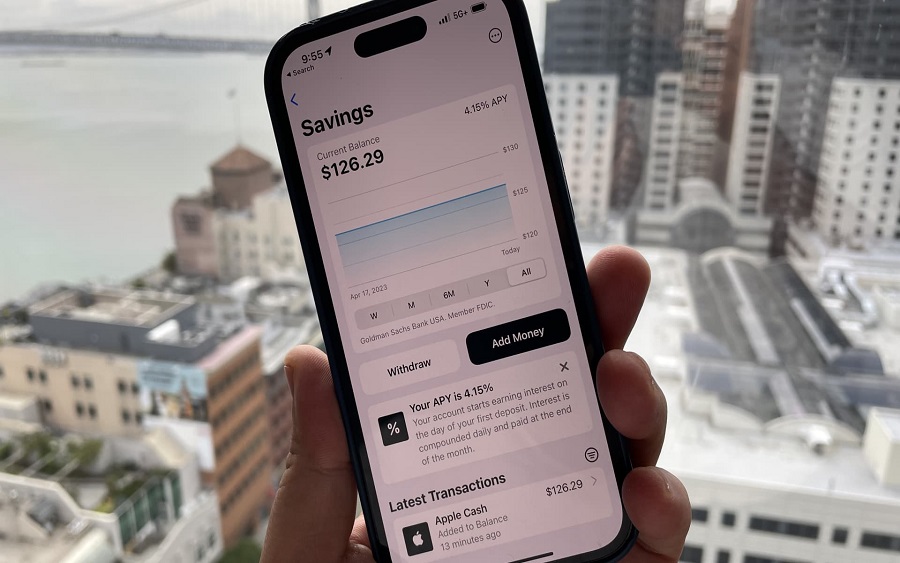

Users can access the mobile Apple Card by signing up using their iPhones or other Apple devices through the wallet App or get their physical Apple cards and pair with their devices.

[READ MORE: Apple records $44 billion loss in market value amidst US trade war with Chin]

What you should know: The Apple card has a number of features that distinguish it from the regular credit card. One of these is the daily cashback offer. The physical card offers 1% cashback, the virtual card offers 2% cash back on Apple Pay purchases and 3% back on purchases from Apple. The cash back is delivered daily to your Apple Cash balance or to the card monthly as a credit balance if you don’t have or want an Apple Cash account.

No penalty/ extra interest rate: Another feature worthy of note is the fact that Apple does not charge you an extra interest rate when you fail to pay up on time. You will continue to pay your agreed-upon interest rate on your outstanding balance, but that rate will not go up.

[READ ALSO: This is how Cryptocurrency works]

Tracked spending: The Apple card uses machine learning and Apple Maps to help customers better understand their spending by clearly labelling transactions with merchant names and locations in the wallet. It also provides weekly and monthly spending summaries for the users.

Meanwhile, Apple card is presently available for only customers in the United States.