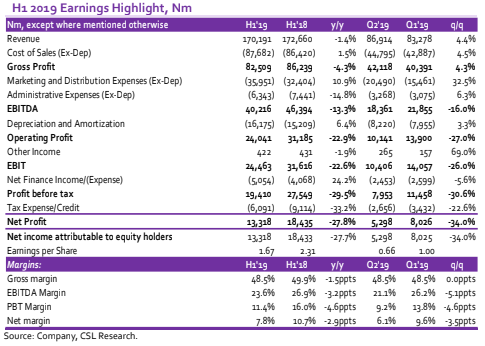

Nigerian Breweries (NB) announced a 1.4% y/y decline in Net Revenue in H1 2019. Although we expect seasonality factors to pressure full-year Revenue lower, annualised Revenue of N340.4 billion came in ahead of our forecast of N332.0 billion. On a q/q basis, Net Revenue improved 4.4% to N86.9bn from N83.2 billion. While Net Income declined 27.8% y/y to N13.3 billion and 34.0% q/q to N5.3 billion.

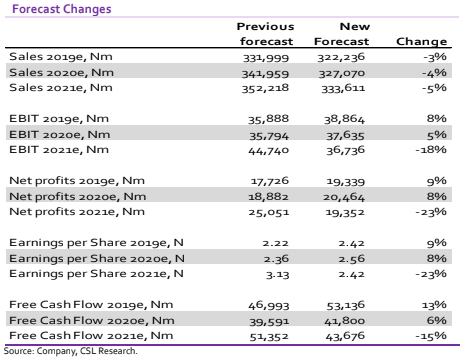

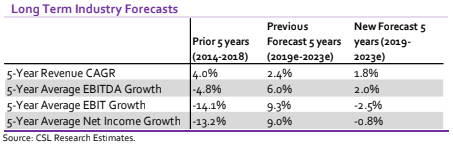

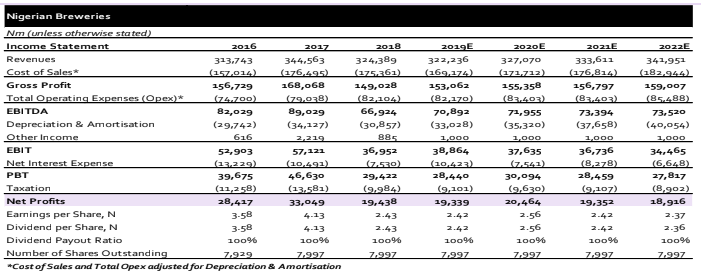

While we raised our forecasts for key profit lines for FY 2019e on the back of controlled costs, we have a long-term prognosis of weakness stemming from growth concerns in the beer industry (We forecast 5-Year average Revenue growth of 2.0% compared to 2.9% previously). With costs still set to rise higher in coming years as the third phase of the advalorem excise duty kicks in, we see beer brewers raising prices and as we don’t expect consumer income to recover, we see the potential impact on volume growth in the long term.

In 2019, NB has aggressively made use of commercial paper issuances to finance its working capital needs. While we do not expect any further issuances this year, we believe there may be a need for more issuances next year as the company looks to take advantage of lower barley prices to stock up materials like it did in 2017.

We have lowered our target price to N61.60/s from N87.90/s previously. Despite attractive valuation following significant sell-off, our not too positive long-term outlook makes us retain a Hold recommendation. Our N61.60/s price target implies a 21.5% upside to closing price of N50.70/s at the close of trading today.

[READ MORE: Investors in Budweiser’s International Breweries wail as N163 billion is wiped out of market value]

We applied DCF and relative valuation using EV/EBITDA multiple in the ratio 60:40 to arrive at our target price. We also note that NB currently trades at a discount (TTM EV/EBITDA – 7.3x) to our emerging market peer average (TTM EV/EBITDA – 12.4x) and the 5-year average (EV/EBITDA 10.0x).

Nigerian Breweries’ (NB) in its recently released H1 2019 financials reported marginal 1.4% decline in Revenue to N170.2bn from N172.7bn in H1 2018. On a q/q basis, Net Revenue improved by 4.4% to N86.9bn in Q2 2019 from N83.2bn in Q1 2019. H1 annualised reported Revenue of N340.4bn beat our 2019e of N332.0bn.

Excerpts from H1 2019 presentation for parent company, Heineken revealed beer volume grew 3.1% within the period. This growth was driven by premium lager beer, Heineken. Furthermore, Heineken CEO, Jean-François van Boxmeer mentioned recovery in some African markets including Nigeria.

While NB did not report volume performance, we believe weakness in mainstream lager segment eroded gains in the premium lager business. In the premium beer segment, we recall IntBrew raised price on its premium beer brand, Budweiser (which it has since reversed). Consequently, it lost market share to NB’s premium brands. However, IntBrew continues to use its discounted brands in the mainstream segment to strengthen its Revenue profile and expand market share.

Thus, we believe a net-off of these occurrences shaped volume direction for NB which consequently impacted sales. Noteworthy to mention, the second phase of the new advalorem excise regime kicked off in June which may have impacted Net Revenue within the period.

[READ MORE: Nigerian Breweries N15bn CPs: Investors to trade holdings on FMDQ]

Cost of Sales adjusted for depreciation climbed marginally, up 1.5% y/y to N87.7 billion in H1 2019 from N86.4 billion in H1 2018. Higher Cost of Sales was driven by uptick in the cost of raw materials (up 1.1% y/y to N63.1bn) and Repairs & Maintenance Expenses (up 13.9% y/y to N13.3 billion).

We note that key input costs for NB faced severe upward pressures in H1 2019 with our average Barley benchmark price in H1 2019 printing at US$1,775.0, a 22.5% y/y rise from H1 2018 US$1,449.0. Despite the pressured cost environment, NB’s raw material cost only grew marginally, which we attribute to the company’s accounting recognition of inventory cost as well as proper inventory management.

Overall, Gross Profit declined 4.3% y/y to N82.5 billion in H1 2019 from N86.2 billion in H1 2018. On a q/q basis, Gross Profit climbed higher by 4.3% to N42.1bn in Q2 2019 from N40.4 billion in Q1 2019. Also, Gross margin slipped lower by 1.5ppts y/y to 48.5%.

Operating Expenses (adjusted for depreciation) increased 6.1% y/y to N42.3bn in H1 2019 from N39.8bn in H1 2018. The rise in Operating Expenses came as a result of a 10.9% y/y rise in Marketing & Distribution (adjusted for depreciation) Expenses to N32.9bn in H1 2019. We believe the increase in Marketing & Distribution costs was largely due to NB’s drive to reclaim lost market share which reflects in the 17.2% y/y jump in Advertising & Sales Expenses as well as a 7.8% y/y rise in Distribution Cost.

[READ MORE: Nigerian Breweries: Cost pressures strain H1 2019 performance]

Meanwhile, Administrative Expenses (adjusted for depreciation) declined 14.8% y/y to N6.3bn in H1 2019 from N7.4bn in H1 2018 due to reduction in staff headcount following the right-sizing exercise done last year.

Higher Operating Expenses and a decline in Gross Profit, caused EBITDA to dip 13.3% y/y to N40.2bn in H1 2019 from N46.4bn in H1 2018. Operating Expenses was significantly higher in Q2 (up 28.2% q/q), thus, EBITDA for Q2 2019 declined more significantly, down 16.0% q/q to N18.4bn from N21.9bn in Q1 2019. EBITDA margin slipped lower by 3.2ppts y/y to 23.6% in H1 2019 from 26.9% in H1 2018 and by 5.1ppts to 21.1% in Q2. A 6.4% rise in Depreciation & Amortisation Charge accelerated the decline in Operating Profit, falling 22.9% y/y to N24.0bn in H1 2019 from N31.2bn in H1 2018.

Net Finance Cost increased 24.2% y/y to N5.1bn in H1 2019 from N4.1bn in H1 2018 on the back of lower Interest Income (down 9.6% y/y to N198.5m) and higher Interest Expense (up 22.5% y/y to N5.3bn). NB’s higher Interest Expense was driven by higher interest-bearing liabilities (H1 2019 – N56.7bn vs H1 2018 – N42.6bn) due to the recent commercial paper issuances done by the company to finance working capital. While Tax Expense declined 33.2% y/y to N6.1bn, Net income slumped 27.8% y/y to N13.3 billion in H1 2019 from N18.4 billion in H1 2018 bringing EPS to N1.67/s in H1 2019 compared to N2.31/s in H1 2018.

Our Outlook: Long term pressures the tipping point

H1 2019 performance signalled Revenue pressures faced in 2018 may not be over as NB struggles to keep its share of the value lager beer segment. The company has guided towards the possibility of raising prices in H2 2019 as the second phase of the advalorem excise duty regime kicks in. We anticipate a situation where prime rival, IntBrew would follow suit, unlike last year’s refusal which forced NB to reverse some of its price changes.

We believe sustained pressures on IntBrew’s profit lines may make it unable to take in the additional cost pressure from higher duties. Nevertheless, we expect volumes to be impacted as consumers adjust to the new realities of higher prices. Consequently, we expect volume decline to outweigh price gains which would drag on revenue.

[READ MORE: Beer Wars: International Breweries takes number 2 market share from Guinness Plc]

Barley prices showed significant pressure in the first half of the year particularly in Q2 2019. However, this did not impact NB’s cost of sales significantly with the company’s weighted average cost flow assumption smoothening out the recent high costs. Sentiments from key barley producers across the globe point to improving grain yield which could boost supply in the near term and thus pressure down price.

We expect NB may take advantage of possible price declines in grains to stock up materials just like in 2017 when barley declined below US$1,400. Against this backdrop, we lower our Cost margin forecast to 52.5% for FY 2019e from 54.6% previously. Consequently, we expect a faster decline in Cost of Sales would improve Gross profit.

NB’s rightsizing exercise has yielded fruits in 2019 with Administrative expenses dipping. However, higher Marketing costs have erased the cost savings from Administrative expenses. We expect this narrative to playout for the rest of the year as an intense competitive environment forces increased Marketing and Advertising expenses.

Overall, we expect an increase in marketing costs to be net-off by cost savings in Administrative expenses. Thus, we project a muted growth of 0.1% in Operating expenses to N82.2bn. Against this backdrop, our EBITDA forecast comes to N70.9bn, a 5.9% y/y increase from FY 2018’s N66.9bn.

In 2019, NB has aggressively made use of commercial paper issuances to finance its working capital needs. Consequently, Interest expense has been higher than we anticipated. Factoring in the Series 3 & 4 commercial paper issuances done in June, we adjust our Interest Expense forecast higher to N10.6bn from our previous forecast of N9.7bn.

[READ MORE: International Breweries’ loss before tax increases by 148% in FY 2018]

In addition, we forecast a 64.6% drop in Interest income to N128.1 millio. Consequently, we expect the higher Net Interest Expense as well as higher Depreciation expense to drag on Pre-Tax profits. We project a 3.3% y/y drop in Pre- Tax profits to N28.4 billion. A lower forecast for an effective tax rate of 32.0% (H1 2019 actual – 31.5%) would help minimize finance cost pressure on Net Income. Thus, we forecast a 0.5% drop in Net Income to N19.3 billion. Our EPS forecast prints at N2.42/s for FY 2019e.

We have a long-term prognosis of weakness stemming from growth concerns in the beer industry (We forecast 5-Year average Revenue growth of 2.0% compared to 2.9% previously). With costs still set to rise higher in coming years as the third phase of the advalorem excise duty kicks in, we see beer brewers raising prices.

Thus, as we don’t expect consumer income to recover, we see the potential impact on volume growth in the long term. Figures below highlight our long-term pessimism as we adjust our long- term growth rate across Revenues and key profit lines:

Valuation: Depressed valuations but HOLD rating maintained

While we raised our forecasts for key profit lines for FY 2019e on the back of controlled costs, we have renewed concerns about the long-term growth dynamics of the beer industry as players adapt to new realities in the industry. This long-term pessimism reflects in our DCF valuation. Consequently, we cut our Target Price from N87.90/s to N61.60/s which implies the upside of 21.5% from today’s closing price of N50.70/s. Despite the decent upside, we maintain our HOLD rating as remain unconvinced of long-term recovery.

[READ MORE: Investors in Budweiser’s International Breweries wail as N163 billion is wiped out of market value]

Our valuation model makes use of the DCF valuation relying on a 5-Year FCFF valuation methodology and Relative valuation which uses Forward EV/EBITDA multiples for our EM peers. We applied a weighting of 60:40 with the greater weighting on DCF valuation. We also note that NB currently trades at a discount (TTM EV/EBITDA – 7.3x) to its emerging market peer average (TTM EV/EBITDA – 12.4x) and 5-year average (EV/EBITDA 10.0x).

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.