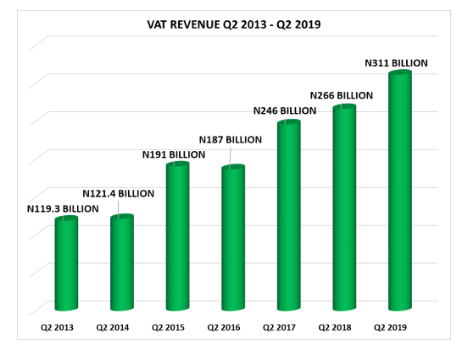

The latest report released by the National Bureau of Statistics (NBS) shows that Nigeria generated N311.94 billion revenue from Value-Added Tax (VAT) in the second quarter (Q2) of 2019.

According to the report, the VAT generated in the second quarter represents a 7.92% increase in VAT revenue when compared with what was generated in Q1 2019. Also, the sum of N266.7 billion was generated in Q2 2018, as against the N311.94 billion generated in Q2 2019.

VAT breakdown: The report further shows that year-on-year, VAT generated rose by 16.95% in Q2 2019. The VAT generated was put at N269.79 billion in Q1, while it rose to N311.94 billion in Q2 2019.

- Out of the total amount generated in Q2 2019, N151.56 billion was generated as Non-Import VAT locally while N94.90 billion was generated as Non-Import VAT for foreign. The balance of N65.48 billion was generated as NCS-Import VAT.

- A closer look into the report reveals VAT revenue by sector. Other manufacturing, professional services and commercial trading top the chart for the highest contribution of VAT generated.

- Specifically, other manufacturing sectors generated the highest amount of VAT with N34.43 billion and closely followed by Professional Services with N29.58 billion VAT, while commercial and trading ranks 4th to generate N16.27 billion. According to the NBS report, other manufacturing has been the biggest contributor to Nigeria’s VAT in several quarters.

- On the other hand, mining generated the least and closely followed by Pharmaceutical, Soaps & Toiletries and Textile and Garment Industry with N50.60 million, N250.09 million and N316.91 million generated.

[READ MORE: Petrol sells at lowest price in North-East Nigeria – NBS]

Biggest Growth: According to the latest statistics on VAT generated across sectors in Nigeria, this is the biggest quarterly VAT revenue generated in over 7 years.

On the other hand, in terms of growth recorded between Q1 and Q2 2019, transportation and haulage services recorded the biggest growth in VAT revenue. Transportation and haulage services posted 205.35% VAT revenue growth.

Similarly, hotels and catering ranks second in terms of growth in VAT revenue. The sector recorded a 31.38% growth in VAT revenue. State Ministries and Parastatals, Petrol-Chemical and Petroleum Refineries rank top to record with the biggest growth in VAT revenue.

On the other hand, sectors that recorded a major decline in VAT remittances include Mining, Gas, Conglomerate, Pioneering and Stevedoring, Clearing and Forwarding.

More VAT? As published by Nairametrics on Monday, effective from January 2020, the FIRS has announced that it would begin to impose VAT on online transactions, both domestic and international.

Speaking on the new development, the FIRS boss noted that a lot of countries had identified Nigeria as a good market and many of them were into online businesses. He added that there was a need to tap the potentials to generate more revenue for the country.

Upshots: While the Federal Inland Revenue Service (FIRS) recorded the biggest quarterly growth in VAT revenue, it remains unknown if the total tax collection in 2019 would meet the 2019 target. A look at the FIRS website shows that in Q2 2018, tax revenue collection was 77% of the total target.

Recall that the Federal Government recently queried the Chairman of FIRS, Babatunde Fowler, over the shortfalls in tax revenues. The FG questioned the FIRS on why tax revenue shortfall became widened and worse off in previous years (2017 and 2018).

Meanwhile, the FIRS Boss has responded, explaining that the dip recorded in tax in 2015 and 2016 happened because the Nigerian economy nose-dived owing to the global crash in world oil price.

Understanding VAT: VAT is a consumption tax placed on a product from production to the point of sale. It means a higher VAT on goods is borne by the final consumer of such goods.

In Nigeria, VAT is payable on goods and services consumed by any person, whether government agencies, business organization or individuals.

VAT in Nigeria is calculated at a flat rate of 5% of the cost of services and products and is charged on a wide array of goods and services. According to Section 8 sub 1 of the VAT Act, businesses are expected to register for VAT within the first six months of the start of the business in Nigeria.

[READ MORE: FG’s VAT charges on online transactions to commence]