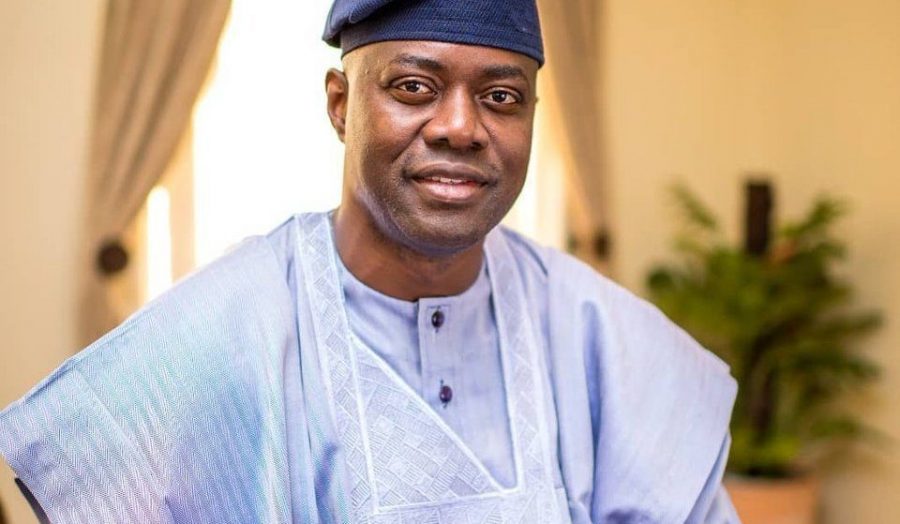

As part of the fulfillment of his campaign promises, the Oyo State Governor, Seyi Makinde has declared his assets. He is worth over N48 billion.

In a statement by Taiwo Adisa, the Chief Press Secretary to the Governor, Makinde had cash at hand and in the bank worths N234,742,296.01, as of May 28, 2019.

Records of his property: The Secretary stated that the Asset Declaration Form contained details of cash at hand, in the bank, landed property (developed and undeveloped), household items, shares and bonds own by the governor, Omini Makinde, his wife, and his companies.

[READ ALSO: Gossy Water returns as Governor Fayemi commissions production plant]

Cash in dollar terms: The Governor had cash valued at $30,056.99 as at the same date. Property, including the developed and undeveloped, as well as household items indicated on the asset forms, showed that the governor is worth N2,624,800,500 as at the date of asset declaration.

[READ ALSO: Oyo State seals Obasanjo Farms over tax evasion]

Property in dollar terms: His property, in dollars terms, developed and undeveloped, as well as household items, were valued at $4,400,000.

Property in Rand: The governor declared buildings and household items worth R4,457,554.04. He also declared details of nine buildings in Nigeria, two in the United States of America and one in South Africa.

The worth of his companies: In the statement, the current value of Makinde’s companies stands at N48,150,736,889, with 33,730,000 units of shares as of May 28, 2019.

List of his companies: Companies owned by the State Governor include:

- Makon Engineering and Technical Services Limited;

- Energy Traders and Technical Services Limited;

- Makon Oil and Gas Limited;

- Makon Group Limited,

- Makon Construction Limited; and

- Makon Power System Limited.

His Worth in Eurobond and Securities: Makinde is worth $3,793,500 Eurobond as well as shares, debentures and other securities valued at N120,500,000.

The governor has urged the members of his cabinet to follow his lead by making details of their assets public.

“I came here to collect the photocopy of the form that I signed in fulfillment of the campaign promise to the people that I will declare my asset publicly and release the document to the public. I will encourage all the members of my cabinet to do the same thing but in as much they stay within the ambit of the law, I will encourage them to do the same.”

[FURTHER READ: This is when I will devalue the naira – Emefiele]