Welcome to Nairametrics‘ summary of the daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills and Bonds. This is brought to you by Zedcrest.

This report is dated July 9th, 2019.

***CBN unveils strategies to revive poultry sector***

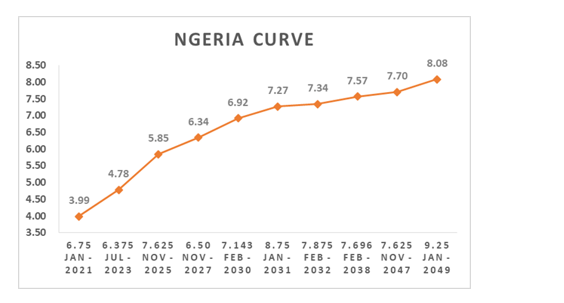

Bonds: The FGN Bond market traded on a relatively flat note, with yields marginally higher by c.3bps on the day. Interests shifted to the long end of the curve, where investors showed renewed interest for the 30year bond, which currently boasts the highest yield on offer (14.40%) among the FGNs. A slowdown in demand interest on the short end however tilted yields marginally upwards on average.

We expect yields to remain relatively stable in the near term, as market players anticipate the release of the Q3 FGN Bond calendar by the DMO.

Treasury Bills: The T-bills market traded on a slightly bullish note, with some demand pressures observed on the mid to long end of the curve, due to the significantly buoyant system liquidity levels and continued lack of an OMO auction by the CBN. Yields were consequently lower by c.5bps on average.

[READ FURTHER: A trip to Sura Market reveals the good and bad of its Independent Power Project]

We expect demand interest to persist in the near term, as market players remain uncertain of an OMO auction, which may likely occur on Thursday, with c.N92bn in OMO maturities expected then.

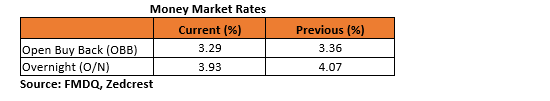

Money Market: Rates in the money market remained stable, as there were no significant outflows from the system. The OBB and OVN rates consequently ended the session at 3.29% and 3.93%, with system liquidity closing the session at c.N530bn positive.

We expect rates to remain stable in the near term, as there are no significant outflows anticipated.

[READ THIS: Investors rally Nigerian Eurobonds as Access Bank calls back its 2021 maturity]

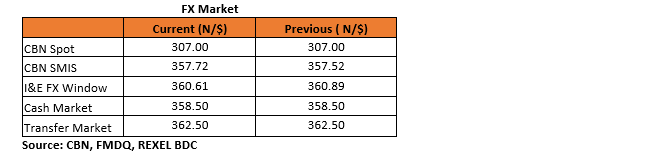

FX Market: At the interbank, the Naira/USD rate remained stable at N307.00/$ (spot) and N357.52/$ (SMIS). The NAFEX rate at the I&E window declined by 28k to N360.61/$, while the cash and transfer rates at the parallel market remained stable at N358.50/$ and N362.50/$ respectively.

Eurobonds: The NIGERIA Sovereigns dipped further as stronger US job gains dampened sentiments for a rate cut by the US Fed. Yields were consequently higher by c.9bps on the day.

Demand interests remained robust on the NIGERIA Corps, with renewed demand lifting prices higher in the FIDBAN 22s.

Contact us: Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.

[KEEP READING: Why foreign investors have a foothold in the Nigerian Stock Exchange]