Welcome once again to the daily summary of the daily performance of major economic indicators, highlights from trading sessions, and key statistics such as Treasury Bills and Bonds. This is brought to you by Zedcrest.

This report is dated July 3rd, 2019.

***Bond Yields Moderate Further Amid Continued Local Demand***

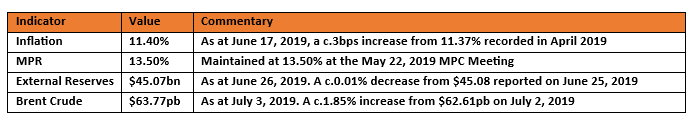

Key Indicators

[YOU SHOULD READ: Fixed Income Daily Report: Treasury Bills, Bonds, and more]

Bonds: The FGN Bond market traded on a positive note, as locals continue to reinvest bond maturities and coupon payments credited earlier this week. While demand at the short-end remained, we noticed increase in demand for duration as yields on the 2034 – 2049 maturities compressed by c.17bps on the average.

Yields closed lower by c.4bps on average across the curve, with relatively large volumes crossed during the trading session.

While we expect demand for FGN Bonds to sustain in the near term, we remain cautious as yields approach a key resistance level (14.00%).

Treasury Bills: The bullish run in the Treasury Bills market continued in today’s session, as yields across the Benchmark NTB curve compressed further by c.7bps on the average. Demand peaked across the mid- to long-dated maturities, as market participants chased available yields invest available liquidity.

At the PMA, the DMO rolled over a total of N88.86Bn in maturing treasury bills across three maturities. The stop rates were closed lower for the 182- and 364-day tenors at 11.70% (+19bps) and 11.91% (+11bps) respectively while the 91-day closed higher at 10.50% (-90bps). Demand again was skewed to 364-day tenor, with a bid-to-cover ratio of 5.36X.

[READ THIS: T-Bill Rates Decline Further in Absence of CBN OMO Auction]

There is a high probability of an OMO auction especially with system liquidity north of N750bn. We maintain our expectation for an uptrend in yields in the near term.

Money Market: Rates in the money market dipped further by c.3.25pct due to the relatively high system liquidity. The OBB and OVN rates consequently ended the session at 3.29% and 4.00%, with system liquidity now estimated at N776.67 billion positive.

We expect rates to trend higher in tomorrow’s session, as we anticipate another OMO auction by the CBN to manage excess system liquidity.

FX Market: At the interbank, the Naira/USD rate remained stable at N306.95/$ (spot) and N357.53/$ (SMIS). The NAFEX rate at the I&E window lost by 9k to N360.52/$, as the market turnover saw a further increase of 7% to close the session at $324.71m.

At the parallel market, the cash and transfer rates remained stable at N358.60/$ and N362.50/$ respectively.

[READ THIS: Daily update on Treasury Bills, Bonds, Forex etc]

Eurobonds: The NIGERIA Sovereigns extended gains today, alongside global bonds, as investors evaluated the recent dovish appointments to two of the world’s major central Banks. Yields compressed by c.3bps on the average across all the papers on the sovereign curve.

Demand remained strong for the NIGERIA Corps in today’s trading session, as we witnessed gains on the ECOTRA 2021 (+49bps), FIDBAN 2022 (+18bps) and ETINL 2024 (+15bps).

Contact us: Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.

[READ FURTHER: Ecobank raises $450 million through bond offering]