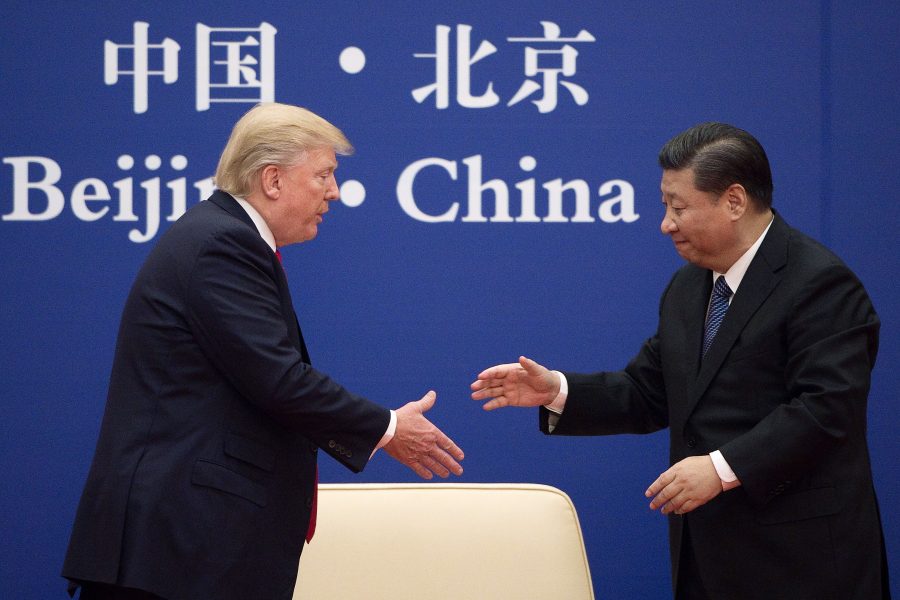

The President of the Association of Bureaux De Change Operators of Nigeria (ABCON), Dr. Aminu Gwadabe, has disclosed that the on-going trade war between two of the world’s largest economy, the United States and China, is playing to Nigeria’s advantage.

How Nigeria get to benefit: The association’s president said the trade war is boosting the price of crude oil in the international market, which in return is increasing its stock of foreign exchange reserves.

Gwadabe also disclosed that the superiority contest between the two world leaders is boosting the strength of the local currency. Confidence in the increasing buffers supports activities, he said.

What you need to know: Since the trade war between China and the US began in 2018;

- The US has already slammed tariffs on $250 billion worth of Chinese products and has threatened tariffs on $325 billion more.

- China has set tariffs on $110 billion worth of US goods and is threatening qualitative measures that would affect US businesses operating in China.

China recently held off further deliberations regarding the trade talks with the U.S, insisting that unless the Trump administration is willing to “adjust its wrongdoings”, the trade talks will not continue.

China’s outburst is due to Trump’s announcement that tariffs on $200 billion worth of Chinese goods would increase to 25% from 10% on May 10 (last two weeks). Beijing retaliated by raising levies on $60 billion worth of U.S. products.

Now, Gwadabe says the naira will experience another level of stability owing to the trade war and the tension in the Persian Gulf. He also noted that since the beginning of April this year, oil prices have remained above $70 a barrel as the trade war rages.

“The rising oil prices as a result of tension in the Persian Gulf and the increasing trade wars between two world economic giants – China and America, will help to take the naira to another level of stability.

“I advise the Federal Government and the Central Bank of Nigeria (CBN), to take advantage of the two situations by introducing what will support growth and development opportunities.”

He added that the U.S. sanctions on Iran and Venezuela have also tightened the supply of crude oil in the international market and put upward pressure on oil prices.

Time for Single digit interest rate: Gwadabe says it’s time for the Central Bank of Nigeria to have a single digit interest rate that would stimulate economic activities and business growth considering the exchange rate stability being witnessed in the market.

He further advised CBN to deepen currency SWAP pact with China and diversify commodity exports to the United States in other to diversify foreign exchange earnings for the country.

“Other great areas to focus for diversifying our foreign exchange earnings include promoting Diaspora remittances for economic buffer and foreign reserves accretion as seen in India and United Arab Emirates where migration remittances have lifted their economies.”