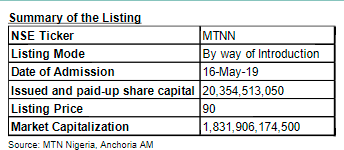

It was all yellow at the Nigeria Stock Exchange, yesterday, as one of the most anticipated transactions was consummated with the listing of 100% of the issued and paid-up ordinary shares of MTN Nigeria Communication by way of introduction.

MTN Nigeria Share rose by 10% from N90 per share to N99 per share after listing on the premium board of the Nigeria Stock Exchange (NSE) yesterday. At the end of the trading session, only 5.5 million units were exchanged, with over 67 million bids left unfilled.

- With the listing of MTN Nigeria on the Exchange, the total market capitalization rose by c18% to N12.52 trillion from N10.63 trillion the previous day.

- The market closed bullish, up by 0.54% after 8 consecutive days of decline.

- .MTN Nigeria becomes Nigeria’s only listed telecoms company.

- MTN Nigeria is now the second most capitalized company on the Exchange after Dangote Cement.

- As at Q1 2019, MTN Nigeria remains the leading telecom operator with a contribution of c38% to the total market share. This represents over 65 million subscribers.

- This is closely followed by Globacom (c27%), Airtel (c26%), and 9mobile (c10%).

- MTN Nigeria‘s active data subscribers increased by c6.04% YoY to 46.55 million representing a contribution of 40.15% to the Total Internet Subscribers.

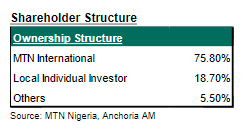

- MTN Group has a total of 236.60 million subscribers with the Nigeria business contributing 25% to the total subscribers while in terms of revenue the Nigeria business contributes c33% to the Group’s revenue.

- Growth in Revenue by 13.19% YoY to N282.09 billion due to growth in key revenue line during the period under consideration.

- The growth in data revenue by 31.5% was driven by the increased number of subscribers coupled with improved network quality and pricing flexibility. The increase in fintech revenue by 22.9% was due to an increase in customer base coupled with the ability to leverage on strong mobile distribution.

- In terms of contribution to the revenue, Voice accounted for 74.9%, Data (16.6%), Digital (1.0%), Fintech (2.9%) and Other (4.5%).

- Increased operational efficiency as the Company’s EBITDA Margin and PAT Margin rose to 53.33% and 17.17% from 41.81% and 12.92% in Q1 2018 respectively while the Cost to Income ratio fell by 400bps to 69% in Q1 2019. This is as a result of increased revenue coupled with cost reduction strategy of the company.

- Despite a 53.84% YoY increase in Net Finance Cost, the Profit Before Tax and Profit After Tax grew by 44.13% and 50.44% to N70.1 and N48.44 billion in Q1 2019.

- Impressive return on asset. In Q1 2019, the Return on Average Asset (ROAA) grew to 16.23% from 13.32% in Q1 2018 while the return on Average Equity (ROAE) fell to 93.58% in Q1 2019 from 117.65% in Q1 2018.

- Reduction in Cashflow in Q1 2019 is due to the payment of N73 billion as dividend and N55 billion as fine payment. The fine payment of the fine is expected to be completed this month, 29th May 2019.

Anchoria Asset Management Limited

5th Floor, Elephant House

214, Broad Street

Marina

Lagos

Investment Research research@anchoriaam.com +234 908 720 6076

Wealth Advisory investor-relations@anchoriaam.com +234 818 889 9455

please i need an article on 10 stocks on the NSE that rose quickly within 3 days