Globally, the cosmetics industry is a cash cow, generating an estimated annual turnover of about $400 billion. This boom in global demand has rubbed off on African cosmetic industry which is valued at €9.2 billion, with an increase of between 8% and 10% yearly.

While the Nigerian cosmetic market is not ranked number one in Africa, it is estimated to be a leader in sub-Saharan Africa, and has been projected to be valued as much as €3.2 billion by 2020 due to population size and the spread of urban lifestyle in rural areas.

Just as the Nigerian cosmetics industry is robust with enormous growth potentials, so also is the beauty and personal care market flooded with various brands jostling for market share. One segment of the market that has caught our attention is the soap market.

Much like all the other segments in the Nigerian cosmetics industry, the bath soap market is saturated with several brands. Top among the household preferences are: Irish Spring, Premier Cool, Extract, and Delta soap. These top brands are readily available on supermarket shelves and neighbourhood stores, due to their wide-spread acceptability among the Nigerian middle-class.

To consolidate their positions in the market, the companies manufacturing these brands adopted the use of unique fragrance, colours, and designs to lure prospective customers and increase customer base. They also produce various brands to attract all skin types.

Economy market: One thing some of these brands have in common is their pocket-friendly prices which are strategically fixed to unburden the middle-class families already struggling with high cost of living in the country. While the companies have applied this marketing strategy to earn sizeable market share, one brand, Irish Spring, has seen its popularity increase in an unprecedented manner.

Why Irish Spring is thriving: Irish Spring is a deodorant soap, first marketed in America by the Colgate-Palmolive company in 1970. The bath soap is categorised in two: Body Wash and Bar Soap.

Years after its introduction into Nigeria, Irish Spring’s bar soap has managed to gain acceptance whilst witnessing increased demand among the middle and even the upper classes.

Irish Spring is fast making the market its fortress, despite being described as a premium product due to its fixed price of about N500. The company’s product price for the Irish Spring bar soap is not suited for the lower class population in a market that has the likes of Premier Cool and Delta soap (N100 respectively).

Irish Spring‘s price could sometimes be a hindrance for the brand, preventing it from penetrating the market deeper and reaching more customers. Yet, despite the need to in cut costs, most Nigerians (especially the middle and upper classes), won’t sacrifice health for less. This has been the key driver of Irish Spring in the market. Note that Irish Spring has several brands for different skin-types. Among Irish Spring’s range of bar soaps are: Aloe, Moisture Blast, Icy Blast, and Deep Action Scrub.

Each of the bar soaps has its unique purpose. In an era of health consciousness, this is a good thing for Nigerians. It also goes a long way to show just how the company cares about its skin-sensitive Nigerian customers.

It is important to mention that Irish Spring’s rise in the soap market is spiked by testimonial marketing. In other words, the brand’s satisfied customers are doing the publicity for the company in an industry that depends largely on media campaigns.

Strength, Weakness, Opportunity and Threat

Strength: Nigeria’s growing middle-class with higher disposable incomes and increasing population are the main drivers of the bathing soap business. Other factors that have contributed to the growth of the segment include wage increment, spread of urbanisation among rural communities, as well as cleanliness and hygiene in modern lifestyle.

Weakness: The bathing soap segment is saturated, like other cosmetic segments. The market is flooded with several brands and this is affecting the customer base of each company. This has resulted in wavering loyalty among customers whose search for economic prices often trigger constant preference switches.

Opportunity: Africa is the new frontier and Nigeria is one of the investment destinations for investors looking for potentially-viable investment opportunities. With Nigeria’s population size above 200 million, the beauty and personal care segment is exposed to an overwhelming customer base. That is why the industry is projected to reach €3.2 billion next year.

Threat: The industry is threatened by lack of basic business necessities such as stable electricity supply, and good transportation systems—all of which contribute to the high cost of doing business in Nigeria. Most companies budget millions of naira just to generate their own electricity. This affects their revenue growth in the long run.

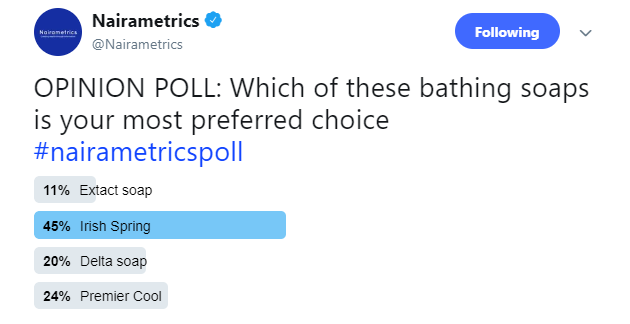

Nigerians queue behind Irish: The growing acceptance of Irish Spring was recently noted in a survey conducted by Nairametrics on Twitter. Irish Spring recorded the most votes in the survey: 45% of the 55 votes were cast in favour of the Colgate-Palmolive brand, Premier Cool recorded 24%, while Delta soap recorded 20%, and Extract (another premium product) accounted for 11%.

Reaction of customers: Nairametrics spoke with some customers to understand which soap brands they prefer and why. As expected, they gave diverse responses. A fashion designer identified Cynthia Okoha, told Nairametrics that Irish Spring is a better choice as she had tried numerous soaps before finally settling for the the brand.

“Irish Spring might be expensive, but it’s better than other soaps I’ve tried in the past. My skin doesn’t react to it since I’ve been using it for two years. Although, there are some soaps that are okay, but Irish spring does it for me.” -Cynthia

Another ardent user of Irish Spring, who is a media practitioner, explained that the brand is best for him and he has been using it for about a year now.

Meanwhile, Gabriel Johnson, a brand enthusiast, said Premier Cool is right for him considering Nigeria’s environment.

“Premier cool has a multipurpose attribute, which gives it an edge over the rest. Others in this category, are just for sweet smells which don’t proffer complete solutions to the skin, as the skin needs more to tackle the daily challenge it faces.” -Johnson

Conclusion: While saturation might limit available market share for these companies, it also causes intense competition which crashes product price and compels them to be customer-centric and innovative. Moreover, customers’ wavering loyalty will continue to compel these companies to offer the best value at cheaper prices.

This is a well curated article!

What really piqued my fancy is the S.W.O.T analysis.

Well done!! ?✔️

Very well written! However I think your survey size of 55 respondents is quite small. Details and structure are fantastic regardless!

thank you for this but can i have how much each of these brands spend digitally.