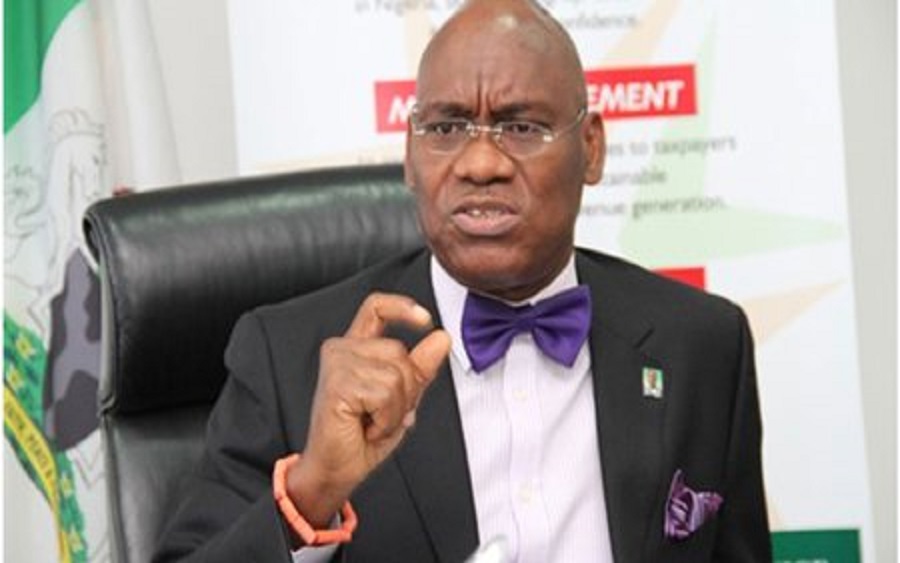

Sir Oseni Elamah, the Executive Secretary of the Joint Tax Board (JTB), has disclosed that Nigeria’s taxpayer roll will hit 45 million anytime from now.

While presenting a report on the new Taxpayer Identification Number (TIN) Registration System to the Executive Chairman of the Federal Inland Revenue Service (FIRS), Tunde Fowler, Elamah said the leap in taxpayer roll is the result of collaborative efforts between the FIRS and State Internal Revenue Services (SIRSs).

Elamah further stressed that the JTB, which is chaired by Fowler, has completed the building of a new TIN Registration System, which is an integration of TIN numbers of various organisations. HD added that the growth of the taxpayers’ database is a major flank of the goals of the JTB in collaboration with the FIRS.

“The leap in taxpayer roll is the result of collaborative efforts between the FIRS and State Internal Revenue Services (SIRSs), part of which is the ongoing integration of databases that will fetch the nation a total of 45 million individual and corporate taxpayers.” -Elamah

Understanding what tax roll entails: A tax roll is an official breakdown of all property within a given jurisdiction, such as a city, that can be taxed. The tax roll will list each property separately, in addition to its assessed value and the amount of taxes due. This roll is usually created by the taxing assessor or other authority within the jurisdiction.

How FIRS’s bank initiative discovered thousands of tax defaulters: Thousands of Nigerians were identified as tax defaulters by the FIRS, through the bank accounts substitution initiative embarked upon by the agency earlier this year (2019).

The number of tax defaulters: While speaking in Lagos at a stakeholders’ forum and the official presentation of the “Nigerian Tax Outlook 2019”, the FIRS Executive Chairman, Mr Babatunde Fowler, disclosed that about 55,000 tax defaulters were discovered.

How FIRS achieved a record-breaking 2018: The tax regulator reported a record-breaking N5.3 trillion revenue in 2018. According to Fowler, the application of technology and other initiatives aided the performance.

Fowler also listed the Service’s tax amnesty and Voluntary Assets and Income Declaration Scheme (VAID) as factors that enabled the positive result the tax agency recorded for the year 2018.