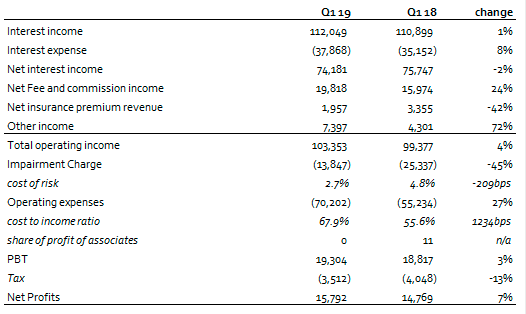

FBNH’s latest financial report for Q1 2019 showed that Interest Income grew marginally by 1% y/y to N112.0bn. We believe this was largely due to the decline in Net Loans to customers, down 12% y/y to N1.67trn in Q1 2019.

Interest Expense on the other hand was up 8% y/y to N37.9bn: This was driven mainly by an increase of 120% y/y to N7.2bn in interest paid on deposits from banks.

Meanwhile, Customer Deposits grew 8.3% y/y to N3.52trn, with low cost deposits making up 78% of total deposits. Overall, the bank’s Net Interest Income declined marginally by 2% y/y to N74.2bn in Q1 2019.

Net Fee and commission Income grew strongly in Q1 2019: Specifically, this was up 24% y/y to N19.8bn. The sturdy growth in Net Fee and Commission Income was mainly on the back of the significant growth in e-banking income (up 83%y/y), account maintenance fees (up 8% y/y) and brokerage fees (up 95% y/y). Surprisingly, Credit related fees grew 28% y/y despite the declining loan growth.

Other Income growths were recorded: Net gains on FX, Net Insurance Premium, Net gains on investment securities, Net gains or loss on financial instruments, Dividend Income, and other Operating Income grew 72% y/y to N7.4bn in Q1 2019 from N4.3bn in Q1 2018.

Impairment Charge declined: It declined 45% y/y to N13.8bn, compared to N25.3bn in Q1 2018; thereby resulting in a decline in Cost of Risk (COR) to 2.7% compared to 4.8% in Q1 2018. Based on our discussion with management, Atlantic Energy, a major exposure of the bank that is partly responsible for its high NPL ratio of 25.9% as at FY 2018, has been fully provided for.

OPEX grew significantly: It was up 27% y/y to N70.2bn in Q1 2019 from N55.2bn in Q1 2018. This negative, completely offset the single digit growth in total Operating Income (up 4% y/y to N103.4bn), thereby leading to a deterioration in cost to income ratio ex-provisions to 67.9% in Q1 2019 compared to 55.6% in Q1 2018.

Pretax Profit Showed Increase: Despite the rise in Operating Expenses, Pretax Profit grew marginally by 3% y/y to N19.3bn in Q1 2019, up from N18.8bn in Q1 2018. Net profits also grew 7% y/y to N15.8bn Q1 2019 from N14.8bn in Q1 2018. Annualised RoAE also improved to 12.0% in Q1 2019 from 9.0% in Q1 2018.

Our recommendation: We have a Buy rating on the stock with a target price of N12.27/s. Current price: N7.25/s.

________________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.

Congratulations to the Board Members, Management Team and Entire Staff of The Great FIRST BANK GROUP. More grease to your elbows. Please, kindly show more compassion to your Pensioners/Retirees. May the Lord reward you all.