Welcome to daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

This report is dated April 17th, 2019.

***Nigeria Gets $247m Loan for Power, Infrastructure Development***

Key Indicators

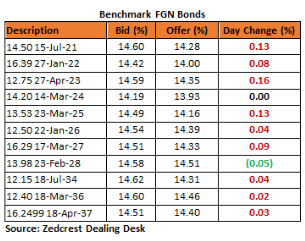

Bonds

The FGN Bond market was scantily traded in today’s session, with only slight demand witnessed on the 2028s which traded c.7bps lower at 14.51%. Yields however reversed gains on the short end of the curve, and were consequently higher by c.6bps on average.

We expect activities to remain relatively muted tomorrow, being the last trading session for the week ahead of the holidays.

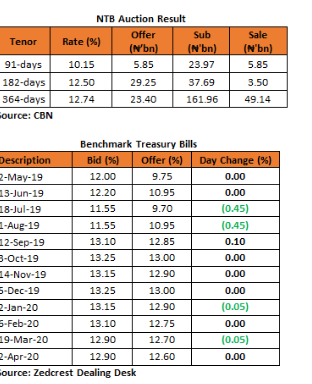

Treasury Bills

The T-bills market was relatively muted, with yields slightly lower by c.7bps on the back of some demand in anticipation of lower clearing rates at the NTB auction. In line with our expectations the auction cleared slightly lower than previous levels, with demand skewed towards the 364-day tenor which was oversubscribed by 7.04x.

We expect yields to trend slightly higher as market players anticipate an OMO auction due to the c.N107bn OMO T-bills maturing tomorrow.

Money Market

Rates in the money market remained relatively unchanged as system liquidity remained in negative territory at c.N48bn opening the day. The OBB and OVN rates consequently ended the session at 15.71% and 16.57% respectively.

We expect rates to moderate slightly tomorrow due to expected inflows from OMO maturities. This is however barring a significant OMO sale by the CBN.

FX Market

At the Interbank, the Naira/USD rate was stable at N306.95/$ (Spot) and N356.26/$ (SMIS). The NAFEX closing rate in the I&E window depreciated slightly by 0.05% to N360.42/$, whilst market turnover rose further by 61% to a three week high of $651m. At the parallel market, the cash and transfer rates remained unchanged at N358.50/$ and N364.00/$ respectively.

Eurobonds

We witnessed some renewed interests in the NGERIA Sovereigns, with demand mostly on the mid to long end of the curve. Yields were consequently lower by c.2bps on the day.

In the NGERIA Corps, activities were relatively muted, except for slight interests seen on the DIAMBK 19s and ACCESS 21s Snr, following positive Q1 results from the combined entities.

________________________________________________________________________

Contact us:

Dealing Desk: 01-6311667

Email: research@zedcrestcapital.com