Last week saw President Muhammadu Buhari of the All Progressives Congress returned to power in general elections (see Coronation Research: Implications of the APC victory, 27 February). What we did not expect was the extent to which foreign portfolio investors would invest, driving down Naira-fixed income rates. One-year risk-free Naira fixed-income rates of between 15.00% and 16.00% may emerge as the new normal. See pages 2 and 3 for details.

FX

Last week, the NIFEX rate remained stable at NGN358.79/US$1. The NAFEX rate appreciated by 0.18% to NGN360.80/US$1. The US dollar in the NAFEX (inter-bank) market trades at a 0.56% premium to the NIFEX rate. In general, we are seeing the convergence of the various active exchange rates in Nigeria, excepting that applied to International Oil Companies (IOC).

Bonds & T-bills

The yield on a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity fell by 81bps to 13.88%, and at 3 years fell by 16bps to 14.64%. The yield on a 364-day T-bill fell by 222bps to 15.02%. The yield on a T-bill with 3 months to maturity decreased by 129bps to 10.66%.

There was a significant rally in T-bills and bonds. In the weeks leading up to presidential and national legislature elections on 23 February, there was a surge in foreign portfolio investment and the Central Bank of Nigeria (CBN) had slowed down the pace of its open market operations (OMO). The result was pent-up demand for paper, forcing down rates. Liquidity in the system remains high, so we think these rates could persist for a while.

Oil

The price of Brent fell by 3.05% last week to US$65.07/bbl. The average price, year-to-date, is US$62.30/bbl, 13.10% lower than the average of US$71.69/bbl in 2018, but 13.80% higher than the US$54.75/bbl average seen in 2017.

There are many reports of investors losing faith in the oil industry as a result of short-term challenges involving low oil prices which remain pressured by high supply of US shale, and long-term challenges centred around decreasing oil demand. We expect an average US$58.00/bbl this year.

Equities

The Nigerian Stock Exchange (NSE) All-Share Index recorded a loss of 2.12% last week, taking the year-to-date return to positive 1.26%. Last week PZ Cussons (+9.00%), Guinness Nigeria (+3.00%) and Dangote Cement (+2.00%) closed positive, while Oando (-11.54%) and Unilever Nigeria (-10.00%) fell.

Last week’s trading sessions saw a reversal in the earlier trend of investors positioning for a possible post-elections rally. In view of the presidential election result we expect investors to maintain a cautious stance on equities, but also note that investors can take advantage of current valuations in high-quality names at historically low valuations.

Naira interest rate adjustment

Last week’s T-bill and OMO auctions produced rates much lower than seen earlier. The 1-yr T-bill auction on 27 February was sold at 16.77% compared with 17.57% on 13 February. The OMO auction of 28 February produced a comparable annualised rate of 16.68%. Naira fixed income markets quickly adjusted to the new yields (see page 1) – in fact with even greater yield tightening which suggests the markets expects OMO rates to fall to around 15.00% annualised. The question for us is whether this was a temporary blip, which might hold rates low for a month or so, or the beginning of a new long-term trend. On balance, we believe rates will adjust down, but not as far as the 13.00%-14.00% one-year risk-free rates we saw from April to August last year.

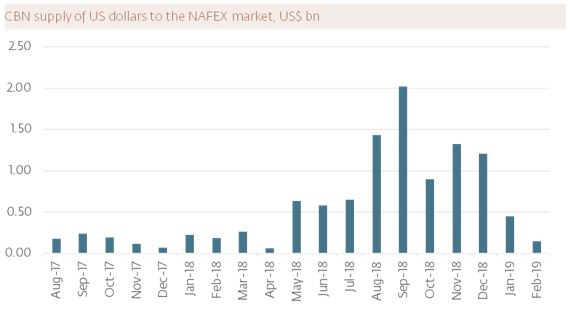

Last week’s auctions followed two exceptional months of inflows of foreign portfolio investment (FPI). As a direct consequence of this, the Central Bank of Nigeria (CBN) had little need to supply US dollars to the principal NGN/US$ market, the NAFEX market (which, incidentally, provides the data for the exchange rate quoted on Bloomberg).

In fact, it seems likely to us that the CBN was likely a net buyer of US dollars in January and in February. There are two consequences of this. The first is that investment institutions and banks held– or still hold – a lot of Naira, thus Naira liquidity was high. This situation was exacerbated by the fact that the CBN slowed down the rate of its OMO auctions, causing, in our view, Naira liquidity to accumulate. Small wonder that rates crashed. When the OMO auction happened on Thursday 28 February it was almost 12-times oversubscribed at a level 113bps lower than the T-bill auction two weeks earlier.

The second consequence is that the CBN’s own FX reserves will have been boosted. So we are looking, over the coming weeks and month, for an uptick in the CBN’s disclosed FX reserves from the current level of US$42.3bn. (NB The CBN published CBN reserves figure is a three-month moving average.) These two factors look like strong arguments for declining Naira interest rates and strong FX reserves.

However, the inflow of FPI was exceptional. February’s inflow of FPI was 4.7x the average monthly inflow in H2 2018. What was this inflow associated with? There is no further breakdown after ‘Foreign Portfolio Investment’ in the official data, so we must make our own estimate. It seems likely that foreign institutional investors took a shine to Nigerian Naira-denominated risk-free fixed income as the elections approached, a view reinforced by the fact that the volumes of hedging through the non-deliverable forwards (NDF) also spiked.

The key questions are:

- is this an exceptional inflow (January plus February); and

- is there so much Naira liquidity that rates will be held down for a while to come?

The answer to the first question is, obviously, yes (see chart) although similar levels of FPI were recorded in March and April 2018. Those big inflows in 2018 were followed by sharp falls in rates – from around 16.00% – 17.00% early in 2018 to 13.00% – 14.00% from April through to August 21018. A similar effect, though probably not as pronounced, is likely now, in our view.

The answer to the second question is more difficult to give. The liquidity will last for some time but its effect over a period of several months will depend on how much liquidity the CBN wishes to soak up through its OMOs, and how much of it heads back into US dollars in the FX markets. What has changed since April 2018 is the CBN’s heightened desire to provide foreign investors with attractive risk-free Naira rates. The CBN adjusted its policy with respect to this in August 2018 and we do not think the policy will reverse now. Therefore, are not looking for one-year risk-free rates in a range of 13.00% – 14.00% to emerge this time around.

These unexpected inflows (in January and February) slightly disrupt our core thesis, set out in Coronation Research Year Ahead 2019, A Tale of Two Halves, 15 January; namely, that we would see high rates in the first half of the year and the possibility of lower rates later in the year if key macro-economic conditions (oil prices, CBN reserves and inflation) are healthy. A very possible outcome, now, is that we are looking at a ‘new normal’. The ‘new normal’ sees one-year risk-free rates in a range of 15.00% – 16.00% for the H1 2019, and our core thesis of deep cuts being possible later in the year still stands.