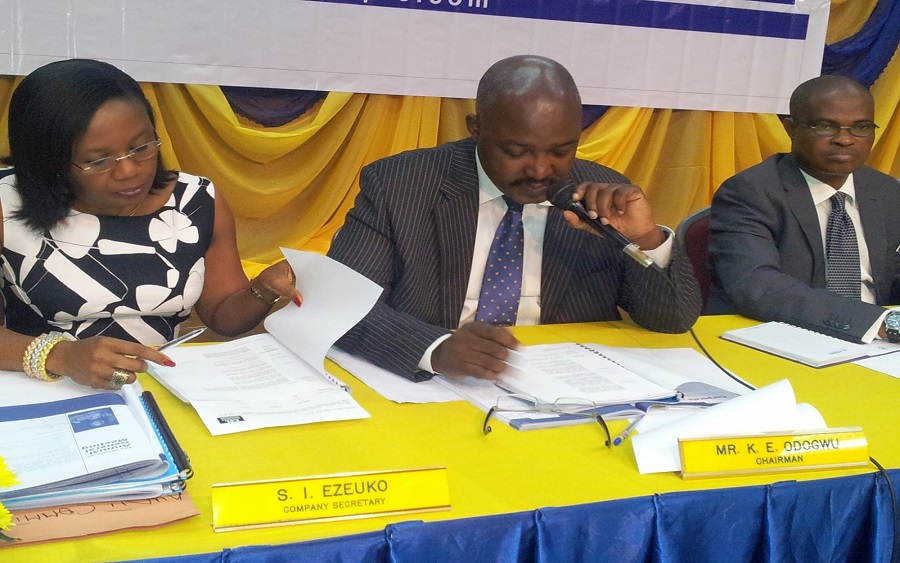

The Managing Director (MD) of Continental Reinsurance Plc (CRe), Dr Olufemi Oyetunji has debunked the rumour that the company is planning to delist from the Nigerian Stock Exchange (NSE).

While addressing newsmen, the Continental Reinsurance Plc boss said the company is only planning to change its business structure to attract capital.

Oyetunji said

“We need all the capital we can get for this restructuring. So, it is not even a wise decision to delist. People saying that we plan to delist are spreading rumours.

“We have no plans to delist or to do a change of name for the company.”

According to Oyetunji, there were plans to transfer the various subsidiaries of the group to CRe Investments to enable CRe Nigeria to shore up its balance sheets and capital required for maintaining and expanding the business.

Oyetunji noted that under the restructuring, the company’s shares would be transferred to CRe Investments in exchange for shares in CRe Investments.

As consideration for the transfer of the shareholders’ shares in CRe Nigeria to CRe Investments under the new scheme, Oyetunji said shareholders have the option to receive one ordinary share of $1 each in the capital of CRe Investments for 176 ordinary share of 50 kobo each in the capital of CRe Nigeria as at the effective date.

The second option, Oyetunji said is for them to receive N2.04 per ordinary share of 50 kobo each held by the shareholders as at the effective date.

Oyetunji added that 92.66 per cent of shareholders voted in favour of the restructuring, while 7.34 per cent voted against it.

Oyetunji maintained that shareholders that choose to remain with the company can either decide to receive dividends from the company and bring more money back or to not receive dividends at all.

Oyetunji noted that following the advice from the company’s advisers on the fairness of the restructuring, the board had resolved to effect the restructuring by way of a scheme of agreement among members of the company in accordance with the provisions of Section 539 of the Companies and Allied Matters Act (CAMA).

Although the company may have come out to debunk rumoured delist, the Nigerian Stock Exchange’s (NSE) review of market Indice probably suggests otherwise. Continental Reinsurance Plc was removed from the NSE Insurance Index alongside other other companies.

About Continental Reinsurance Plc

Incorporated in Nigeria in 1985, Continental Reinsurance started business initially as a private reinsurance company. From January 1987, the company began operating as a general reinsurer and in January 1990, it became a composite reinsurer, offering both treaty and facultative life and non-life reinsurance, with a well-diversified business mix and customer base.

Continental Reinsurance Plc stock last traded at ₦1.91 on the floor of the NSE on December 28, 2018.