Yesterday, Access Bank and Diamond Bank hosted a joint conference call on their recently announced merger proposal. The presence of both CEO’s (Herbert Wigwe of Access and Uzoma Dozie of Diamond) on the call was greatly appreciated.

Following this call, I would like to make the following comments and then list my outstanding questions and provide my conclusions.

Who really got the better deal?

Whilst the press release described this transaction as a merger, it is rather clear that Access is buying Diamond. However, what is still not clear to me is, who really got the better deal. At first glance, we calculated that at N3.13 per share, Access was paying 0.33x book, so it looked like a very good deal for Access. However, following yesterday’s call and the announcement of a further N150-180 billion of provisions, which would reduce Diamond Bank’s equity to N41.6 billion if the upper end of the provisions are taken (vs a reported figure of N221.6 billion), Access is actually paying 1.74x book for a bank that is technically insolvent. What is even more worrying is that, after the due diligence, Access stated that the final amount of additional provisioning could be as high as N200-220bn. Why do they not know the number? Why agree to pay cUSD200mn for a bank and not know how much of its loan book needs to written-off?

As for Diamond Bank, how did they publish 3Q18 figures with N100.7bn of NPLs, only to announce with this deal that there are a further N150-180bn of NPLs? What are these NPLs? Why was the market not told about this before the announcement of this deal? If these NPLs are real, then Diamond Bank shareholders are probably getting a better deal, but they were never told their bank was insolvent.

Why is Access paying Diamond to do what Diamond should do on its own?

On the call, we were told that Diamond Bank would be making additional provisions of N150-180bn to be compliant with IFRS9. I frankly cannot accept this answer. The reason being that, if one reads page 7 of Diamond Bank’s 1Q18 Financial Statements, they made an IFRS9 adjustment of N2.48bn on 1 January 2018. All the Nigerian banks we cover took their IFRS9 adjustment at the beginning of the year. So, to now say that the IFRS9 adjustment is between N150-180bn is just not acceptable – how did it increase so much all over of a sudden. And even if it did, surely this should have been communicated to the market in the form of a profit warning.

By requiring Diamond Bank to make this provision and clean its back book, Access Bank is doing what Diamond Bank should have already done. Surely it would have been cheaper for Access Bank to wait for Diamond Bank to make these provisions and raise the minimum capital before paying USD63mn in cash for these shares? By raising the USD207mn of new capital through a rights issue, Access Bank shareholders are doing what Diamond Bank shareholders should be doing.

What is the real cost of the Transaction to Access shareholders?

As per the joint announcement today, the total value of the deal is cUSD200mn (USD63mn and USD137mn in stock). Whilst I understand that this is what Access Bank is paying Diamond Bank for its equity, I would argue that the cost to the bank is much more. I think the total cost of this deal is almost USD1bn! I know that sounds almost impossible given that Diamond Bank’s market cap is currently USD73mn, but please consider the following:

- the payment to Diamond Bank shareholders of USD200mn;

- the tier II capital raising of USD250mn;

- the annual cost of the tier II capital raising (USD20mn if raised at 8% – just a guesstimate as no figure was provided); and

- the rights issue (USD207mn).

This gets you to a total figure of USD677mn, but I think it is only fair to deduct the NPV of the stated synergies (N30bn annually for the next three years), which I estimate to be USD194mn. So, the adjusted cost of this deal is now USD483mn, but we are not done. The reason being that Diamond Bank has a lot of maturing debt over the next three years. As shown below, Diamond Bank has USD427mn of debt maturing over the next three years (assuming the convertible loans are not converted to shares, but even if they are this will come at a cost to Access as it would need to issue more shares). So, if you add the maturing debt (USD427mn) to the adjusted cost of this deal (USD483mn), you get a total cost of USD910mn. Btw, Access Bank’s current market cap is USD614mn.

At year-end 2017, Diamond Bank had the following material debts maturing:

- USD200mn Eurobond maturing in May 2019

- USD100mn loan to Afrexim Bank that will come due on 3 March 2019

- USD69.79mn convertible loan to the IFC that matures in July 2019 – Note that, conversion of these shares will make the deal more expensive for Access if the swap ratio is not adjusted

- USD7.5mn convertible loan to Kunnoch that matures in June 2020 – Note that, Kunnoch has the right to convert this loan into shares in the “event of a change in control”. Given that this change in control will trigger a conversion, the public should know the strike price.

- USD50.0mn loan to Anambra State Government, which is due in March 2021

Acquisition track record of Access Bank

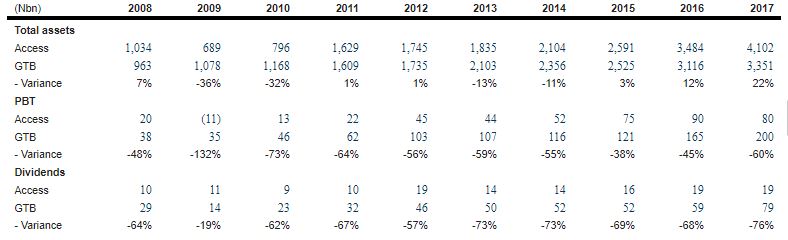

On the call today, Herbert was very convincing on this subject, so I decided to compare their operating performance post their largest deal prior to this one (Intercontinental in 2011) to GTB’s performance over the same period. While I recognise that GTB is a tough bank to be compared against, I just wanted to see how much of the gap between them and GTB has closed over the past six years.

As shown below, the Intercontinental Bank acquisition did a lot to bring Access Bank’s asset base into line with GTB in 2011 and at year-end 2017, Access Bank’s total assets were 22% higher than that of GTB. However, GTB’s 2017 PBT of N200bn was more than 2.5x that of Access Bank (N80bn). This profit gap is not very different from 2011 (2.8x). With regards to value creation, I am a believer in dividends and since 2011, GTB has paid cumulative dividends of N370bn, while Access Bank has paid N111bn over the same period. At today’s exchange rate, GTB has paid cUSD1bn in dividends while Access Bank has paid cUSD300mn since 2011.

My questions (in order of importance):

Where was the due process?

Diamond Bank’s Chairman (Seyi Bickersteth) and three non-executive directors (Rotimi Oyekanmi, Juliet Anammah, Aisha Oyebode) recently left the BoD and this meant that, Diamond Bank’s BoD approved this deal without two independent directors. Why is this acceptable? On the question of process, one has to ask how the Diamond Bank BoD went from asking its CEO (Uzoma Dozie) to leave to ask him to lead a transaction that would mark the end of Diamond Bank as a standalone entity? We understood that the CEO had agreed to leave at the beginning of next year, but now we understand that this deal will not close until the middle of next year. So, has the BoD asked him to stay?

From the leaked letter (https://www.proshareng.com/news/Frauds%20&%20Scandals/What-Does-It-Mean-That-Independent-Directors-Accuse-Diamond-Bank-Of-Corporate-Governance-Issues-/43104) of the former Chairman of the BoD (Seyi Bickersteth), it clear that there were problems at the BoD, so why are shareholders now being asked to basically ignore them. I would strongly encourage the BoD of Diamond Bank to issue a full response to the previous Chairman’s letter. Full transparency is what shareholders need in order to make an informed vote at the EGM.

What is the position of the Carlyle Group?

How does a highly reputable PE fund that invested at N5.80 per share (as per press reports) in 2014 want to exit for N1 per share in cash and 3.3% (on our calculation) of the combined group’s paper? How does Carlyle go from considering injecting more capital into Diamond Bank on the condition that the CEO leaves to asking the CEO to lead this transaction that is clearly value destructive for their clients?

What is real financial position of Kunnoch Holding Ltd?

In today’s conference call, Access Bank denied press reports suggesting that Kunnoch had taken a substantial loan from them. Given the clarity in which the CEO stated this, we are inclined to believe this. But, this does not answer the question of what the financial position of Kunnoch is. Does Kunnoch have an outstanding loan to another bank and is that bank asking for this loan to paid? Is the collateral of this loan Diamond Bank and MTN shares? How big is the loan? Whilst these are typically private affairs, they are important as they could help explain the motivation of a key shareholder to accept this transaction. As the board member representing Kunnoch, is the CEO accepting this transaction for the sake of Kunnoch or for all Diamond Bank shareholders? This needs to be clarified.

Can we get some real detail on the synergies?

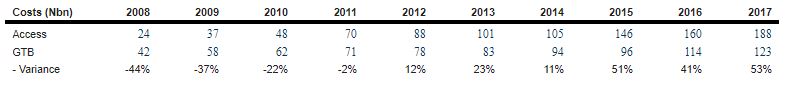

If I annualize Diamond Bank’s 9M18 costs, I get an annual cost base of N90bn. So, these synergies represent roughly 1/3 of Diamond Bank’s cost base. That is a very tall order in my opinion. So, how much staff will they have to cut, what buildings/branches are being sold/closed, what are the cost saving from having the same MIS, what are the benefits of lower funding costs (numerically please), etc…? A simple table breaking down the sources of these synergies would be greatly appreciated. Costs are very hard to control, as shown in the table below.

Can the accounting treatment of this deal be confirmed?

When calculating their proforma equity, is Access Bank using purchase accounting or merger accounting? If merger accounting (i.e., the equity of the target is added to the acquirer), how is this possible when Access Bank is clearly buying Diamond Bank. This is not a merger of equals surely. Understanding the accounting will help us understand Access Bank’s estimated proforma CAR of +20%.

My conclusion:

As an African storyteller, I must conclude by sharing real life experience. Like this story, it involves a Diamond, but my diamond was not a bank but a ring for my wife. Before buying her Diamond, I did some research and quickly learned that you do not buy a diamond for its size (carats) alone. One must consider the qualitative aspects of the diamond (its cut, clarity and colour).

I think the same applies to this transaction. I am happy that Access Bank will become the largest bank in Nigeria, but I am yet to be convinced by the cost of achieving this accolade, both to minorities and the system. Also, I am very disappointed by Diamond Bank’s management team; they published 3Q18 figures that in no way told the full story about the solvency of the bank. And even if they did not know about the additional N150-180bn of provisions when they published their 3Q18 figures, why was there no profit warning before announcing this deal? Why did the BoD of Diamond accept such an important deal without naming an independent chairman and another independent non-executive director? Why could this deal not have waited and due process followed? Too many questions and too few answers to be positive on this deal as of now.

Written by: Kato Mukuru

This is actually quite insightful. It presents many perspectives as to how nebulous this acquisition (sorry, I meant merger) is.

I appreciate this your analysis, quite insightful i hope this will be put into consideration and proper investigation be done about the visible and hidden assets of Diamond Banks to prevent corruption and eventual crumbling of Access bank too.