In my article on using moving average cross overs as a stock picking strategy, I did promise to be sending alerts as I find them. This article is the first of such alerts based on stocks that are either approaching or forming death or golden cross. I did explain what those (Death and Golden Crosses) mean, but for the benefit of those who did not or have not read that article, may I surmise here that a golden cross occurs when a shorter term moving average crosses above a longer-term moving average to generate a buy signal. On the other hand, a death cross occurs when a shorter term moving average crosses below a longer-term moving average to generate a sell signal. In this article, the short-term moving average is the 50-day simple moving average (SMA) represented by the 10 week SMA on the charts, while the longer term moving average is the 200-day SMA represented by the 40-week SMA on the chart.

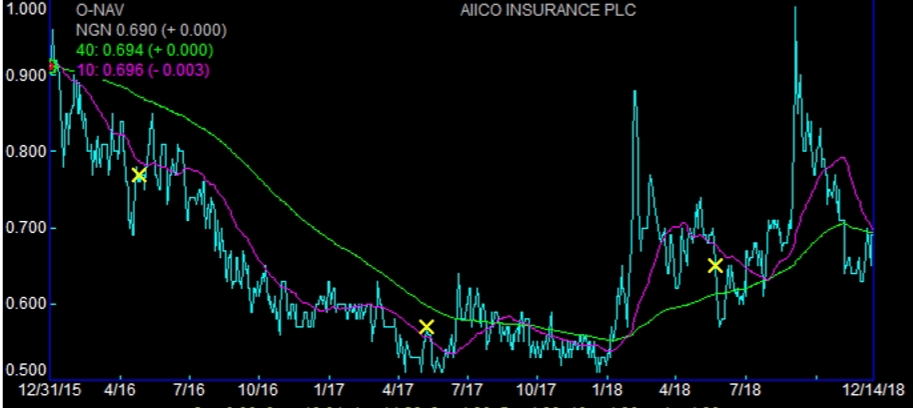

AIICO Plc is approaching a death Cross

AIICO Plc is flashing a death cross and investors may be better off being eagle eyed about the trends being exhibited by the stock. Technically speaking, there have been some unfavourable trends on the moving average cross over perspective. Recently, the 50-day Simple Moving Average (SMA) of AIICO Plc is fast approaching the point at which it will break out below the 200-day SMA.

AIICO stock has moved lower by 13.75% in the past 3 months. And with the recent posture of moving average crossover as can be seen in the above chart, more unfavourable trading may be ahead for AIICO stock. On the basis of the crossover alert, AIICO Plc may be a stock to avoid, at least for now.

Continental Reinsurance is forming Golden Cross

Unlike AIICO Plc which is flashing a death cross, Continental Reinsurance is flashing a golden cross as the 50-day moving average is at the verge of crossing above the 200-day moving average.

Proposed Acquisition: The rally being witnessed by Continental Reinsurance sequel to a proposed acquisition by CRe African Investments Limited to acquire all the outstanding and issued shares Continental Reinsurance Plc. The proposed acquisition is offering N2.04 for every share of Continental Reinsurance plc which overs 10% premium over the current price of the stock. Based on the crossover alert, Continental Reinsurance stock may be a stock to buy.

Fidelity Bank Plc Approaches a Golden Cross

Another stock that is approaching or gradually forming a golden cross is Fidelity Bank Plc. Although the company may be reeling under the part it played in the Mrs Madueke saga and the rumours going around as to whether its former managing director, Nnamdi Okonkwo had jumped bail or went abroad on medical treatment, Fidelity Plc stock looks like a good pick from technical analysis point of view. The company has seen some favourable trends recently and the stock price has moved up 20.12% since the last 3 months. The last time the stock had a golden cross was on May 23, 2017 and it kept its bullish run then till January 18th, 2018. But then, the stock hit a death cross on June 12th, 2018 and as can be seen in the chart below, it seems to be approaching another golden cross if its current trend continues.

On the earnings front, Fidelity Bank is not doing badly as its 9-month financial report indicates that profit soared to N20 billion. Its “Gross Earnings grew by 6.9% to ₦139.0 billion from ₦130.1 billion reported in the same period in 2017 whilst profit-before-tax soared by 23.6% from ₦16.2 billion to ₦20.1 billion”. In the same token, total assets grew by 21.9 % to ₦1,680.8 billion from ₦1,379.2 billion in the same period last year. On the basis of the now forming golden cross, Fidelity Bank shares may be something to keep an eye on.

Disclaimer: The author of this article holds investments in AIICO plc and Fidelity Plc, none of which has been the motivation for this article.