Nigerian Deposit Money Banks (DMBs), according to industry sources, are nervous following the recent announcement by telco giant, MTN of its readiness to apply for a Payment Service Bank (PSB) licence and launch mobile banking in Nigeria by the second quarter of next year.

As other telecommunications are also billed to go into mobile banking, the banks are worried that the MTN announcement, which came in the wake of the Central Bank of Nigeria (CBN) release of guidelines on PSBs, would make the business environment, which was already tough for lenders, even tougher.

A senior industry player said with a PSB licence, MTN’s subscriber base of over 50 million clearly gives the telco an edge over banks.

“In fact, most of the major telcos can easily provide most of the services being offered by banks.”

The industry player further stressed that compared to banks, the telcos have a bigger budget and better technical know-how to drive mobile banking.

Nairametrics had last week, reported the MTN Group’s plans to apply for payment banking license in Nigeria and launch a service in the country by the second quarter of 2019.

The success story of mobile money in East Africa, pioneered by Kenya’s Safaricom, has convinced investors and the industry that financial services are the next growth area for telecoms to offset falling prices for basic services.

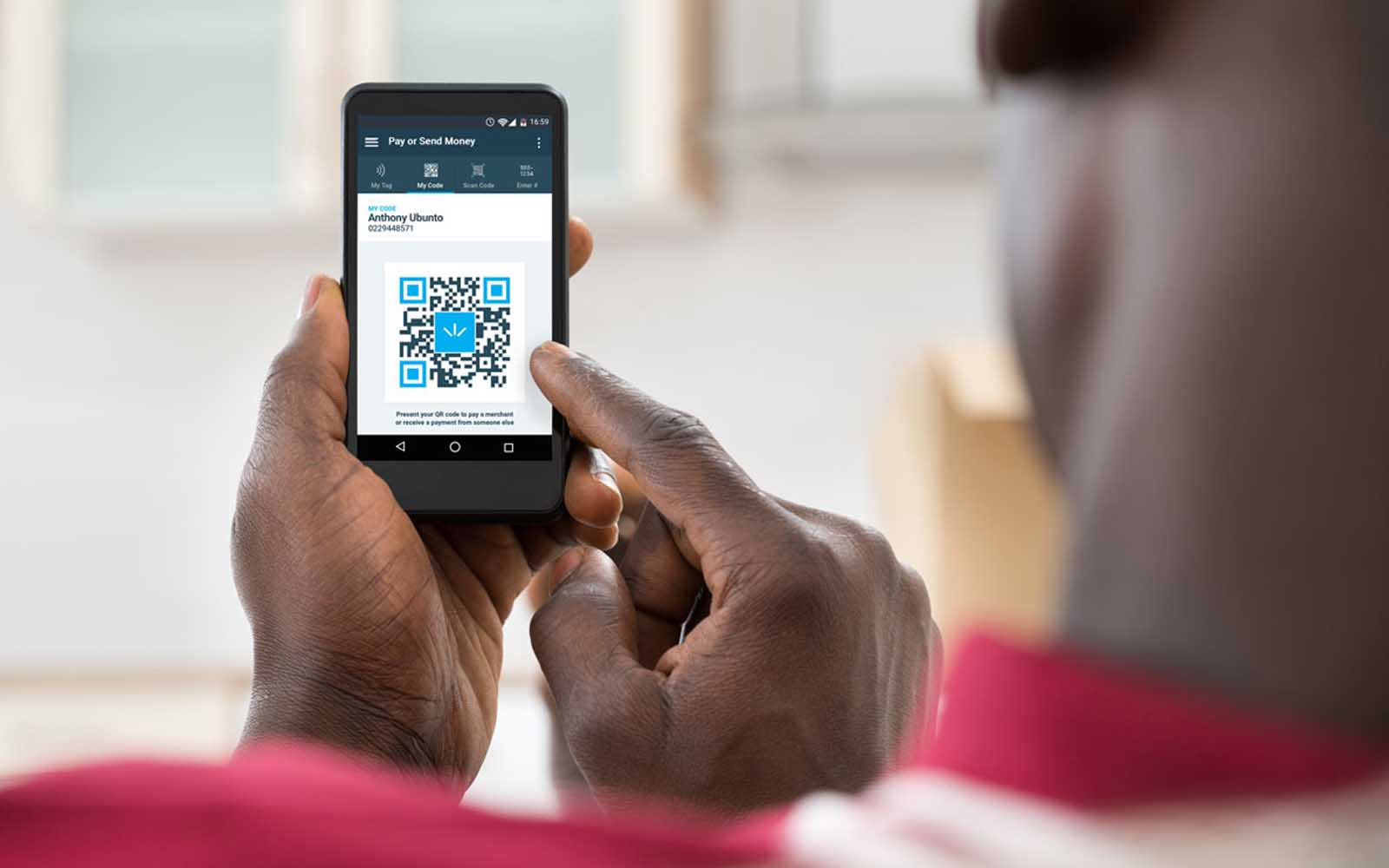

How the mobile money works

MTN Mobile Money is a service that enables users to send and receive money with their mobile phone. The intended recipient must have an MTN Mobile Money account, which is an electronic account linked to their MTN mobile number. Once a mobile money transfer has been made, the recipient can use their mobile wallet to pay for goods, public transport costs and even household bills. Importantly, they can also withdraw the money as cash.

Hello Nairametics ,is this Mobile banking part of the Blockchain thing?

No

CBN should be weary of MTN excesses in their dealing with Nigerians for services they provide. Their charges for data and calls before considering granting licence for PSBs. This is very important. Positive thinking.

Go and study the block chain thing don’t let the media study for you

Hi why don’t you integrate Disqus comments system here. Vanguard, Punch, PMtimes and the rest use it. Your contents are really quality and the site name perfect. Kudos.

Fact is, Nigerians have a tendency to trust only banks for anything money related. And unless Mtn is willing to eventually build a structure specifically called a bank, then I fear it might not yield so much success.

Nigerians bank have nothing to fear please, except rival them with better services.

You never can tell. Since it works in East Africa, it can work here too. If MTN provides this service at a lower cost and they got the backing of the CBN, you just need a little time and many people will be convinced. Telcos even have more technology to provide these services than the banks and that’s why they are scared.

Charges in the bank are so enormous. This might bring cool competition.