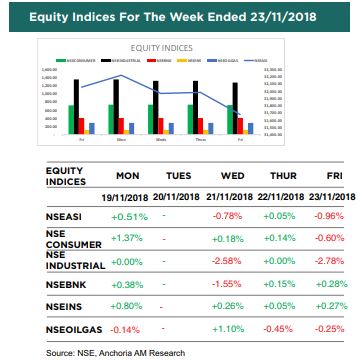

The performance of the Nigerian Equity Market remained bearish last week with the index (NSE ASI) down by 1.18% WTD to close at an index level of 31,678.70 and Market capitalization of N11.57 trillion.

Most sectors closed the week on a bullish note with the exception of the Banking and Industrial Goods Sectors, down by 0.75% and 5.28% WTD respectively. The Industrial Goods sector recorded the highest decrease amongst NSE indices owing to significant price depreciation in DANGCEM (-4.18%) and WAPCO (-14.00%).

Market activities were characterised by profit taking on 2 out of 4 trading sessions as sell offs in bellwether stocks dragged the equity market to the negative zone despite gains in the Consumer goods, Insurance and Oil and Gas Stocks.

In the global space, all selected equities remained bearish after the Thanksgiving Day and Black Friday celebration in the U.S. The decline continued as slide in Oil prices weighed heavily on energy stocks and as U.S Government continues to persuade foreign allies to avoid Telecommunication Equipment from China.

Stock Watch

Over the last five trading sessions:

SEPLAT (Seplat Petroleum Dev. Company) remained unchanged to close at N652.70.

Recommendation: We maintain a hold rating on this stock.

FBNH (First Bank of Nigeria Holdings) rose by 2.01% to close at N7.60.

Recommendation: We maintain a buy rating on this stock.

GUARANTY (Guaranty Trust Bank) fell by 1.36% to close at N36.50.

Recommendation: We maintain a buy rating on this stock.

ZENITHBNK (Zenith Bank) remained unchanged to close at N24.00.

Recommendation: We maintain a buy rating on this stock.