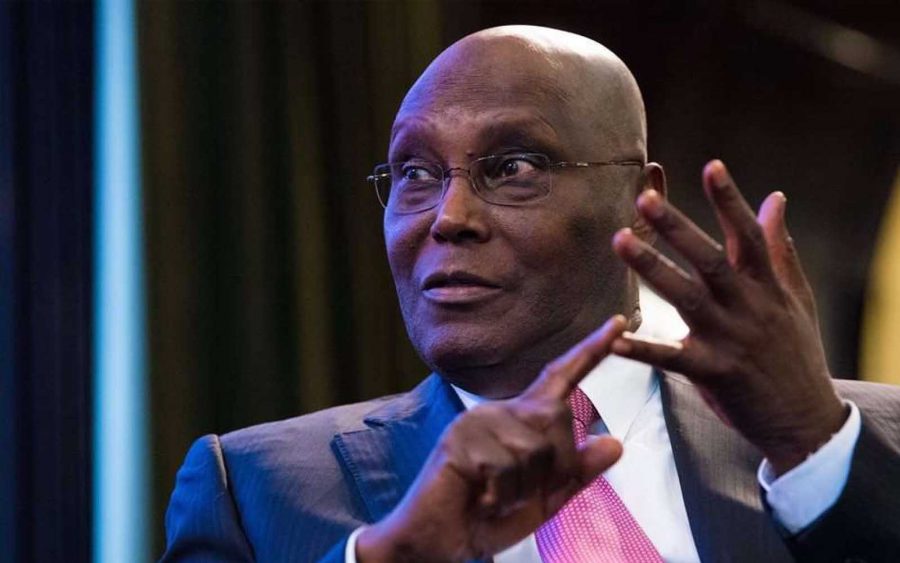

The Presidential candidate of the People’s Democratic Party (PDP), Atiku Abubakar today released his policy document titled let’s Get Nigeria Working Again. Here are key points of the document as they pertain to the economy.

The Economic Agenda is divided into 5 key points:

- Competitive and open economic system

- Reforming public institutions

- Reducing Infrastructure deficit

- Promoting economic diversification

- Human capital development

The State’s critical policy priority is to build a broad-based, dynamic and competitive economy with a GDP of US$900 billion by 2025.

Growth drivers

Under the enabling business environment section, the Atiku administration aims to:

- Reform public institutions to make them stronger and more supportive and facilitating.

- Enhance private sector access to credit which will be prioritised.

- Strengthen regulatory institutions with their independence shielded from political interference.

PPP for Infrastructure

- Accelerate investment to double infrastructure stock to approximately 50% of GDP by 2025 and 70% by 2030.

- Power sector reform will be a critical policy priority.

- By 2025, Nigeria shall make giant strides in diversifying its sources of power and delivering up to 20,000 MW.

Stable macroeconomic environment

- Deepen monetary and fiscal reforms to promote a stable macro-economic environment.

- Monetary and fiscal policies shall ensure a low inflation rate, stable exchange rate and interest rates that will be supportive of businesses’ quests for credit.

- Increasing flow of FDI to the non-oil Sector by working towards the lowest corporate income tax in Africa as well, as lower capital gains taxes.

- Streamlining the multiplicity of often discretionary incentives for investment and simplifying the associated complex legislative and regulatory framework.

- Ensuring that the granting of qualification for tax incentives is automatic, according to predetermined uniform, and clear criteria.

Promoting the agribusiness sector

- Collaborate with the States in the design and implementation of robust and sustainable land reforms.

- Strengthen the markets for agricultural commodities.

- Orderly privatization of the Nigerian Commodities Exchange

- Improve agriculture sector’s access to financial services, through NIRSAL, by de-risking lending to the sector by commercial and development banks.

- Encourage Investment in Agro-processing Cluster by offering concessional financing, tax breaks and seed funds.

Promoting the manufacturing sector

Policy Objectives

- Achieve a sustained increase in manufacturing output from 9% to 30% of GDP by 2025.

- Reduce the sector’s dependence on imported raw materials.

- Achieve a diversified production structure with more processing of domestic raw materials.

- Promote the competitiveness of the sector nationally and internationally.

Action plan

- Ensure that all major economic and investment policies are formulated after sufficient prior consultation with the organized private sector.

- Work with the Manufacturers Association of Nigeria (MAN), chambers of commerce and other relevant stakeholders to identify ways to reduce the cost of borrowing, tackle incidences of multiple taxations and improve the availability of foreign exchange for legitimate production input purchases

- Review of import duty on raw materials that are available in the country and on imported machinery for local production

- Support and vigorously enforce the buy-made-in-Nigeria initiative by ensuring compliance with the relevant executive order by Federal Government procurement agencies

Promoting Micro, Small and Medium Enterprises

- Extend mandate of NIRSAL to cover de-risking of MSMEs lending.

- Increase the MSME funding window currently, from N200 billion to N500 billion.

- Promote awareness of the National Collateral Registry of Nigeria and further simplify the collateral registration process.

- MSMEs and SMPs (Small and Medium Practitioners) will be given special fiscal advantages including tax breaks and rebates to accelerate business formalization.

- Ensure that approvals needed for the creation of new businesses such as land acquisition, property registration and construction permits are simplified, streamlined and are not subject to excessively complex bureaucratic procedures.

- Enhance the efficiency and effectiveness of SMEDAN in the delivery of business support/advisory services to MSMEs.

Provide support through the NEPC and NIPC to entrepreneurs who experience restricted access to external markets for goods and services

- Promote the harmonization of State and federal tax laws to avoid overtaxing businesses

- Pursue an aggressive regime of tax credits to critical sectors of the economy.

Promoting the New Economy

- Establish a ‘Technology Support Programme’ (TSP) to be funded by a diaspora bond.

- Develop a more effective and efficient Intellectual Property Rights (IPR) framework.

- Produce a comprehensive policy on blockchain technology and cryptocurrencies.

- Enhance ICT literacy initiatives from early school programmes to adult education.

I think they just got a new supporter right here

Not at all. We are neutral at Nairametricss. We also reported highlights of PMB. We will also do same for the 29 other candidates that release theirs.

Good for PDP or not.the only way.it will happen,if the CBN comes along or.they must forces cbn on a targetted growth strategy within a time fact.the main problem is the cbn is focusing on containing inflation,which I think,they will not co-operate alternatively the incoming govt will do a form of social funding,the other thing to do is for fed govt intervenes and creates a robust money market.this money market wil create venture capitalist/asset management company bonds dealer and adviser,thirdly the fed govt will borrow heavily to fund this programme,with a hybrid of govt and private sector,participate from all level from board,management to staff,fortly for fed govt broaden and increases taxes,it will happen,when this govt gives us the details and how it will happens and i believes it.

The vice-president did posted some stuff on twitter about 2 yrs ago,and I said it will not happen.this will go artikulated PDP slogan..on positive angle this PDP must empower the youth.the young Nigerians have started to warm-up to atiku.they have stared to atiku,DO NOT LET US DOWN OR FAILS US EVER AGAIN,they have turn English lauguage into their native language.they are using this word ATIKULATE INSTEAD OF ARTICULATE.

One of them posted an item on the internet.they have an artkulate blackboard in front of it is atiku as a teacher,with a stick pointing to the articulate blackboard,with Mr buhari in the back a few metre behind atiku.on the blackboard,it have about 5 messages on the board,unfortunately I can only remember about 3 messages on the board,the first message (1)Do not wait for 6 months before you forms a cabinet (1)Do not fraternizes with herdsmen(3) listens to Aisha,being mr Buhari’s wife,or do they means titi atiku’s wife,or do they means Mr Buhari does not listens to his wife or they are saying Aisha buhari is a smart wife.

All I am saying young Nigerians are very creative,hardworking and they can do impossible for their country.empowers the young Nigeria,they will suprises you