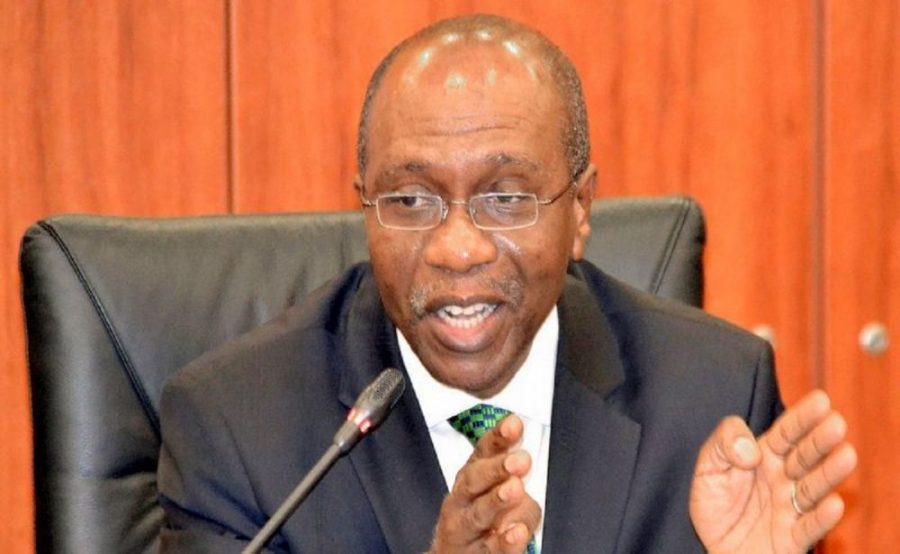

CBN Governor, Godwin Emefiele, fired shots at critics of the apex bank’s policies at the second Nigeria Investment Conference organised by the CFA Nigeria charter. The event which held at the Eko Hotel in Lagos got attendees shocked to the bones as the CBN Governor went on the offensive at critics who have for years criticised his economic policies.

41 items remained banned

The CBN Governor foreclosed the possibility of the 41 items, that were banned from the official foreign exchange markets, being reintroduced.

“In the area of external reserves management, we introduced demand management measures for controlled use of FX for import of goods that can be produced in Nigeria.

“We established a decisive withdrawal of the de facto subsidy for the importation of 41 nonessential commodities with unfolding successes.

“This policy is expected to continue until the underlying imbalances in the Nigerian economy have been fully resolved.”

The battle for toothpick importation

He recounted the opposition he faced when toothpicks were placed on the list.

“I was abused. I was told that the rationale for picking toothpick as part of the 41 items was unthinkable. They conclude as if I just entered a room and was looking for various items and I picked toothpick. That I wasn’t ashamed for picking toothpick.

“Ladies and gentlemen, isn’t it a shame that a country like Nigeria, that is endowed with the resources to produce what we eat, imports toothpick from outside? What is the tech behind making toothpick? Toothpick is made from bamboo tree. The size of the factory that makes toothpick is just one of the partitions in this room.”

Why he banned toothpick importation

The CBN Governor also revealed that the ban on foreign exchange for importing toothpicks was in order to create jobs.

“For me, it’s not about reducing reserve or the pressure on reserve from importing toothpick. How much is that? I can understand why The Economist or the paper that came up with that abused me.

“How did this guy come up with toothpick? How much reserve is he going to save from toothpick? Ladies and gentlemen, it’s not about the FX reserve that I save through not allocating FX to importation of toothpick, but it is about the jobs created.

“If we policy makers fail to develop these people below the age of 32, and you sit down wearing ties from abroad, Lord knows what will happen to you by the year 2050 when Nigeria’s population will be the third largest in the world. Today, people who just graduated from NYSC, somewhere in Ogun state are producing toothpicks of better quality, cheaper than those imported from outside the country.”

Emefiele defends anchor borrowers’ scheme

The CBN Governor also blew hot concerning a report that Nigeria was importing more rice, labeling it as fake news.

“The anchor borrowers’ scheme has ensured that Nigeria is gradually emerging from being a net importer of rice, to a net exporter. I was reading a report again yesterday (Wednesday). They said the United States said that the volume of import of rice in Nigeria increased by 400,000 tonnes.

“Ladies and gentlemen, I am not a politician, but I have said that people should be very mindful when they open their mouths and say what is untrue. Because we will come out at Central Bank and attack it. Particularly if you use data incorrectly.”

He continued:

“I seize this opportunity to say it is untrue. Most of you here are bankers and you can check volumes of your LCs and judge whether one dollar has been allocated for the importation of rice since 2016 when 41 items were banned. The data that we have today shows that rice imported legally is less than 25,000 tonnes in 2018 so far.

“How could an agency who has not even been to Nigeria, who has not been to the farms to see what we are doing, just come up and say that Nigeria imported more than 400,000 tonnes above more than what it should normally import? Go to the data from countries that export. Go to Thailand. Go to India. Our policy is working. We need advocacy. We need people to talk about it positively and not negatively. Do not sit idle and criticise using false data just because you want to gain some points, either politically or otherwise.

“I repeat I am not a politician. I am a banker. Since the anchor borrowers scheme was introduced, Nigeria has empowered over 800,000 smallholder farmers. What does a smallholder farmer require? Less than N250,000 to cultivate one hectare of rice. These people never had access to finance…and people sit and use geopolitical satellites to say Nigeria has imported 400,000 tonnes in excess of what it imported the previous year. This is false and fake news.”

He tackles critics of MPC

Emefiele also stated that global interest rates were rising, due to the withdrawal of quantitative easing in the US, UK and EU. He then took a swipe at critics of the MPC.

“Similarly, the bank of England raised its policy rate in August 2018, for the first time since 2008 that means ten years. So those of you on the day of MPC, that sit down on television and say CBN, for two years, has not touched policy rate, does it mean they don’t know what to do? There are other climes where policy rates have not been adjusted for ten years.”

Forecast for the rest of the year

He then gave a forecast for GDP, Balance of payment, Exchange rate and Inflation for the remaining part of the year.

GDP

“GDP is expected to pick up in the remaining two quarters of 2018, buoyed by anticipated budgetary and electioneering spending in the near term. Growth is projected to quicken to 1.7 in the third quarter and 1.9% in the fourth quarter of 2018.”

Inflation

“For the rest of 2018 and towards the middle of 2019, inflation is expected to rise slightly to about 11.5% and then moderate thereafter.”

Don’t bet on a devaluation

The CBN Governor also hinted at the possibility of the current exchange rate band being defended, advising investors not to bet on a devaluation.

“Nothwsitanding the fact that the forthcoming elections could exert some pressure on the exchange rate, the FX rate is expected to remain relatively stable. Gross stability is expected in the FX market, given increased oil-related inflows and contained the import bill.

“Are we going to be able to achieve this liquidity? Those who think we will not be able to, I will say don’t bet with us on this subject.”

He hinged his confidence in possible output cuts in Saudi and Russia as well as Iran sanctions kicking in. This, in his opinion, would lead to an upward trajectory in crude oil prices.

Balance of Payment

Overall balance is expected to remain positive in the short term as oil prices continue to recover. We expect the current balance to strengthen due to improved non-oil performance and as diversification efforts yield results to reduce monthly imports.

Back to the 41 items

The CBN Governor again maintained the 41 items would remain banned.

“Ladies and gentlemen, the foreign exchange restrictions on the 41 items will continue to be implemented in the medium term and indeed more vigorously. The objective being not just to conserve scarce foreign exchange, but also encourage local production and create jobs on a mass scale for our teeming youthful population.”

Economy is resilient

The apex bank Governor also maintained that the economy was resilient and could withstand any anticipated shocks, due to robust foreign exchange reserves.

“Our economy remains strong as evidenced in the stable exchange rate and robust reserves. We are assure you that with numerous policy measures put in place, the economy is very much resilient to anticipated shocks.”

He continues

“You will agree with me that the CBN was able to weather the storm when oil prices nose dived in 2014 and 2015. We are at a much more advantageous position as both oil price and production levels are improving, leading to robust reserves. As we approach the 2019 elections, please rest assured that the economy will remain resilient and it won’t stutter.”

Hard knocks for banks

In response to a question on how sustainable the CBN interventions where, and at what points the banks would take over, Emefiele interjected midway with hard knocks for the banks.

In his view, the banks were to work hand in hand with the CBN, but preferred to buy treasury bills.

“Your job as a bank is to stimulate the economy. To act as a catalyst for growth and development. You have a responsibility to work for your shareholders. What you do is put the money in treasury bills because you feel the yields are good. We are not happy with you about that.”

Parting shot

As a parting shot, the CBN Governor again touted the success of the anchor borrower scheme and asked critics to keep quiet.

“We have empowered 800,000 people in our rural communities. We have disbursed over N100 billion on this project. That is why it is painful when people say that it hasn’t worked. We are importing rice. It’s very discouraging. That’s why I say. If you can’t join us in this message, just keep quiet and let us continue on our journey.”

THANK YOU EMEFIELE!!!

Always supported his policies since the banning of those 41 items. Definitely the best CBN Governor we have ever had judging from the challenges he faced and quietly worked on them. Political and academic Governors in the past led us to no where. Let such people please keep quiet as he advised