The Senior Vice President of Africa Finance Corporation, Investments, Begna Gebreyes has announced that the financial agency is about to ink a $100 million (N36.5 billion) investment deal in Nigeria’s mining sector.

While making known that AFC is a very big supporter of the Nigerian mining sector from inception, Gebreyes said about half of the planned investment into the mining sector is coming by way of debt, equity, and off-take instruments.

Gebreyes said, “AFC is a very big supporter of the Nigerian mining sector from inception. We want to support the Nigerian mining sector from inception. In the last four and half years, we have started making investments throughout the continent, and we’re actively seeking to make investments in Nigeria.”

The AFC chief noted that the financial institution was wrapping up an investment deal in Nigeria, adding: “We’re very close. We are in a transaction which will be concluded before the end of the year.”

How investors can take advantage of Nigeria’s mining sector

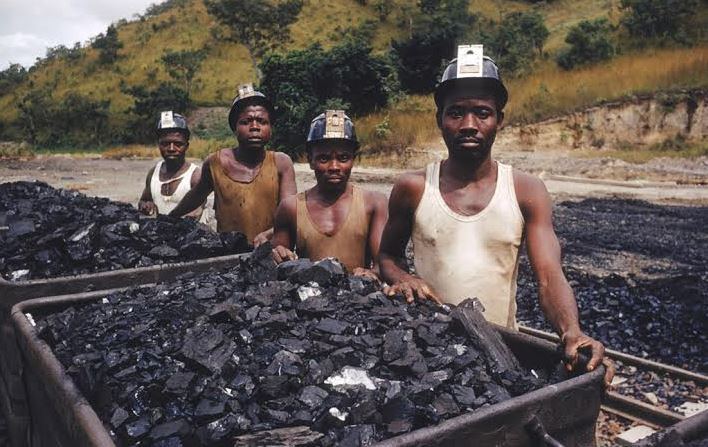

Nigeria is no doubt blessed with multiple mineral resources aside crude. The solid minerals potential, if given its deserved attention, could bolster economic growth.

Mineral resources’ contribution to the nation’s Gross Domestic Product (GDP) was abysmally low, hovering within the region of N103 billion in 2014 despite the country being blessed with over 44 types of solid minerals in varying quantities across the 36 states and Federal Capital Territory ( FCT) of the country.

In view of this, it would not be erroneous to say Nigeria’s mining sector has been dormant and abandoned for illegal miners to profit from, while genuine investors have been made to look on.

The scenario endured in the sector until crude oil prices crashed. Consequently, the Federal Government decided to diversify the economy, making mining and agriculture the priority.

Nigeria’s solid minerals sector had no clear-cut structure for discerning investors to invest. In view of the pending challenge, it may be a good time for anyone intending to invest in the mining sector.

About AFC

The Africa Finance Corporation is a pan-African multilateral development finance institution established in 2007 to bridge Africa’s infrastructure investment gap through the provision of debt and equity finance, project development, technical and financial advisory services.

The financial institution finances infrastructure projects in Africa, focusing in particular on power, transportation, telecommunications, heavy industry and natural resources (oil, gas and mining