Daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills, bonds, Forex inflation, oil price.

- Bond Yields Close Bearish for the Month amid OMO rate Hikes and Slight Offshore Sell

- Manufacturing Sector Expands at Faster Rate in October – CBN

KEY INDICATORS

Bonds

The bond market traded on a relatively mixed note, with slight demand on the short end of the curve offset by selloffs on the mid to long end, notably on the 2028s and 2034s, which were sold off to 15.68% and 15.48% respectively. Yields were slightly lower by c.3bps on the day, but closed the month at c.31bps higher M/M, due to the double OMO T-bill rate hikes by the CBN and slight offshore sell toward month end.

In the coming month, we expect the market to remain slightly bearish, with the DMO confirming the weak fiscal position of the FG via higher stop rates in recent auctions (Bonds/T-bills), and the CBN also expected to sustain higher rates in the T-bills market, in a bid to checkmate excessive FPI outflows.

Treasury Bills

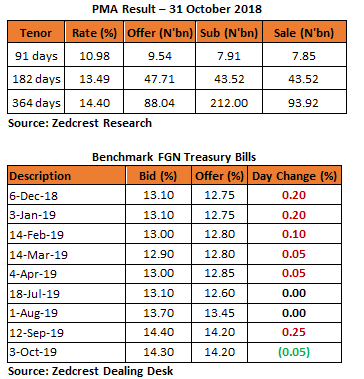

Yields inched slightly higher by c.6bps in today’s session, following a weaker than expected NTB auction result, which prompted slight selloff on some mid and long tenured maturities. Despite the significant boost in system liquidity from FAAC payments in the previous session, trading activities remained very low as market players anticipated a further OMO auction by the CBN to mop up c.N382bn in OMO maturities tomorrow.

We expect the market to tilt slightly bearish tomorrow, with the lift in the PMA rates on the 182-day (+95bps) and 364-day bills (+80bps), fuelling speculations for a further hike in OMO rates by the CBN.

Money Market

The OBB and OVN rates declined further by c.5pct to 4.33% and 4.92% respectively, as system liquidity was significantly bolstered to c.N488bn positive, via inflows from FAAC payments in the previous session.

We expect rates to remain relatively stable tomorrow, with inflows from OMO maturities c.N382bn expected to net off outflows from the expected OMO auction sale by the CBN.

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.60/$ (spot) and N362.82/$ (SMIS). At the I&E FX window, the NAFEX closing rate depreciated by c.0.06% to N363.54/$ from N363.32/$ previously. Rates were however unchanged at the parallel market segment, with the cash and transfer rates closing at N361.00/$ and N364.00/$ respectively.

Eurobonds

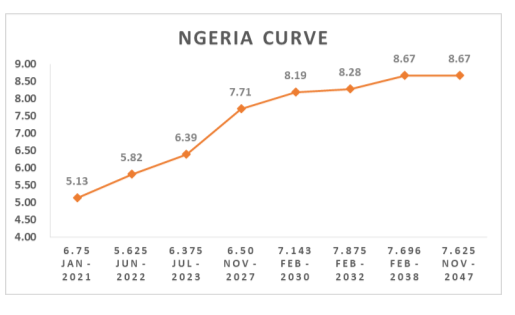

The NGERIA Sovereigns weakened slightly by c.2bps in today’s session, due to continued selling pressures witnessed mostly on the Feb 2038 bond, now the highest yielding bond on the curve. An uptrend in US treasuries earlier in the month, and news of fresh supply of c.$2.8bn worth of FGN Eurobonds later in the month provided a context for an uptrend in yields over the course of the month, with yields closing by c.63bps higher M-o-M.

The NGERIA Corps were relatively flat in today’s session, except for slight interests seen on the UBANL 22s and slight sell on the ACCESS 21s Sub. On a M/M basis, the highest gainers were the SEPLLN 23s (+1.25pct) and ACCESS 21s (+0.31pct), whilst the worst loss was seen on the DIAMBK 19s (-0.32pct), in what was a relatively positive month overall for the Nigerian Corporate Eurobonds.

Disclaimer

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.