Daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Bond Yields Weaken Further As Traders Set Sight on Auction

Labour to Embark on Indefinite Strike over Minimum Wage

KEY INDICATORS

Bonds

Bonds

The bond market was largely order driven in today’s session, with sight sell witnessed on some short and mid tenured maturities which pushed the yield curve c.3bps higher on the day.

We expect the market to be relatively muted, as market players cautiously anticipate the forthcoming auction which is expected to clear slightly above its previous levels across the tenors on offer.

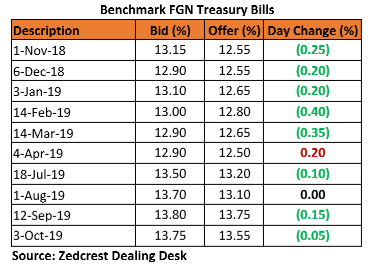

Treasury Bills

Interests within the T-bills Space were largely focused on the short end of the curve (Nov – Jan) which compressed by c.30bps, as market players cherypicked on attractive rates (> c.12.50%) on that end, whilst they maintained a risk off stance to maturities on the longer end, in anticipation of a further OMO Auction by the CBN later this week.

We expect the market to be slightly bearish in the build up to the OMO auction, as system liquidity is expected to tighten further, following a Wholesale SMIS by the CBN today.

Money Market

In line with our expectations, the OBB and OVN rates trended higher by c.10bps, closing today at 20.00% and 22.29%, as market players reacted to funding pressures from the c.₦75bn wholesale SMIS by the CBN.

We expect rates to remain elevated tomorrow, as there are no significant inflows expected.

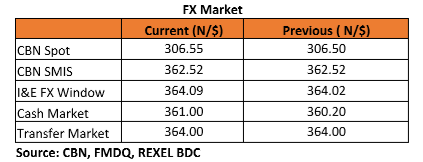

FX Market

At the Interbank, the NGN/USD Spot rate depreciated by 0.02% to ₦306.55/$, while the SMIS rate remained unchanged at ₦362.52/$. At the I&E FX window a total of $244.69mn was traded in 275 deals, with rates ranging between ₦358.00/$ – ₦365.00/$. The NAFEX closing rate depreciated marginally by c.0.02% to ₦364.09/$ from ₦364.02/$ previously.

At the parallel market, the cash rate depreciated significantly by 80k to ₦361.00/$, while the transfer rate remained unchanged at ₦364.00/$.

Eurobonds

The NGERIA Sovereigns were relatively mixed in today’s session, as market players were better buyers of the shorter tenured maturities, whilst remaining slightly bearish on the longer tenured bonds, with special focus on the 2032s and 2038s.

In the NGERIA Corps, we saw renewed interests on the DIAMBK 19s, ACCESS 21s Snr and SEPLLN 23s.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.