The relatively new sports betting industry has been growing rapidly, leveraging on an increase in internet penetration in the country, the increasing youthful population, and the desire to make additional income.

Though Nigerians love sports (especially football) and watch sporting events for entertainment, the love has gone beyond just entertainment now; it has also become about making (and losing) money. The multi-million sports betting industry is obviously growing astronomically, and as new entrants make their way into the market, the consumers are spoilt for choice.

On this week’s edition of product review, a weekly analysis where Nairametrics features brands contending for leadership and prominence in Nigeria’s consumer market, we bring to you the various sports betting companies in the country and how they are responding to competition in the industry, while strategically positioning their outlets for visibility and profitability.

Facts and figures

Generally, sports betting entails punters predicting the results of matches and placing their bets to correspond with the stakes of the game. If the predictions are correct, the bets are rewarded with stipulated winnings.

According to a research by the News Agency of Nigeria (NAN), an estimated 60 million Nigerians between the ages of 18 and 40 are involved in active sports betting, while almost ₦2 billion is spent on sports betting daily in Nigeria. This translates to nearly ₦730 billion in a year.

Sports betting has found its proverbial home in Nigeria as established sports betting companies are thriving, while new ones spring up daily at different corners, all with the aim of capturing market share.

A report by KPMG in 2016 revealed some startling numbers from the sports betting industry in Nigeria. As at 2016, the leading sports betting company, Bet9ja raked in an average monthly turnover of $10 million, while NairaBet made an average turnover of $3 million – $5 million, a 20 – 30% margin on profit.

Major sports betting companies in the Nigerian market

The surge in the number of mobile phone users in Nigeria has been a game changer for the sports betting business in the country. Everyday, it gets easier to pay, play and win or lose. As at March this year, the Nigerian Communications Commission (NCC) reported that there were 147 million cell phone users and 100 million internet subscribers in Nigeria, with 80 percent of this figure being able to access the internet on their phones.

Alexa, an Amazon company that commercialises web traffic data and analytics, ranked Bet9ja (bet9ja.com), a betting company, as the second most visited site in Nigeria after Google.com

Over the years, several sports betting companies have emerged in the country; these include Bet9ja, Nairabet, Merrybet, Naijabet, Bet King, Sporting Bet, Surebet24, Supabets, 1960bet, Nairastake, Parknbet, 360bet, and many more.

Competition is stiff among players in the market and the dominance of some legacy outlets (Bet9ja, and NairaBet) is being threatened with the daily arrival of new entrants (Sporting Bet, and King Bet) into the market.

Nairabet started operations in 2009; it is the first company to come up with a fully functional website where punters can deposit money, place bets and make withdrawals. The platform is also the first sports betting company to get legalised and regulated, and the Lagos State lotteries board was the first regulatory agency to develop a framework for regulating sports betting in Nigeria.

Another big player, Bet9ja is one of the most innovative market leaders, with more outlets opening every week. The platform is aggressively recruiting agents and it also provides everything the agents will need to start their own outlets including products, training and a support network.

Most Bet9ja agents enjoy commission rates on turnover for every printed ticket, and partnerships with leading sports betting software companies in Europe. The platform also has a partnership with former African Footballer of the Year, Victor Ikpeba, constant development of new betting products, integrated online betting systems, support for hardware, technical support on-site and via telephone, and on-site support from the Bet9ja field staff.

Few of the betting outlets have endorsement deals with popular athletes to promote their brands and put their products in the faces of their customers. King Bet signed Austin JayJay Okocha as its brand ambassador, while Sporting Bet signed Kanu Nwakwo as the face of its own brand.

SWOT Analysis of the market

Strength

The growing sports culture among Nigerians, growing internet penetration vis-à-vis the widespread use of mobile phones, and huge population are factors that have helped the growth of the industry in the country.

Weakness

The potential for the gambling sector to cause harm in form of addictions, loss of savings, laziness and increased crime is high.

Opportunity

The industry has the prospects of providing employment for the young population, and cash windfall for ordinary people. It also generates tax revenue for the government and contributes to economic growth.

Threat

Some cultural and religious doctrines do not encourage sport betting activities. Although this has not disturbed Punters from making additional money through the platforms.

What customers are saying

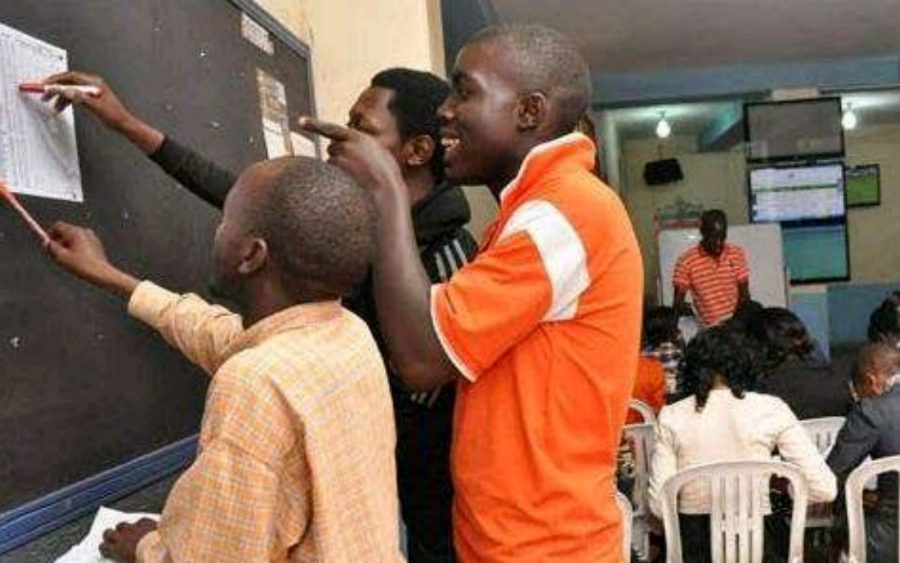

Nairametrics’ visit to some outlets shows that sports betting has become a serious business among young Nigerian males. Findings also reveal that most people prefer placing bets through their mobile phones instead of visiting retail outlets.

Mr. Ben, a manager in one of the outlets, concurred that the industry is fast growing and has great potentials if well managed. He further stated that customers place bets more during major football events such as the World Cup and when major football leagues in Europe are in season.

The manager also pointed out that the Lagos State Government has done a lot to regulate operators in the industry.

Nairametrics spoke with Akeem, a customer in one of the outlets, who revealed that sports betting provides another means of income for him.

According to him

“I place bets here daily and it has become my side hustle. I am not afraid of placing bets because everything is risk.”

Akeem also revealed that he places an average of ₦3,000 daily and he has won over N200,000 while placing bets.

Most of the customers Nairametrics spoke with revealed some of the factors that influence their choices of brands which include the ease of play via mobile phones, and quick payment on wins.

The verdict

In a poll conducted by Nairametrics, Bet9ja got 59%, NairaBet got 38% while SureBet and Merry Bet got 3% and 1% respectively.

OPINION POLL: Which Sports betting platform is your most preferred? #Nairametricspolls

— Nairametrics (@Nairametrics) October 16, 2018

The sports betting industry needs more government regulation; also, platforms looking to gain market share must leverage on technology to reach more customers.

If well regulated, the industry can support revenue generation of different tiers of government.

Bet9ja is not a good game, they just dey like scam most youth they deceive them, they use their fastbet scam youth in nigeria, please our government stop anything fastbet in nigeria, more crime everyday, more issue of money everyday, will dont want anything fast bet again please to stop it now, most people no it has virtual bet